US GDP data surprised the negative side over the quarter

- US GDP signed an annual rate of 0.3%in the January-March period.

- The US dollar index trades a decent bar 99.30-99,40.

The US economy signed 0.3% a year in the first quarter of 2025 per year, according to data released on Wednesday, according to the Economic Analysis Bureau (BEA), there are no market forecasts and fell from the previous 2.4% expansion.

The section below was published as a preview of the US Q1 GDP growth rate at 8:00 GMT.

- The gross domestic product of the United States is extending 0.4%in the first quarter of the year.

- Investors focus on the potential impact of tariffs on the economy.

- The US dollar sees the consolidating at the bottom of its annual range.

The Economic Bureau of the United States (US) Analysis (BEA) on Wednesday is planning to preliminate the first quarter of total material (GDP). Analysts expect the data to show annual growth only 0.4%, which is a sudden slowdown compared to the 2.4% pace registered in the last quarter of 2024.

Markets for braces for US main growth data, in the middle of tariffs, inflationary problems

Before the first quarter of the first quarter, the markets are preliminary GDP preliminary figures on Wednesday publication in Edge-there was a width of the three more mobile estimates issued by the width of each quarter. In addition to the growth of titles, the report also includes fresh personal consumption expenses (PCE) data, the Federal Reserve (FED) preferred inflation meter.

The numbers of this quarter carry a special weight, as investors are looking for early signs from President Donald Trump's newly established tariffs. In the focus of both production and domestic prices, the data could provide important hints of the broader macroeconomic impact of the administration's trade policy.

The edition is followed by Fed 18-19. To the March meeting, where policy makers forwarded the outlook mixed in their latest economic forecasts (SEP), commonly referred to as the points of the points. Officials celebrated growth expectations by 2025, even if they were a little stronger inflation in PCE. Auditors reflect the uncertainty in the central bank over the risks of risks to the US economy.

The report also includes GDP Price index – Usually called a GDP deflator – which measures inflation in all domestic goods and services, including exports, but except imports. In the first quarter, it is expected to rise to 3.1%, compared to 2.3% in the last months of 2024, providing additional information on how inflation weighs for actual production.

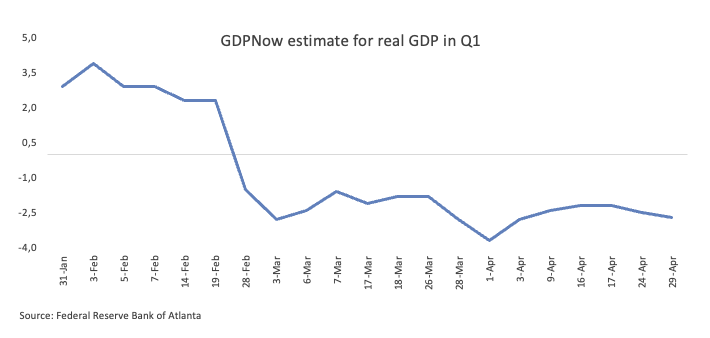

In addition to caution, Atlanta Fed's GDPnow model-tracked monitoring of the real-time monitoring of economic activity was predicted by 2.7% of the 27% shrinkage of the 27th April update.

When will the GDP print be issued and how can it influence the US dollar index?

The US GDP report, which has a deadline on Wednesday at 12:30, may turn out to be pivotal for the US dollar, as investors are considering the strength of the economy against permanent inflationary pressure and tariff spectrum. In addition to the growth indicator of the headlines, the markets check updates to the GDP price index and the Q1 Personal Consumption Consumption Price Index, the main data points that could change expectations towards the Federal Reserve Policy and the Dollar.

A stronger than expected GDP print can temporarily alleviate fear of a stagflation environment, potentially short setback for Greenback.

Wider technical outlook US dollar index (DXY) remains decisively quenching. The index continues to traded under its 200-day and 200-week simple moving average (SMA), now positioned 104.48 and 102.70 respectively.

Negative levels are in focus, with support services 97,92-2025. The lowest level of the year was celebrated on April 21 and 97.68, which is the key turning point from March 2022. Each upside-down adjustment could first be directed to a psychologically important 100.00 handle followed by 55-day SMA 103.64 and 26 March 104.68.

Impetus indicators Emphasize the bear. Relative strength index (RSI) per day chart It has fallen to about 36, while the average direction index (ADX) has risen over 55, indicating that there is increasing strength behind the recent downward movement.

Economic indicator

Basic costs of personal consumption – price index (MOM)

The main costs of personal consumption (PCE) published US Economic Analysis Bureau Monthly, the US (USA) measures changes in the prices of goods and services purchased by consumers. The PCE price index is also the preferred inflation meter in the Federal Reserve (FED). The mother's figure compares the prices of the goods to the previous month. The basic reading eliminates the so-called volatile food and energy components to obtain a more accurate measurement of price pressure. In general, high reading is a bullish for a US dollar (USD), while the low reading is a carak.

Read more.

Economic indicator

The price index of gross domestic products

The price index of home products (GDP), which is a quarterly exempt by the Bureau of Economic Analysis, measures the change in prices of goods and services produced in the United States. The prices that Americans pay for imports are not included. Changes in the GDP price index are followed as an inflationary pressure indicator, which may require higher interest rates. High reading is considered a US dollar (USD) bullish, while low reading is considered a bear.

Read more.