XRP Hits $130 Billion Market Cap as Bullish Momentum Grows

The XRP is getting momentum again, climbing nearly 6% last week and pushing its market cap above $ 130 billion in the first time since March 27th.

The RSI of Altcoin entered excessive territory for the first time for a month, the Ichimoku cloud -cloud setup remains bullish, and its EMA lines formed a successive gold cross. With entrepreneurs looking at both breakout targets and major zone supports, the XRP enters an important moment that can specify the next major move.

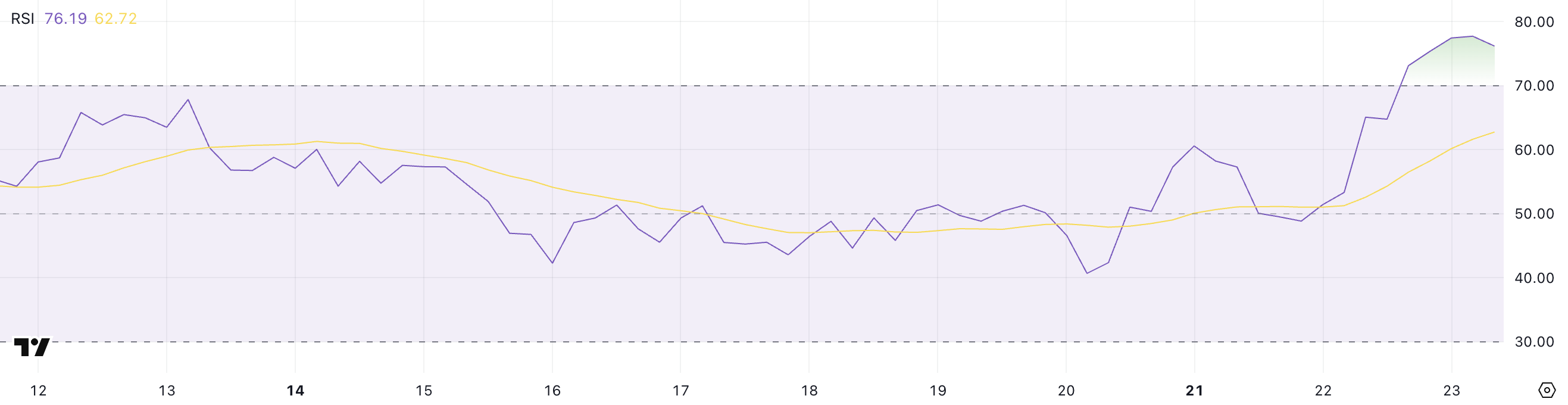

XRP enters the overbought zone for the first time since March

The KaMag -Child strength of the XRP (RSI) rose to 76.19, climbing above 70 threshold at the first time since March 19 -more than a month ago.

Just yesterday, its RSI was at 51.4, which signed a sharp increase in the purchase of momentum for a short time.

This jump suggests that the XRP enters an overbought zone, a level where price action often begins to slow or upside down, depending on the broader emotion in the market.

RSI is an indicator of momentum range from 0 to 100 and helps entrepreneurs assess whether a owner is excessive or overweight. A reading above 70 is usually signals of overbought conditions, suggesting that the owner may be due to a pullback.

Reading below 30, on the other hand, signals oversold conditions and potential for a bounce. With XRP today at 76.19, entrepreneurs can begin to guard for signs of momentum weakening or integration. Despite this, some analysts claim the XRP market cap may exceed Ethereum's.

However, the strong upward movement of the RSI may also signal the start of a breakout if supported by volume and greater bullish emotions.

