Veteran Trader Peter Brandt Calls Ethereum “A Moon Shot”

Veteran businessman Peter Brandt has identified a chart pattern on the Ethereum price he believes that could lead to a major price move. Known in his critical views on Ethereum, Brandt said the current pattern of congestion on the ETH's monthly chart could support what he called the “moon shot.”

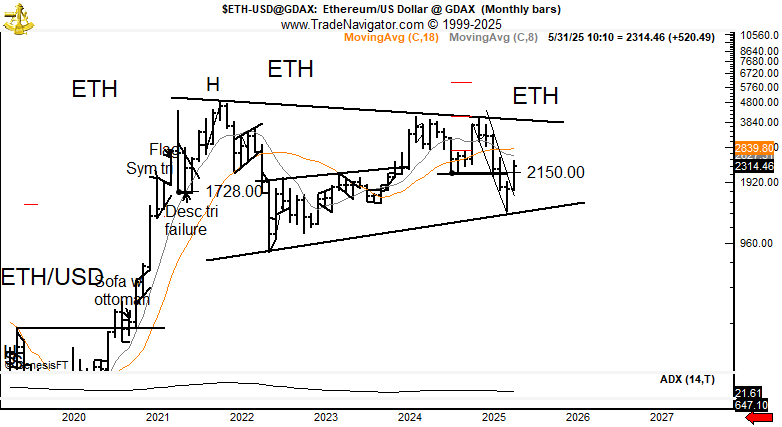

Brandt shared the review on his social media, noting that ETH has been trading within a long -term symmetrical triangle pattern since 2021. This formation often appears in market integration and could lead to a strong price breakout if confirmed.

Ethereum price structure suggests breakout at $ 6000

According to Peter Brandt's chartThe Ethereum price is formed by a large pattern of symmetrical triangle at a monthly time. This pattern is made of lower highs and higher lows, compressing the ETH price on a narrow range. The upper border links highs from 2021 and 2024, while the lower border is formed from 2022 bottom and recent 2025 lows.

Brandt pointed out that this pattern could be the basis for a large upward move. “This congestion pattern can support a moon shot,” he said. He also noted that he generally avoids commenting positively on Ethereum price but sees technical strength in the current chart structure.

ETH prices have booked from lower triangle support around $ 1,728 and $ 2,150 and closed the May 2025 bar at $ 2,314.46, with a monthly benefit of $ 520.49. Brandt added that if Ethereum prices break above the triangle resistance around $ 2,850- $ 2,900, the price could have reached between $ 5,600 and $ 6,000.

ETH price pattern corresponds to the 2020 breakout structure

Some analysts, such as Tardigrade Trader, have taught a repeated pattern from 2020. The ETH formed a similar upward triangle in 2020, followed by a strong rally from below $ 150 to top of $ 400 in a few months. The current 2025 glass chart sets up, with a horizontal level of resistance and increasing support trendline.

Breakout in 2025 was marked with a strong bullish candle and an indicated increase in purchase volume, increasing transfer credibility. The Ethereum price currently generates a curve of parabolic support under its price, similar to the 2020 structure that led to a multi-month rally.

According to the projection path from the height of the triangle, the ETH can move to $ 3,800 and beyond if the current breakout holds. In addition, institutional development also contributes to the growing interest in Ethereum. This week, Blackrock filed for an Ethereum ETF with the capabilities of staking after upgrading ETH, hoping for the hopes of hitting a new ATH.

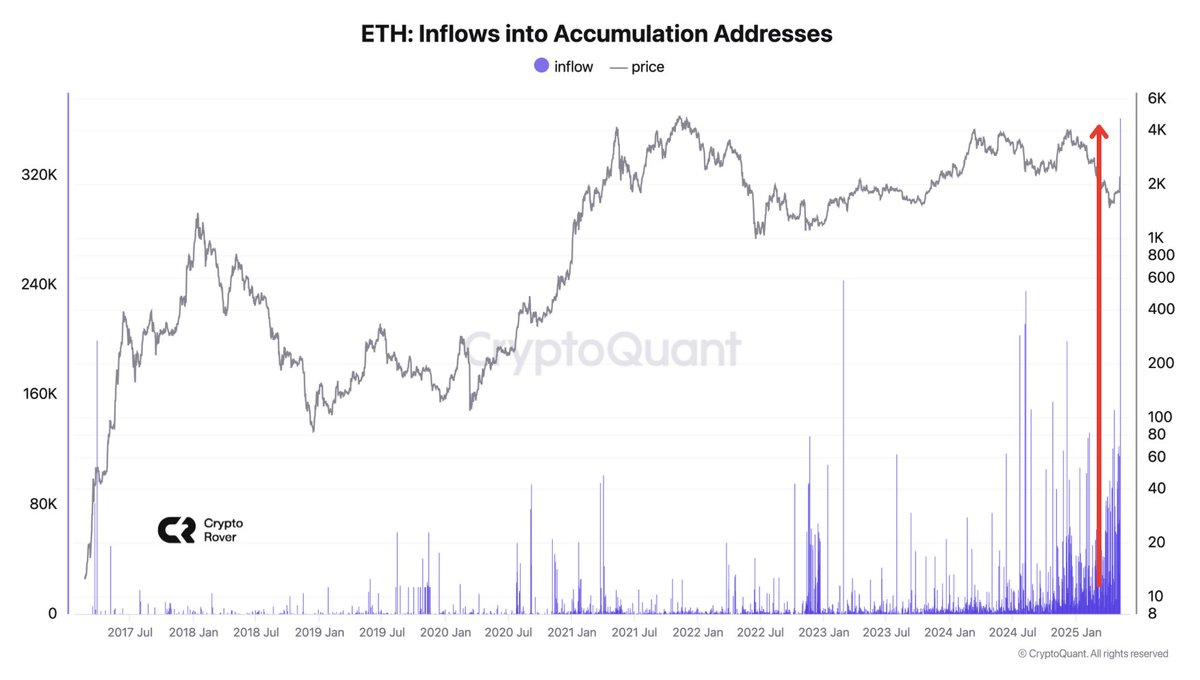

The whale activity increases in interest

As the ETH continues its upward motion, on-chain data shows that accumulation purses receive record flow. A large blue bar on the chart indicates the highest single-time flow of accumulation of wallets in ETH history since 2017. Despite this, the current price of Ethereum is still 47% below the full time of $ 4,891 set in November 2021.

The recent whale activity also attracts attention. A purse linked to Ethereum ICO has sold thousands of ETHs in recent weeks. The ICO participant originally bought 76,000 ETH at $ 0.31 each and ongoing liquid handles, including 1,900 ETH sold in Kraken for $ 4.44 million.

In addition, Brazil's B3 exchange has announced that it will list ETH and Sol Futures in mid -June, which expands the trading of crypto derivatives in Latin America. This step came as the market sees higher stablecoin supplies and improved investors' improved feelings due to expectations of reduction in US interest rates.

Denial: The displayed content may include personal opinion of the set and subject to market condition. Do your market research before investing in cryptocurrencies. The set or the publication does not hold any responsibility for your personal financial loss.

✓ Share: