359,000 BTC Turns Long-Term As Market Swallows New Supply

The Bitcoin market (BTC) was very optimistic last week, prices jumping by more than 10%. In the midst of this positive development, there has been a notable activity of investors, which underlines an inflexible demand which could support a sustained price trend.

BTC Supply Reboup: long-term holders are increasing, new buyers work above $ 92,000

In a recent X jobThe popular expert Crypto Axel Adler Jr. shared interesting information on the channel on the Bitcoin market.

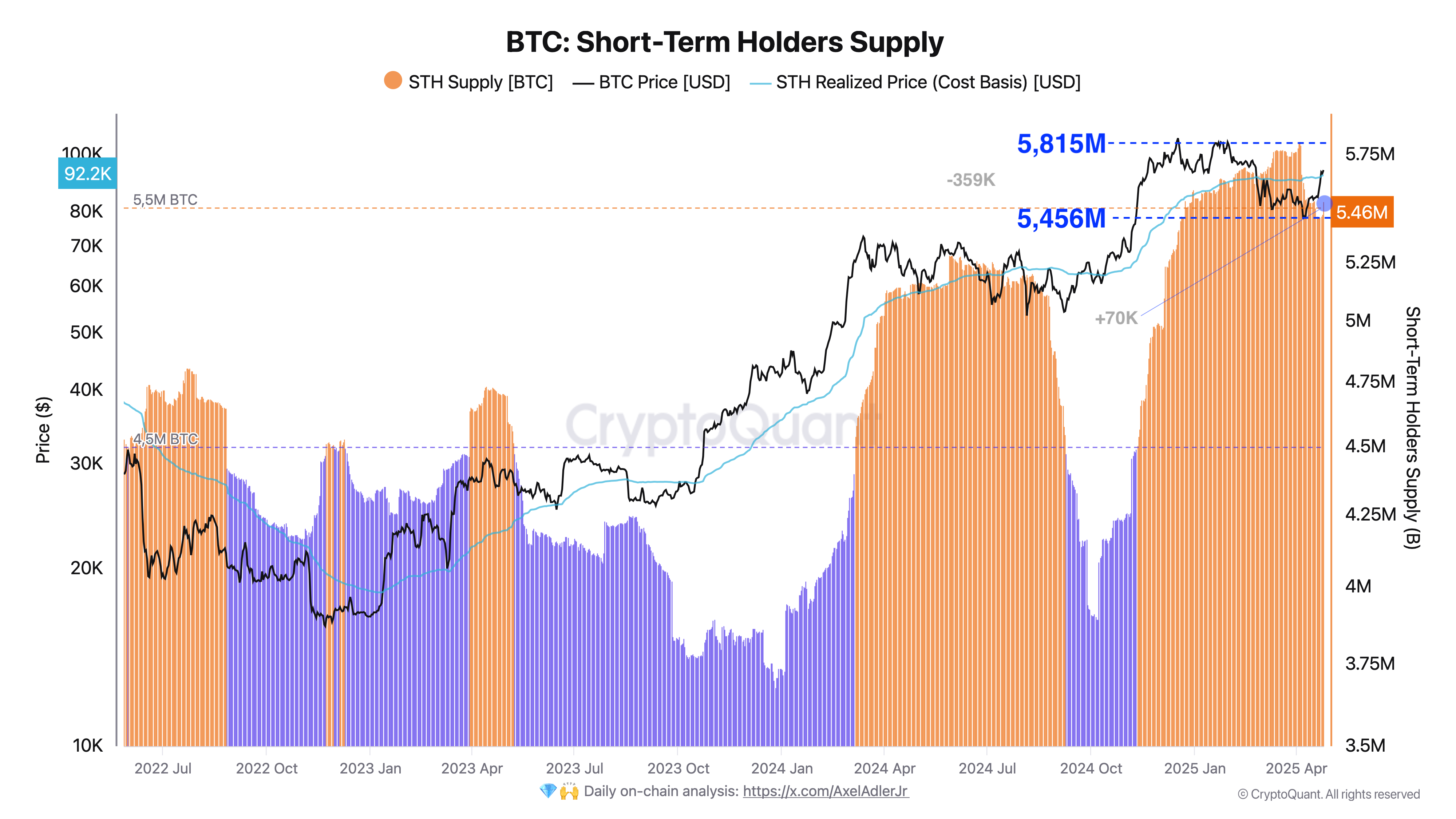

Using Cryptochant's data, Adler reports that the short -term holder market supply has decreased by 359,000 BTC, worth $ 33.84 billion, over 16 days between April 4 to 21. Interestingly, this decrease was not due to sales pressure but rather to the maturation of parts, resulting in a transition to the category of long -term holders.

This is a positive market signal indicating that holders are confident from the long -term Bitcoin perspectives. By opting against the sale, holders strengthen demand for the underlying market, offering a solid base for future price rallies.

In another interesting development, Axel Adler JR also noted that the short -term BTC offer increased by 70,000 BTC, worth $ 6.59 billion, during the last two days following the last Bitcoin price rally.

The analyst explains that this increase follows from the profits by long -term holders via redistribution As prices went up. Above all, short -term holders have effectively absorbed this new supply, reporting high demand on the Bitcoin market.

This request is strongly reflected in Bitcoin's ability to stay above $ 92,200, the basis of short-term holders, representing the average acquisition price of their assets. This indicates solid market confidence while new buyers are aggressively on the market, expanding the STH cohort.

Overall, the combination of the significant maturation of coins, healthy redistribution and bitcoin resilience above the cost base of short-term holders highlights a strong structural demand from the market. Long-term holders demonstrating confidence and new demand effectively absorbing the offer, BTC seems well positioned for an ascending momentum sustained nearby in mid-term.

Bitcoin price preview

At the time of writing this document, Bitcoin is negotiated at $ 94,408, reflecting a drop of 0.78% on the last day. However, the daily volume of asset exchanges is down 55.53%, suggesting decreasing market participation.

Nevertheless, BTC seems ready to maintain its price rise in prices, after having exceeded the Major resistance level at $ 91,000Supported by other bullish developments, including a renewal in FNB entries totaling around $ 3.06 billion in last week.

The next resistance is $ 96,000, exceeding the past, which could open the way for a new price increase to around $ 100,000. However, a price rejection could force a return to around $ 92,000, effectively creating a movement linked to the beach.

Star image of The Economic Times, tradingView graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.