USDINR Technical levels amid Geopolitical flare up

- Summary:

- The technical examination of the USD/INR along with the main factors that affect its exchange rate including major drivers should be considered.

At our start today on May 7, 2025, with this news that India launched the so -called “Operation Sindoor,” which conducts missile strikes that target their claims are terrorist infrastructure. Pakistan strongly condemned the strikes, calling them an act of war. The revolt of geopolitical issues affecting Indian rupee pricing has led to volatility in USDINR currency pair. So, in this article, let's look at technical analysis, price prediction for USD/INR, as well as other major factors that may also affect the exchange rate.

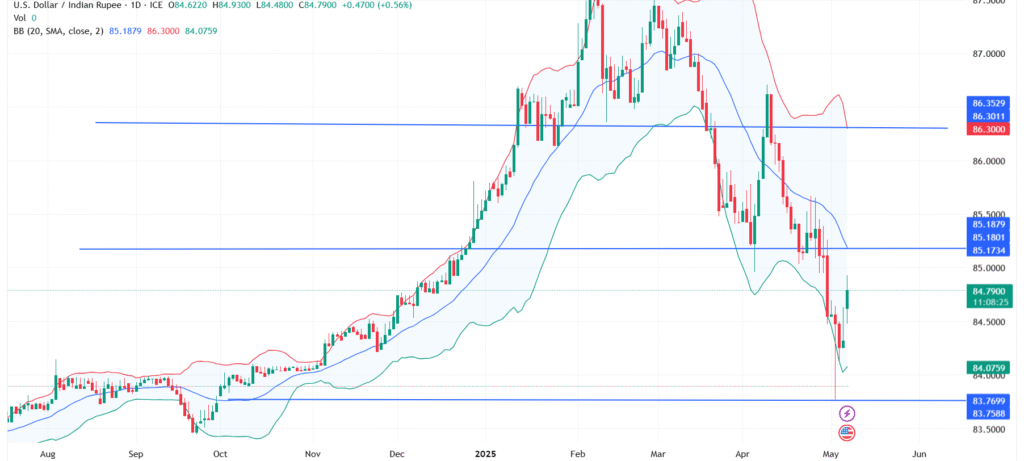

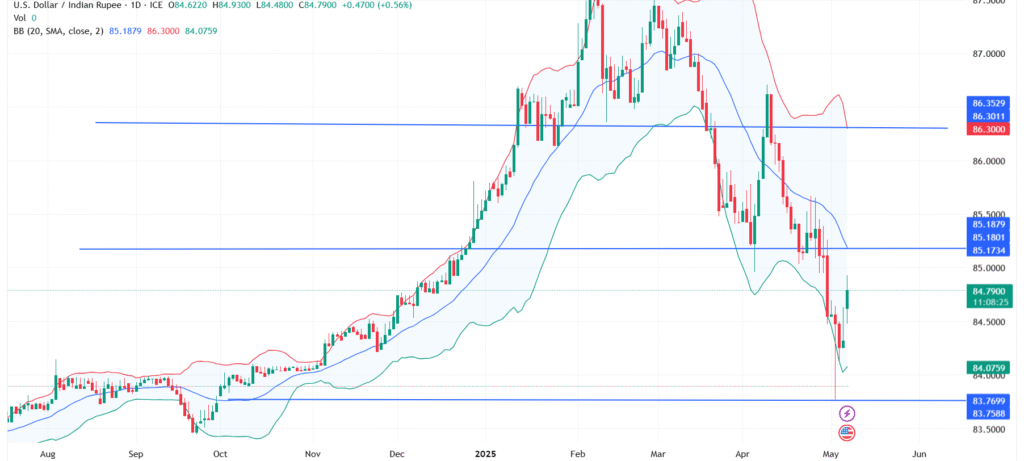

USDINR technical levels

Usually, the rise of geopolitical tensions weakened the Rupee, led the pair to get the ground, and it spun around 84.50 on Wednesday. In the day -to -day chart, technical analysis recommends the bearish perspective as the pair is still inside a descending channel pattern.

According to the downside scenario, at the lower border of the downward channel, approximately 84.08 is a support level. And any clear rest below this level can move downward and potential at the level of 83.75, which is the eight months low.

On the other hand, a reversal scenario can be performed if the pair can break the resistance level at 84.70. A prolonged rest of this level can boost short -term bullish momentum and climb to reach 85.17, which is another level of resistance; Its breaking up can bull a pair of its two months high 86.72

Main USDINR drivers: US dollar remains stronger, waiting for Fed policy

US Federal Reserve Policy:

The market is still focused on the Federal Reserve policy decision that is expected later during the North American session, and is widely expected to maintain interest rates. Especially in the midst of the uncertainty related to tariff and pressure from President Donald Trump for rate cuts. The Fed's bearing on interest rates and the upcoming economic perspective will continue to be the main driver for the USD in the broader market, which will affect USD/INR's volatility.

The geopolitical tensions:

As we mentioned above that today's main event affecting USD/INR pricing has occurred between India and Pakistan. This increases risk prevention and usually boosts US dollar (safely demanding) and weakens the rupee

Republic Bank of India Intervention:

Consequently with the geopolitical tensions and weakening of Rupee, market sentiment expects a potential intervention from the RBI to support money, therefore, any intervention can influence the USDINR rate.

While there are already declines in the produce, driven by expectations of more rates, the RBI maintains excessive liquidity.

Crude oil prices:

In this regard, India is a major oil import, crude oil price remains an important factor for India (oil prices are in a weak dollar). Because any significant movement in oil prices can affect USD demand and also support INR.