XRP's short stakes hit 1 month because the recession is afraid of fabric activity

⚈ XRP short positions achieved the 1-month highest recession problems and bears.

⚈ US GDP decreased in Q1 2025 by 0.3%, no expectations and market fears.

⚈ Opening the mark and the ETF delay add the XRP downward pressure and the insecurity of the investor.

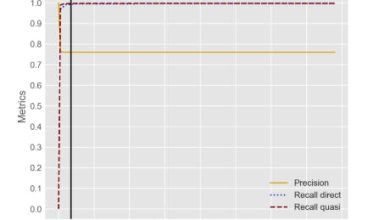

According to recent data, the relationship between long and short XRP futures positions has reached a level of 0.8622 on April 30 obtained By Finbold Crypto from the reconnaissance platform CoinglassTo.

In other words, the XRP shorts are 1 month in height, with 53.7% of positions open in the last 24 hours.

Moreover, the increase in bear stakes is not a reaction to the oversized movement. On the contrary, the XRP has marked the fall of 5.30% over the last 24 hours and traded at $ 2.16 on April 30 during the press.

XRP shorts after GDP Miss, Token Unlock and ETF delay

The game has several factors that influence the prospects of derivative traders.

First of all, the whole market is dynamics. Interior in the United States (GDP) The contract is concluded by 0.3% In the first quarter of 2025 – celebrating the first such fall from quarter 2022.

To worsen the situation, consensus estimates with GDP growth were confirmed by 0.3% – thus the rate of inadequacy is quite important. Two consecutive quarters of GDP negative growth is the rule of thumb in determining the recession.

In addition, the XRP is expected to face a significant displacement of the dynamics of supply and demand, as 1 billion chips will be opened on May 1, potentially increasing sales pressure.

Finally, the Securities and Exchange Committee (SEC) pushes its decision on the approval of the Spot XRP Fund (ETF), which aims to postpone the adoption of cryptocurrency by institutional investors.

Picture of Shutterstock