US Bitcoin ETFs face the largest outflow after the 15-day stripe ⋅ cryptocurrency echo kay

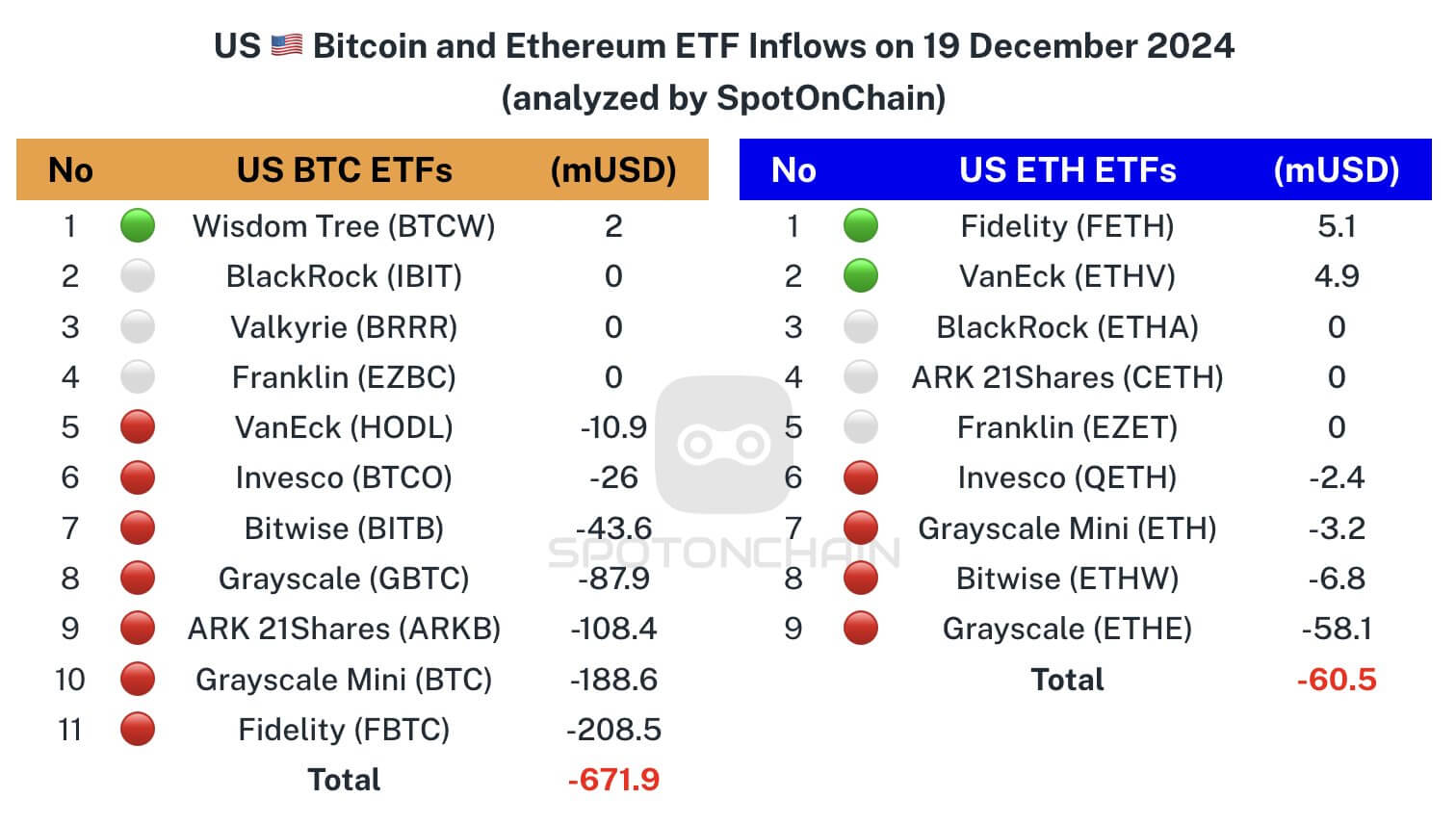

The US place Bitcoin and Ethereum On December 19, the stock-marketed funds (ETFs) were witnessing a sharp decline in December 19, with significant outputs disturbed the long-term streaks of investors.

Data Sponchain revealed that Bitcoin ETFs registered their most important one-day outflow after launching in January. The previous record was set in May a $ 563 million outflow. Investors took back $ 671.9 million from the funds, violating a 15-day inlet.

Fidelity fbtc led the sale with an outflow of $ 208 million, followed by Gray scale Bitcoin mini trust and ARK 21shares' arkbWhat looked like $ 188 million and $ 108 million respectively.

In spite of the widespread withdrawal, The btcw of wisdom Buck the Trend by registering $ 2 million with modest inlet. Blackrock Ibit And other ETFs remained flat, without significant changes.

Ethereum ETFS Final Strip

Spot Ethereum did not save ETF, a total of $ 60.47 million outflows and ended an 18-day inlet.

Grayscale Ethe was the hardest of losing $ 58.13 million while Bitwise's ETW It was followed by $ 6.78 million. Grayscale Ethereum Mini Trust and Invesco qeth Saw loss exceeded $ 5 million.

In the backward, Ferry feth and Vanecki ETV attracted $ 5.1 million and $ 4.9 million respectively.

However, these profits did not compensate for the broader decline in the market, as other Ethereum ETF products recorded zero flows.

Post US Bitcoin ETFs face the largest outflow after a 15-day stripe break appeared first CryptoslateTo.