Will Bitcoin Hit $100,000 in May?

Bitcoin (BTC) enters May 2025 with a modified momentum, getting more than 14% in the past 30 days and trade only 6.3% below the key $ 100,000 mark. Behind the price action, Bitcoin's apparent demand has been positive for the first time since late February, which has signed a move on on-chain behavior.

However, fresh flows from US-based ETFs-are covered compared to 2024 levels, suggesting institutional faith has not yet returned. According to Mexc COO Tracy Jin, if current conditions hold, a rally in the Tag -heat to $ 150,000 may occur, with emotion that becomes more bullish.

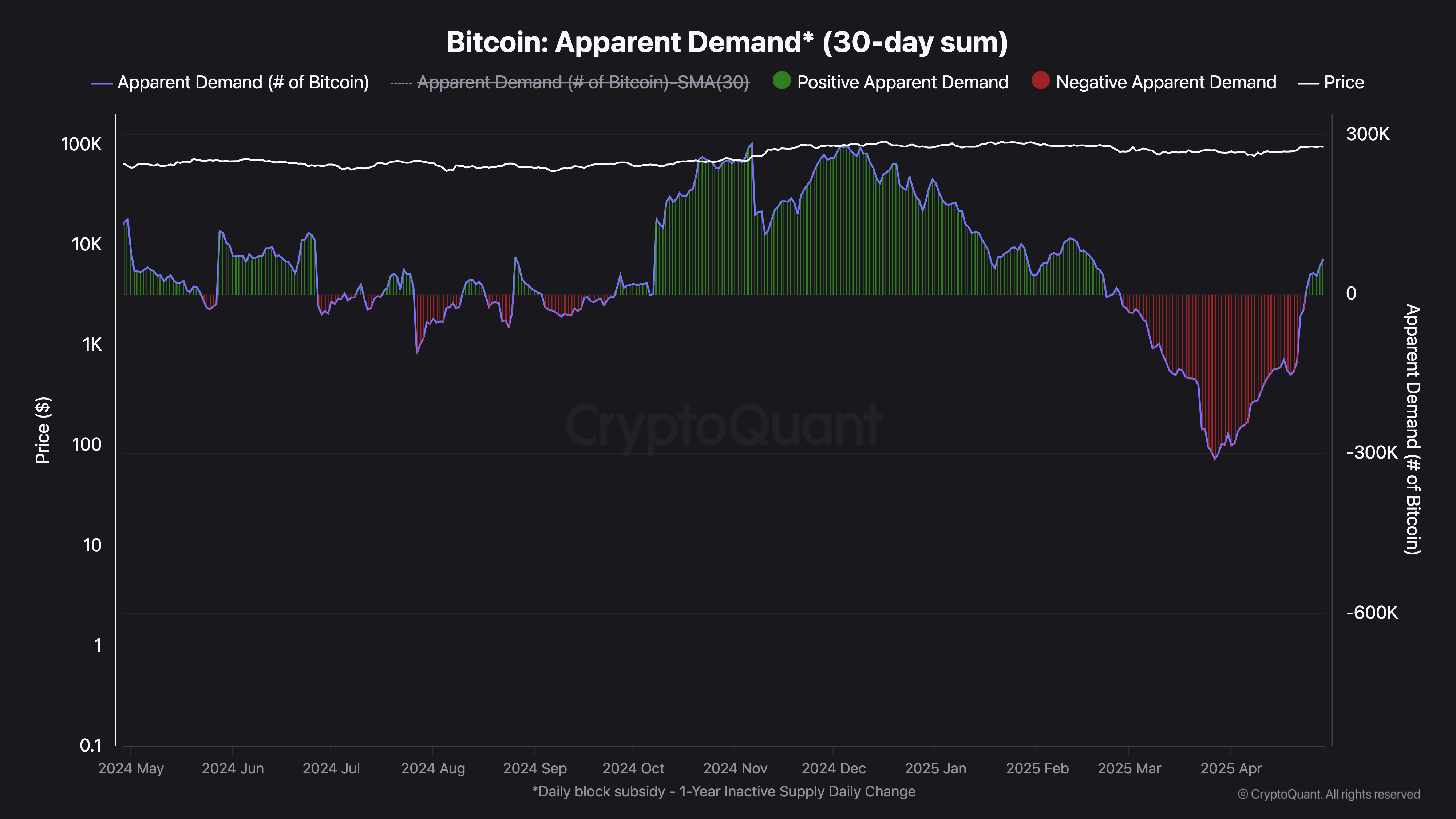

Bitcoin's apparent demand becomes positive, but fresh flows are still lacking

Bitcoin's apparent demand has shown clear signs of recovery recently, rising to 65,000 BTC over the past 30 days. It marks a sharp rebound from the trough on March 27, if the apparent demanding -a defined as the Net 30 -sun change in handling all the cohorts of the investor -talked to a deep negative level of -311,000 BTC.

Bright demand reflects the combined -joint balance changes throughout the wallets and provides insight into whether the capital enters or exits the Bitcoin network.

While the current demand level was still under the preceding peaks in 2024, a significant point of inflection occurred on April 24: Bitcoin's apparent demand became positive and remained positive for six consecutive days after nearly two months of long flow.

Despite this improvement, the broader momentum of demand remains weak.

Continued lack of significant new flows suggest that most recent accumulations may be pushed by existing holders rather than fresh capital entering the market.

For Bitcoin to mounted a sustainable rally, both apparent demand and demand momentum should showcased the same and synchronized growth. Until that alignment takes place, the current stabilization may not support a strong or prolonged price breakout.

