Will Strong Loan Growth Push Profits to New Highs?

- Summary:

- Bajaj Finance (NSE: Bajfinance) is scheduled to post stable Q4 results, encouraged by increasing loan growth and stable quality of property.

Bajaj Finance (NSE: Bajfinance) is preparing to release highly expected Q4 results tomorrow. Analysts predict a double digit income increase, driven by stable loan growth and stable quality property. After a strong rally this year, the stock now faces a critical test: can it meet high sky expectations and push towards new record highs?

Bajaj Finance Q4 Preview: Buzz driving is mainly expected

The agreed market points to a solid quarter for Bajaj Finance. The main expectations include:

- Net Interest Income (NII) is expected to rise 25-28% year-on-year, fueling through strong traction throughout the consumer, auto, and SME segments.

- The income after the tax (PAT) is expected to grow strongly in the double number, reflecting stable margins and leverage operational benefits.

- The quality of the asset remains apparent, with the NPA gross likely to remain below 1.5%, featuring underwriting skills of discipline.

- Loan disbursements are expected to surge by 20-22% yoy, which is strengthened by the feast of demand and growing penetration into Tier-2 and Tier-3 cities.

If Bajaj Finance meets or exceeds these estimates, it can mark another strong step in the post-paper growth trajectory.

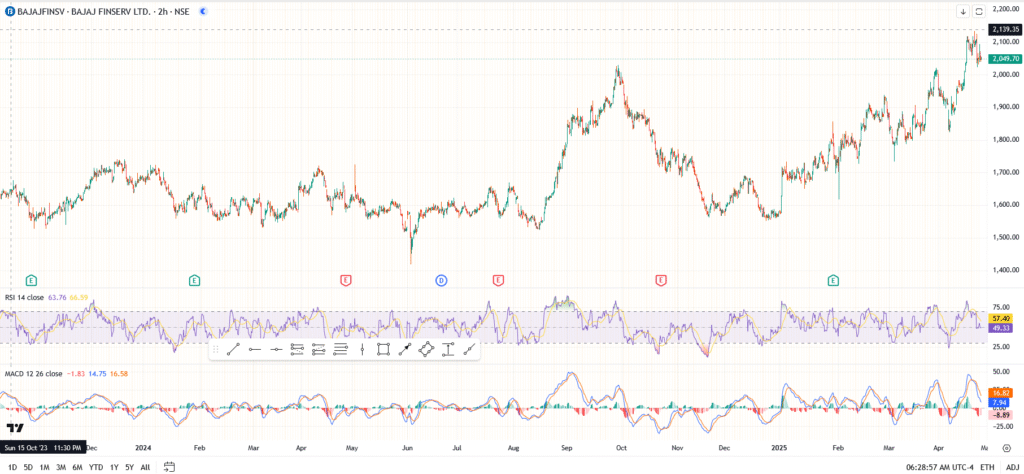

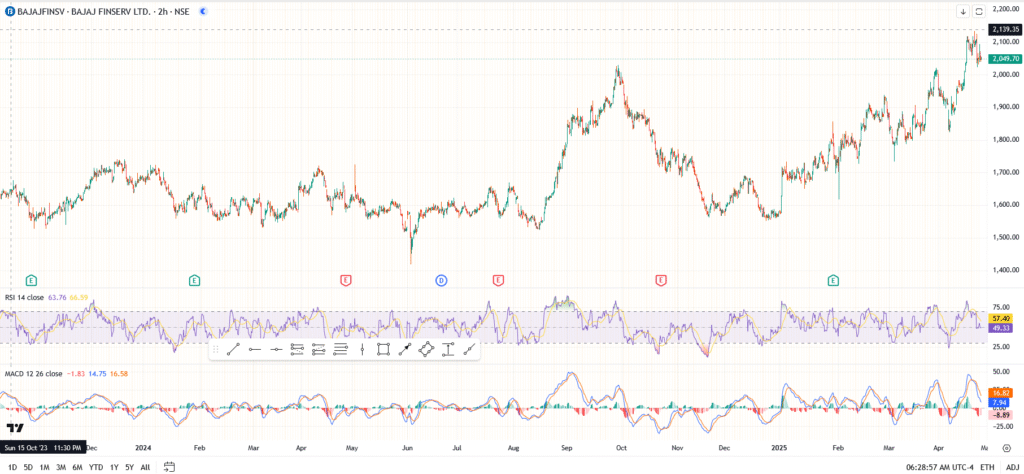

Bajaj Finance Stock Analysis: Will the revenues spark a new breakout?

Bajaj Finance's stock leaked, rising more than 20% year-to-date and more than a wider financial sector.

- Support firmly holds ₹ 2,049 – recent dips have been addressed by aggressive purchase interest.

- Immediate resistance stands near ₹ 2,140 – a clean breakout above this level can release the upside down to ₹ 2,200 and more.

If the income goes up, Bajaj Finance can rally towards ₹ 2,200- ₹ 2,250. However, a Miss can trigger a quick income getting back to ₹ 2,000 psychological zones.

Final Perspective: Can Bajaj Finance keep alive?

Upon reaching the stock all the time high and the investor hopes to run hot, Bajaj Finance needs a convincing beat income to maintain its momentum. All indicators point to a stable Q4 performance.

However, with values stretched and increased market volatility, merchants should brace for increased post-earnings swings.