XRP Price Prediction – Is $XRP The Most Undervalued Crypto?

XRP is increasingly considered a major competitor in the cryptocurrency space, not only for its market rank, but for the vast infrastructure to support it.

Over the past decade, Ripple – The company behind XRP – has built a robust global payment system which now covers more than 55 countries and has joined forces with more than 350 financial institutions.

This success places it well before many cryptographic projects which are always based on potential future utility rather than real proven use.

Unlike speculative tokens that make promises, Ripple is actively performing on his vision, demonstrating an ability to evolve, to integrate into traditional finance and to fulfill critical financial functions through borders.

Often called a “sleeping giant”, the XRP is considered an undervalued asset with significant unexploited potential. The metaphor highlights the belief that a large part of its capacities and its value remain hidden from the general public and even the broader cryptographic community.

This perception stems from the size, scope and integration of XRP with global banking systems. Institutions such as the entire Japanese banking network have shown interest in Ripple technology, and the infrastructure it has developed is already used – not just theoretical or waiting future launches.

Source – Austin Hilton on YouTube

The legal clarity and the alignment of the Ripple's financial system could be Launchpad from XRP

One of the most notable aspects of Ripple's trip is its resilience in the face of regulatory challenges. This is the only major cryptocurrency to get out of a multi-year legal battle with the American Securities and Exchange (SEC) commission with a partial legal victory, creating more regulatory clarity around its status.

The resolution of this trial, in particular with changes in regulatory leadership, should release significant institutional interest and open valves for wider adoption. Financial entities that have hesitated to announce partnerships due to regulatory uncertainty can now be more willing to move forward.

The alignment of Ripple's objectives with the traditional financial system is another factor fueling optimism. Rather than disturbing inherited banking institutions, Ripple aims to improve the speed, profitability and transparency of cross -border transactions.

Its real competition lies in obsolete systems like Swift, not with the banks themselves. This distinction makes Ripple's proposal more attractive for financial entities seeking modernization without systemic disruption.

In addition, the potential introduction of an XRP trust by the BlackRock investment giant adds another layer of anticipation and asset credibility. If such a development materializes, it would serve as powerful approval and probably attract institutional capital.

Ripple is positioned to operate the global cross -border payment market of $ 150 billion – a figure planned at the end of the decade. With its existing infrastructure, Ripple is well equipped to claim a substantial part of this expanding market.

The XRP Foundation is not built on media threshing, but over a decade of execution, adoption and strategic positioning. Its progress goes beyond the speculation of the market, based rather on the application of the real world, the regulatory evolution and the increasing alignment with institutional needs.

While the market is starting to recognize the complete scope of Ripple's achievements and potential, XRP can indeed prove to be one of the most underestimated assets in the digital finance landscape.

XRP price prediction

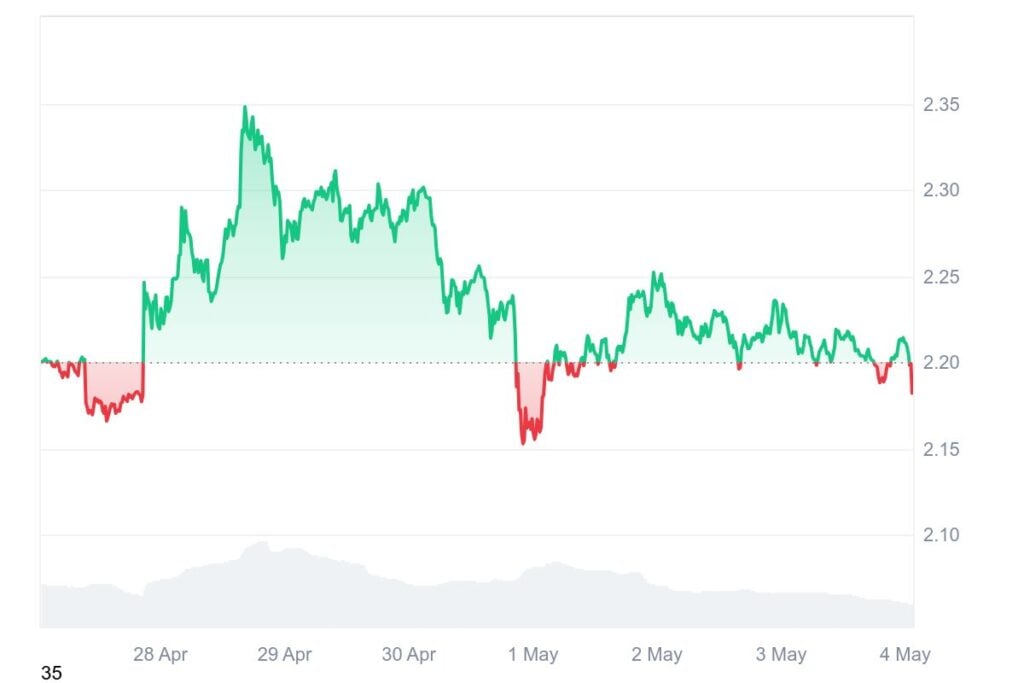

$ XRP continues to display unusually stable price behavior, oscillating in a tight range that has persisted since the end of April.

