What happens when the chip chain miners deceive the system

Table

Summary/Zusammenfassung

Publications

Recognition

1. Chapter: Introduction

-

Introduction

1.1 Overview of nature guarantee

1.2 Review of the thesis

Chapter 2: Background

2.1 Block Chains and Smart Contracts

2.2 The rules for setting the importance of transactions

2.3 Setting of transaction priorities and transparency of dispute

2.4 Decentralized Management

2.5 Chip Chain Scales with layer 2.0 solutions

Chapter 3. The order of the order of the importance of transactions

-

The order of the order of the importance of transactions

3.1 methodology

3.2 Analyzing the following norm

3.3 Investigating the offenses of the norm

3.4 Dark Defense Transactions

3.5 Summary notes

Chapter 4. Setting of transaction priorities and transparency of dispute

-

Setting of transaction priorities and transparency of dispute

4.1 methodology

4.2 on the transparency of the application

4.3 of the transparency of a priority

4.4 Summaries

Chapter 5. Decentralized management

-

Decentralized management

5.1 Methodology

5.2 Leadership attacks

5.3 Compound Management

5.4 Summary notes

Chapter 6. Related to work

6.1 The rules for setting the importance of transactions

6.2 Setting of transaction priorities and transparency of dispute

6.3 Decentralized Management

Chapter 7. Discussion, restrictions and future work

7.1 Ordering a transaction

7.2 Transparency of the transaction

7.3 Vote Distribution to change smart contracts

Conclusion

Extras

Appendix A: Further analysis of transaction priorities standards

Annex B: Additional analysis of transaction priorities and transparency of dispute

Annex C: Further analysis of voting force distribution

Bibliography

Conclusion

In this thesis, we used a data -based approach to study justice in the contexts of the chain chain, focusing on three key aspects: (i) Justice on ordering; (ii) justice in transparency; and (III) Justice in voting in changing smart contract applications.

Our findings show a discrepancy between the expected importance standards and the actual practices of the chip chain community. In particular, miners often tend to set aside these standards, prioritizing transactions that serve their own interests or friendly miners. This is in contrast to the principle of reward -based priorities.

Through active experiments, we have revealed cases of a miner collusion that includes dark breeding transactions. These transactions provide miners non-chain stimuli non-transparent, contributing to the lack of transparency in the ecosystem. These fees are kept private between the miner and the issuer of a specific transaction, even after the transaction is approved in the chip circuit. This exacerbates the challenge of the exact assessment of the fees. As a result, transaction issuers are struggling to determine the right fees because they do not have a complete overview of all the transaction fees offered.

In addition, chip chain applications, or smart contracts, are often changed with control protocols. The purpose of these protocols is to distribute decision -making among the participants. However, we show that the redundancy of the voting power based on Token's ownership tends to decide dynamics. The small subset of participants with a significant symbolic part affects the disproportionate impact, allowing them to design proposals and votes according to their own benefit. This practice damages the actual decentralization of decision -making rights in the ecosystem of the chip circuit.

We believe that our findings provide valuable knowledge of the design of new and fairer chip circuits. In addition, we have made the code and data sets used in this thesis to ensure the reproduction of our results in this thesis (Messiah, 2023a, b).

Appendix A: Further analysis of transaction priorities standards

A.1 congestion in a data set in a mempool b

Mempol congestion is not only typical not only in A (as discussed in §3.2.1), but also in B. Figure A.1 shows a huge variation of mempool deadlines, which is much larger than A. The fluctuations of Mempol size in B, for example, are about three times larger than A (maximum size size) about three times. Around June 22 was the price of Bitcoin after Facebook Libra announcements[21] And another rise around June 25th after the news of US dollar depreciation (Paul R. La Monica, 2019). These prices significantly increased the number of transactions issued, which in turn led to delays. As a result, Memphol B at times takes a much longer duration than when emptying all transactions.

A.2 The importance of transaction fees

Table A.1 shows the contribution of transaction fees to miners' revenue in all 2016-2020 extracted blocks. In 2018, the average of 3.19% of the total revenue per block accounted for the fees; In 2019 and 2020, 2.75% and 6.29%, respectively. However, if we only consider blocks mined by May 2020 (ie blocks of 6.25 BTCs), the average of 8.90% of the STD accounts for the fees. A total of 6.54%. As a result, the revenue of transaction fees (Easley et al., 2017) increases and tends to continue.

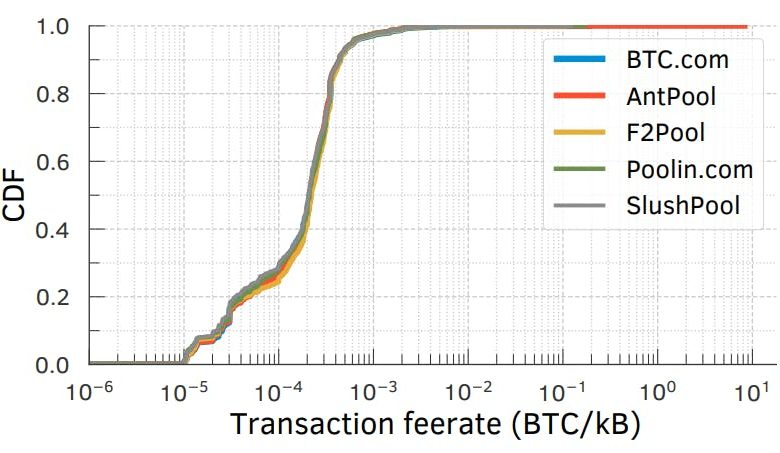

A.3 Interest rates for transaction fees in mining tubes

A.4 of fees and congestion

Figure A.3 shows 4 different trash bins or congestion at the level of transactions observed B. Each bin of each graph corresponds to a specific congestion level identified: lower than 1 MB (free of congestion), (1, 2]MB (lowest blockage) (2, 4]MB (4]MB (4]MB (4]MB (4](in the distribution and thus on average)

If at low congestion level. Therefore, users increase transaction fees to alleviate the delays during congestion.

A.5 Payment of Children-Parents (CPFP) Transactions

A.6 The behavior of miners during scam

To investigate miners' behavior during a Twitter scam attack, from 14 July to August 9, 2020, we chose all mined blocks (3,697 in total, which included 8 318 621 transactions) during this time C. Välja pool (B: 565; H: 15.28%), F2pool (b: 536; h: 14.5%) 11.47%), Antpool (B: 404; H: 10.93%) and Huobi (B: 353; H: 9.55%)

A.7 Transactions Acceleration Fees

In this experiment, we compare the transaction registration fee to the typical transaction fees in Bitcoin. To this end, on November 24, 2020, we obtained the current state of the UTC, which included 26,332 approved transactions from our Node Mempol. We then searched for each transaction through the price (or acceleration fee) of this transaction through the acceleration service provided by btc.com (btc.com, 2022). We concluded from 23 341 (88.64%) acceleration fees from 26 332 unverified transactions. Figure A.6 shows the acceleration charges provided by both Bitcoin transaction fees CDF and BTC.com. The acceleration fee is on average 566.3 times higher (4734.67 std.) And average 116.64 times higher than Bitcoin transaction fees. During this experiment, $ 18,875.10 was worth 1 BTC.

Author:

(1) Johnnatan Messiah Peixoto Afonso

[21] On June 18, Facebook announced its cryptocurrency weight, which was later renamed Diem.