Warren Buffett's wit and wisdom

Treasure We met Warren Buffett by accident in 1966. I wrote an investment article about another man Alfred Winslow Jones, who was not famous at that time but was soon due to this article. Jones led something called a risk fund and Treasure The description of what it was and how Jones acted started at the mini -boom. Buffett Partnership Ltd. – a kind of competitor of the Jones Foundation – received one line in the article. To my eternal indignation, I made a buffet wrong, giving it only one “t”.

A little later, my husband John met a buffet and came home, saying, “I think I met the smartest investor in the country.” I'm sure my eyes turned. But then I also got to know Warren (and his wonderful late first wife Susie) and realized how impressive this unknown companion was. The created shares were bought by his small company Berkshire Hathaway (Brka); We became good friends of Sweden; And finally, I became the editor of Pro Bono, an increasingly famous letter to shareholders.

In the meantime Treasure Take a long -term Buffett Course. He received two paragraphs and a picture in 1970. Treasure The story called “Hard Times come to the Hedge Funds” -Tema Foundation was a rarity that had a 13-year-old profit and 1977.

Now, 46 years after Treasure For the first time he met a man, we have a book, Dance for workWhat collects everything important that we have done about him (and some lighter things), with the comments I wrote. All of the above articles created by the AW Jones story is that – and that is just the beginning. A total of Buffett Banket is a book.

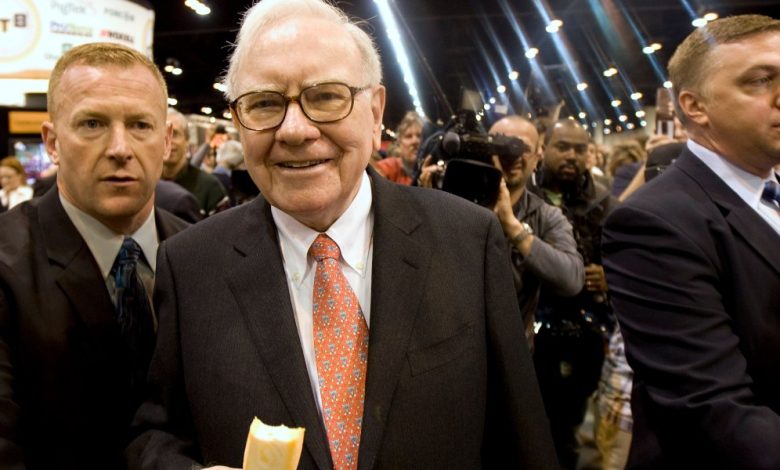

The following are some of the pages of quotes and a selection of photos that mark the passage of time, as Buffett grew into investor/manager/philanthropist whose place is certain in history. One thing is for sure: we are terribly pleased that we have been there as it happened.

A Coda: In 1966, when Treasure For the first time, Warren Buffett met, Berkshire's share (today's class A) was $ 22. At the beginning of November it was about $ 130,000.

1970s

January 1970: Hard times come to the hedge funds

“Buffett's record has been exceptionally good. During his thirteen years of operation … he supplemented his investors' money at the 24% annual rate … [Now] Buffett gives up the game game. ”

May 1977: How does inflation deceive an equity investor

“Most of the public office is quite clear against inflation and are firmly in favor of the policy that produces it,” Buffett wrote.

1980s

August 22, 1983: Letters of Buffett, Chairman

“The market, like the Lord, helps those who help themselves. But unlike the Lord, the market does not forgive for those who do not know what they are doing.”

December 26, 1983: Can you cross the stock market?

When investing, Buffett says: “You wait 3 and 0.”

January 20, 1986: Accession fees that bend the mind

“Buffett is so smart,” Bruce Wasserstein remembers, “that you had to be careful to avoid choosing.”

September 29, 1986: Should you leave it all for the children?

“Would anyone say the best way to choose the championship Olympic team is to choose the sons and daughters of the winning people 20 years ago? [That would be] A crazy way to compete in society. ”

December 7, 1987: Early fears of index futures

“We don't need more people who are identified in this country with the stock market, and the brokers who encourage them to do so … We need the intelligent commitment of the investment capital, not the amplified market bets.”