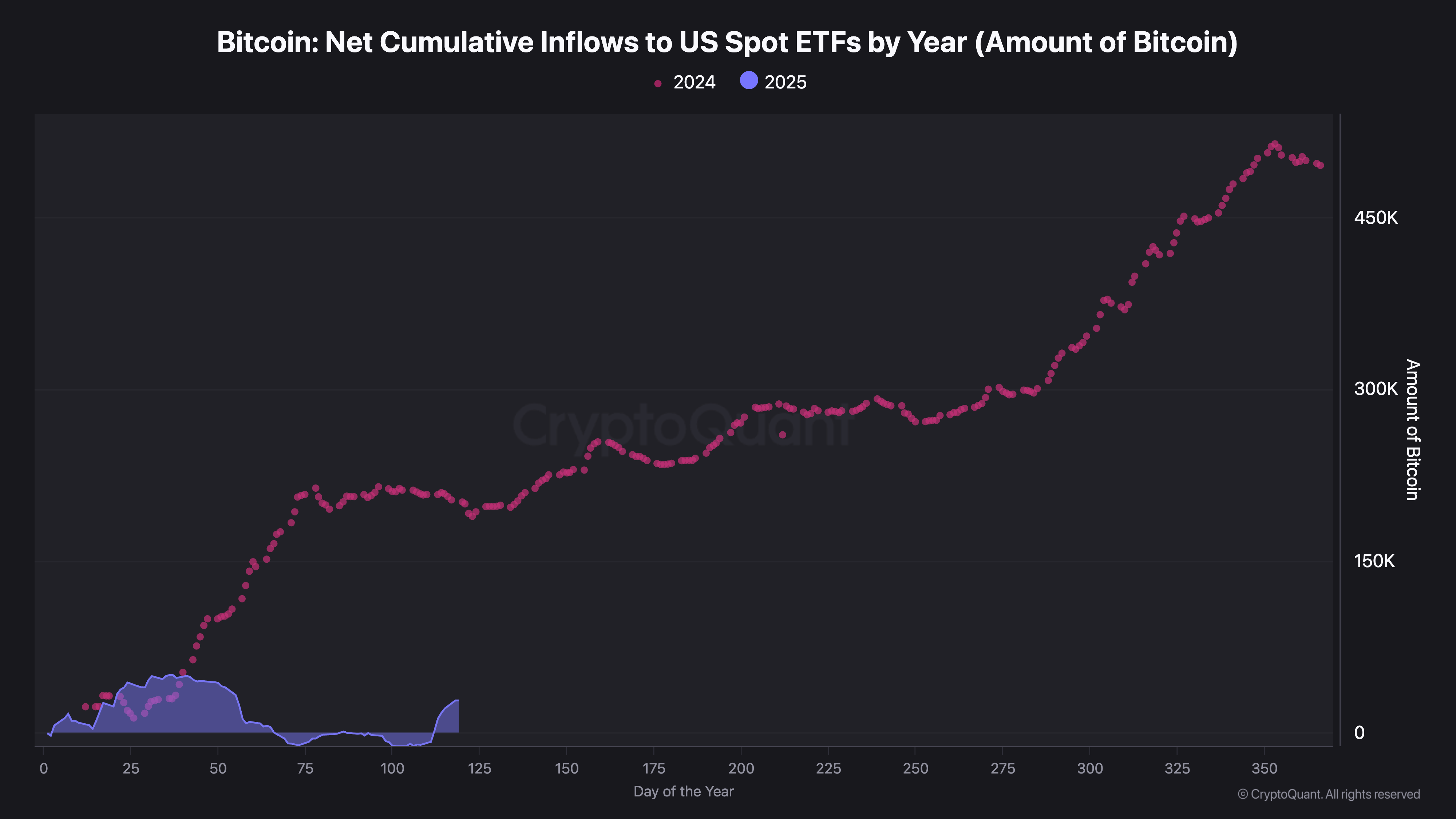

US SPOT BITCOIN ETF INFLOWS Still Below 2024 Levels

Bitcoin purchases from US -based ETFs have remained mainly since late March, changing between a sun -flow of -5,000 to +3,000 BTC.

This level of activity is strictly contrasting to the strong flow that is seen in the late 2024, when the sunny purchase often exceeds 8,000 BTC and contributes to the initial Bitcoin rally to $ 100,000.

So far in 2025, BTC ETFs have collected a net of 28,000 BTCs, which is less than 200,000 BTC they bought at this point last year.

This refusal shows a slowdown in institutional demand, which has been the key to driving major price movements.

There are early signs of a moderate rebound, with ETF flows starting to check the check recently. However, the current levels remain inadequate to fuel a prolonged uprising.

ETF activity is often viewed as a proxy for institutional beliefs, and a well-known increase in purchases is likely to signal a modified trust in Bitcoin's medium-term trajectory.

Until those streams return, the wider market can struggle to generate the momentum required for a long rally.

Bitcoin is close to $ 100,000 while the momentum builds despite the macro pressure

Bitcoin's price gained more than 14% in the past 30 days, strongly rebound after sinking below $ 75,000 in April.

This modified momentum is coming as the BTC shows relative stability amid the broader volatility of macroeconomic and policy-driven pressures, including Trump's tariff steps weighing on risk properties.

While the entire crypto market felt the effect, Bitcoin appears detaching slightly, showing less sensitivity to external shocks than other digital possessions.

The BTC only sits 6.3% below the $ 100,000 mark and remains under 17% from a potential move to $ 110,000. According to Tracy Jin, COO of Mexc, the emotion became positive again:

“Beyond the immediate price action, the growing appetite of institutional and shrinkage of supply mechanisms against macroeconomic uncertainty backdrop point to a structure transfer to Bitcoin's role within the global financial market. BTC is used in hedging against inflation and the fiat-based financial model.

According to Jin, a rally in the Tag -warm to $ 150,000 could occur. He emphasized that the $ 95,000 range is likely to be a point of launching for deciding brewing above $ 100,000 in the coming days.

“Global trading tensions should be further stabilized and institutional accumulation continues, a rally at the day to $ 150,000 can occur, which potentially reaches up to $ 200,000 by 2026. In general, the external background remains desirable for the continuation of the upward movement, especially the increase in the upcoming the Bitcoin on the weekend. ”

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.