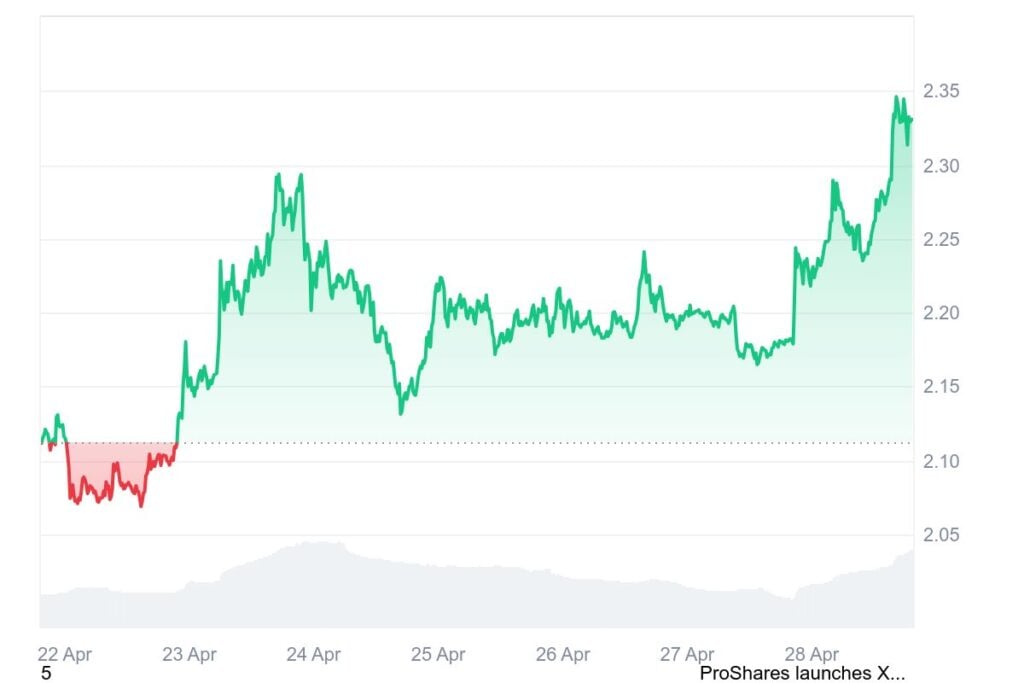

XRP Price Prediction – XRP Surges 10% After SEC Approves ProShares ETFs

The SECURITIES AND EXCHANGE Commission (SEC) of the United States approved three FNB FNB XRP of Proshares, which dropped the price of XRP by 10%. Scheduled on April 30, the new products include an ultra XRP ETF offering a 2x lever effect, a short ETF and an ultra short ETF XRP with a -2x lever effect.

The ETF SPOT XRP application of Proshares is still under examination of the dry, with an early pivot decision by May 22. This approval represents a major step for the presence of XRP in traditional finance.

Earlier this month, Teucrium launched the first XRP ETF in the United States, attracting more than $ 5 million in a day's negotiation volume, making it the most successful beginnings in the company.

While the ETFs of Proshares offer an XRP exhibition through derivatives, Nate Geraci, president of the ETF store, noted that they can have a limited direct impact on the price of XRP. He also asked why the long -term products progress before the ETF spots.

While the Multiple ETF XRP ETF proposals await decisions, attention is now turning to the Application of Grayscale, May 22 marking the next key deadline. The sharp increase in documents follows the conclusion of the prolonged legal battle of Ripple with the dry earlier this year.

Meanwhile, a company recently revealed that it now holds XRP in its financial books, marking the start of a new important trend in the cryptocurrency market. Although the company itself is not a major familiar name, the announcement is considered an important signal for the future of the adoption of XRP.

Similar to the way Bitcoin has been added more and more to business balance sheets, XRP is starting to reach the same level of institutional interest. This development suggests that more companies could soon follow suit, acquiring quietly and holding XRP as long -term assets without major public ads.

As the adoption of companies increases, it could gradually reduce the supply of XRP and potentially increase its value over time. The emphasis is placed here on long -term growth rather than on the movement of immediate prices, encouraging investors to consider XRP as a precious asset for the future.

Source – Austin Hilton on YouTube

XRP price prediction

XRP has shown relative stability in recent weeks, even during periods of high market volatility. While Bitcoin has experienced sharper reactions to market changes, XRP movements were much softer.

Currently, $ XRP seems to be negotiating in a well -established range, despite certain interpretations of recent prices action such as a potential decrease trend or a bull flag formation.

The overall structure suggests that the token remains linked to the beach over higher deadlines, with short -term fluctuations between key levels such as $ 2.05 and $ 2.14.

Intrajournal support of around $ 2.20 is currently good, and a gathering to higher resistance levels like $ 2.35 and $ 2.40 seems more likely if the larger market remains stable.

Ripple's decision not to continue a public list in 2025 was also noted, a decision which reflects a strategic choice to maintain operational flexibility in the evolution of the regulatory environment.

While the trading volume of $ XRP remains low and its correlation with Bitcoin remains high, the technical indicators suggest a continuation of the current model linked to the beach before next week.

Austin Hilton supports the diversification strategy; BTC Bull appears as a promising presale linked to Bitcoin

Crypto Austin Hilton's analyst and merchant also stressed the importance of diversification, suggesting that investors distribute their investments through bitcoin, XRP, main altcoins and presale projects such as BTC Bull (BTCBull).

BTC Bull The presale is positioned as a new exciting crypto project focused on the capitalization of Bitcoin's historical performance and the future potential. Having already raised nearly $ 5 million in pre -sales.

The project strategically links its success directly to the future performance of Bitcoin. Underlined as the most efficient asset in history, the bruise of Bitcoin is at the heart of the BTC Bull mission.

The BTC Bull is designed around a series of milestones, offering chip burns and Bitcoin Airdrops while Bitcoin reaches large price levels such as $ 100,000, $ 125,000, $ 150,000, $ 175,000, $ 200,000, $ 225,000 and $ 250,000.

BTC Bull encourages users to keep their native token in Best walletA multi-chain cryptographic portfolio integrated into their ecosystem, allowing participants to automatically receive Bitcoin rewards. The roadmap describes how these stages will trigger major community rewards, stimulating commitment and inciting long -term detention.

With a total supply of 21 billion tokens, the allowances take place in marketing, liquidity, community awards, stimulus and tokens burns, ensuring a balanced approach to sustainability and growth.

With the price of the presale currently around $ 0.002,485 and a growing community of supporters contributing millions, BTC Bull represents a promising opportunity for those who believe in the inevitable rise of Bitcoin.

The project also simplifies the purchase process by allowing purchases with crypto or card payments, which makes it accessible to a wide range of investors.

In addition, investors can immediately accuse their $ BTCBull tokens and obtain an impressive annualized shuttle award of 81%, offering a strong opportunity for passive income. Bitcoin Bull emphasizes a mega-bullin community vision, strong incentives for chip holders and partnerships with platforms like Best Wallet.

This reflects his ambition to align himself with the next Bitcoin major rally and to offer participants a chance to benefit directly from the broader explosive momentum. To participate in the preventing of token $ BTCBULL, Visit BTCBULLTOKEN.com.

This article was provided by one of our business partners and does not reflect the opinion of Cryptonomist. Please note that our business partners can use affiliation programs to generate income via the links in this article.