April 11, 1988: Warren Buffett's internal story

“With a few exceptions, when a reputable manager for Brilliance deals with a reputation with a bad main economy, the company is reputable.”

October 30, 1989: Are these new Warren buffets?

“You don't need a rocket scientist. Investing is not a game where the 160 IQ type beats the guy with 130 IQ … Rationality is essential when others make decisions based on short-term greed or fear. This is when money is made.”

1990s

April 22, 1991: Buffett buys junk

“I wish I would like to do a lot of things in retrospect. But I don't think much about investment decisions in general. You will only be paid for what you do.”

January 10, 1994: Now hey

“Paul Mozer paid $ 30,000 and he is sentenced to four months in prison. Salomon's shareholders – including myself – paid $ 290 million and I was sentenced to 10 months as CEO.”

March 20, 1995: Discussion of derivative instruments

“Buffett says he deals with derivative instruments, demanding that each CEO confirm in his annual report that he understands the contract for each derivative that his company has entered into.” Put it in, “says Buffett,” and I suspect you will confirm almost every existing problem. “” ”

February 5, 1996: Gates on Buffett

“You should invest in a company that even a fool can run because you will once want a fool.”

October 27, 1997: Warren Buffett's Wild Ride in Salomon

Looking back at the Salomon crisis: When Buffett became a temporary chairman, he asked him how he could handle both New York and Omaha. “My mother is my name to sew my underwear, so it will work out,” he replied.

July 20, 1998: Bill and Warren Show

“In most of the acquisitions, it is better to be a target rather than an acquirer. The acquirer pays for the fact that he will return to the carcass of an animal conquered in his cave.”

November 22, 1999: Mr. Buffett in the stock market

“I think it's hard to come up with a convincing case that stocks will fill something like this over the next 17 years something Like – they have occurred with the last 17. If I had to choose the most likely income based on dividends and recognition to make all investors … would earn … that would be 6%. ”

2000s

19th February 2001: Value machine

”[Berkshire] Reminds me of a miki mouse as a witch's apprentice FantasyTo. His problem was the flood. Ours are cash. ”

December 10, 2001: Warren Buffett in the stock market

“To refer to my personal taste, I intend to buy hamburgers all my life. When the hamburgers fall below the price, we sing the Buffett household” Hallelujah choir “. If the hamburgers rise to the price, then cry. For most people, it's the same as they buy in life – excluding Stocks. If the shares fall and get more for their money, they no longer like them. ”

November 11, 2002: most oracle

“The bubble has jumped but the stock is still not cheap …”

March 17, 2003: Prevention of mega catastrophe

“The derivatives are the financial weapons of the destruction of the mass destruction, carrying the dangers that are now hidden, potentially deadly.”

March 11, 2005: The best advice I have ever received

“I had $ 9,800 at the end of 1950 and by 1956 I had $ 150,000. I thought I could live like a king.”

July 10, 2006: Warren Buffett gives it away

“I know what I want to do and it is wise to start.”

April 28, 2008: What does Warren think

“It seems that everyone says [the recession] It is short and shallow, but it seems to be the opposite. You know that deleting by nature takes a lot of time, a lot of pain. ”

June 23, 2008: Buffett's great contribution

“There are a number of smart people involved in the management of the risk funds. But for the most part, their efforts are self -neutralizing and their IQ does not exceed investors. Investors can do average and over time with a low -priced index fund than a group of fund funds.”

July 6, 2010: My charity pledge

“My wealth comes from a combination of living in America, some happy gene and compound interests … My nature [born] Males and whites also removed the big obstacles that most Americans faced … The distribution of long straws of fate is wildly capricious. ”

AdaptedTap dance for work: Warren Buffett for virtually everything, 1966-2012Has collected and expanded Carol J. Loomis, published in portfolio/Penguin, for sale on November 21, 2012. © 2012 Time Inc.

The shorter version of this story appeared in the number of December 3, 2012TreasureTo.

This story was originally reflected on Fortune.com