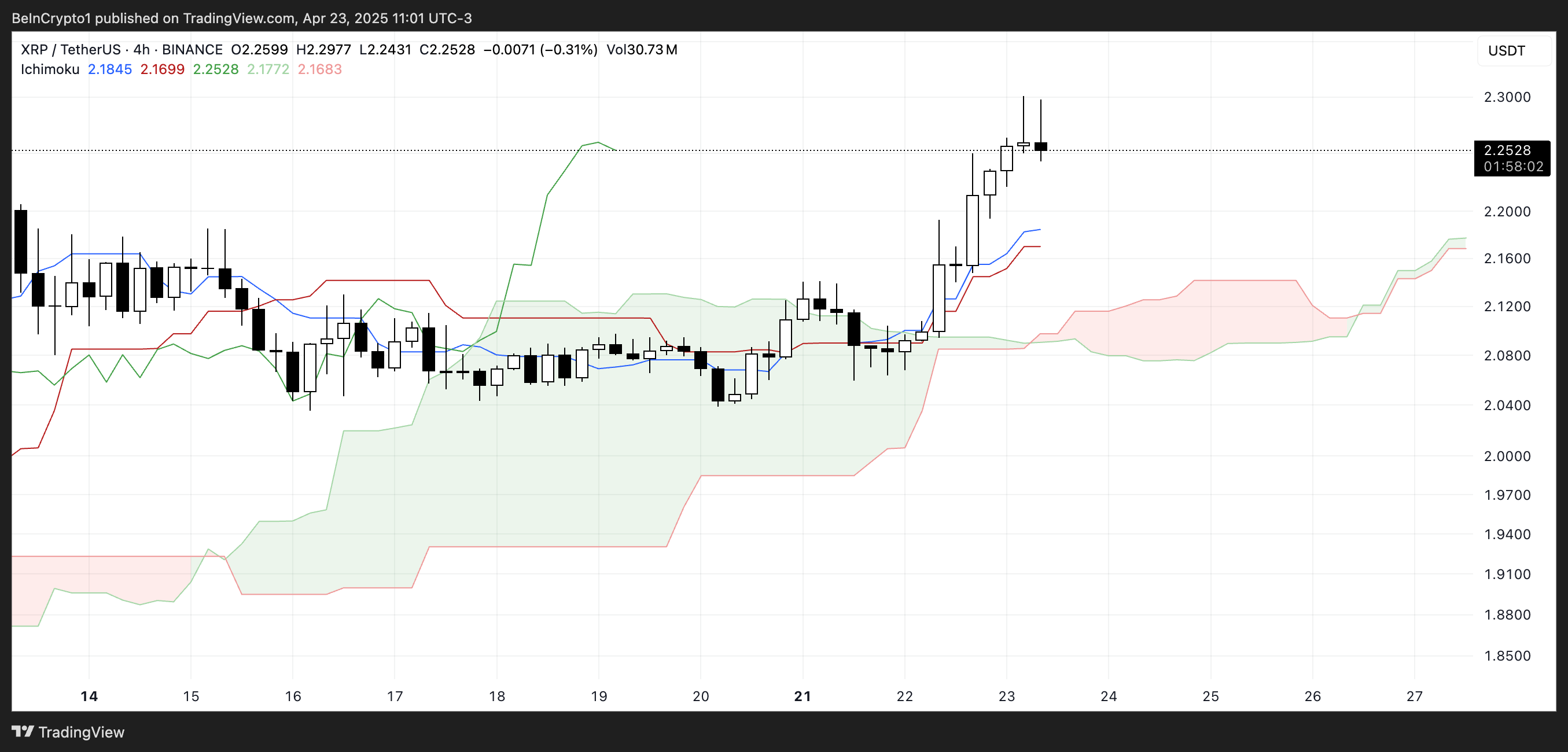

Ichimoku signals are aligned for XRP as the cloud turns

The Ichimoku Cloud of XRP remains in a bullish adjustment, whose price is clearly positioned above the Kumo (Cloud), formed by the Senkou Span A (Green Line) and Senkou Span B (Red Line).

This indicates a continuation of the upward momentum, even though the green cloud ahead is narrower than ever, suggesting that bullish convincing may not be as strong as the previous stages of trend.

However, being above the cloud generally favors consumers for a short time.

The Tenkan-Sen (Blue Line) is above the Kijun-Sen (Red Line), which signs short-term bullish momentum through a positive crossover.

Meanwhile, the Chikou Span (green lagging line) is above the cloud, proving that the current momentum is supported by the previous price strength.

However, the thinner clouds ahead call for some caution – while the trend remains bullish, a weaker cloud may suggest reduced support if the price turns.

So far, the XRP has a positive technical structure, but entrepreneurs will monitor for any signs of weakness.

XRP builds momentum on gold crosses – reversal or rally?

The exponential transfer lines of the average (EMA) of the XRP have formed consecutive gold crosses from yesterday, a strong bullish signal indicating growing upward momentum.

This pattern suggests that short-term averages cross above those longer, often seen as a sign of a recurrence or the beginning of a new ascent.

If this momentum continues, XRP prices can climb to test $ 2.50, with additional resistance levels to $ 2.64, $ 2.74, and $ 2.83.

If the broader return of bullish emotions, the XRP may try to get the level of $ 2.99 – and it is possible to break more than $ 3 for the first time in the months.

However, if the momentum is breaking and the trend returns, the XRP may return to try support for $ 2.18. Losing that level will open the door for a deeper correction towards $ 2.03.

The ongoing downside pressure can push the XRP below the $ 2 mark, with the next major support levels at $ 1.90 and $ 1.61.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.