Although this stability may seem dull for certain traders, it in fact signals a relative force in a market in volatile cryptography, especially when comparing the current XRP position where it was in the end of November or early December.

Currently, $ XRP is consolidated between a resistance area of around $ 2.26 to $ 2.28 and a support range of $ 2.15 to $ 2.18. This narrow range has a short -term limited increase potential, with a potential break offering a 9%gain, while the risk of decrease to $ 2.05 represents approximately a loss of 7%.

Given these dynamics, more attractive purchasing opportunities are either above the current resistance, or at lower support levels. A confirmed escape greater than $ 2.28 with a strong volume could open the door to a movement around $ 2.41, offering better risk-re-compensation report with a limited drop.

On the other hand, if Bitcoin initiates a wider decline in the market, $ XRP could find convincing purchasing areas almost $ 2.05 or even as low as $ 1.65, where strong historical support remains.

While the short -term price movement is likely to remain silent unless the main Bitcoin changes or the specific news in XRP do not focus on global perspectives and focus on purchasing opportunities in small groups rather than by accumulation in the current range.

With the rebound on the market, the best portfolio becomes a Go-To for the storage of intelligent cryptography safely

As the crypto market shows signs of recovery, Austin Hilton also explains how to have a reliable and secure wallet has never been so important – and Best wallet (Best) stands out as a superior candidate to meet this need.

It is a non-slippery cryptocurrency portfolio rich in functionality and not a guardian designed to give users a total control over their digital assets. Unlike traditional childcare services, where user funds are held by third parties, the best portfolio guarantees that users maintain property through private keys management.

This basic principle of “not your keys, not your chips” responds to the concerns raised by numerous exchange collapses in recent years, which have seen many investors lose access to their funds. By empowering users with full autonomy, the best portfolio establishes a higher standard for safety and transparency in digital asset space.

Functionality is the place where the best wallet is really distinguished. The application incorporates an cryptography purchasing system in the portfolio, allowing users to buy digital assets with competitive exchange rates and low processing costs.

Its transparent design allows secure storage and management of a wide variety of crypto on more than 60 different blockchains, including Bitcoin, Ethereum, BNB Chain and Solana.

Whether users manage tokens from established chains or exploring emerging, Best wallet serves as a unified hub. In addition to basic portfolio services, it offers an integrated decentralized exchange. Users can exchange any token supported in the application, eliminating the need to visit external exchanges.

The portfolio also supports the monitoring of the portfolio, with the possibility of creating several portfolios adapted to different strategies, such as maintenance, jalitude or participation in presale. The best portfolio offers early access to partner tokens launches via a feature called “tokens to come”.

This tool helps users to look for, assess and invest in early stage projects by analyzing white pods, tokenomics and other relevant data before the official start of a presale. The best portfolio also includes implementation options, allowing users to win rewards by locking their tokens.

The implementation of the native $ Best token provides additional advantages, including reduced transaction costs and the potential advantages of the debit card. A function of cryptographic flow card within the application allows users to spend their assets while gaining up to 8% cashback in purchases.

This makes the best portfolio a viable daily financial tool, not just a storage solution. The token $ Best is currently in its presale phase, after having collected nearly $ 12 million, each token at a price of $ 0.02,495.

Security is an absolute priority, the platform incorporating advanced fraud prevention mechanisms and recovery tools. Users can be guaranteed to know that their digital assets are protected by advanced technology. To encourage the adoption of users, the best portfolio is currently organizing an air campaign.

Participants can win the best tokens by performing integrated tasks, engaging on social networks or by referring new users. However, time is limited – the air card officially ends on May 15.

With its roadmap aimed at supporting more than 60 blocks of blocks, include limit orders and implement medium cost tools at a cost, the best portfolio is positioned as an all-in-one solution for modern crypto investors. Visit the best portfolio token presale here.

This article was provided by one of our business partners and does not reflect the opinion of Cryptonomist. Please note that our business partners can use affiliation programs to generate income via the links in this article.