Trump’s USD1 rockets into top 7 stablecoins, flips PayPal and Tether Gold

The President of Donald Trump president, World Liberty Financial (WLFI) Stablecoin, is heading for the greatest cryptos on the market. The USD 1 USD exploded in the 7th largest stablecoin in the world in just two months.

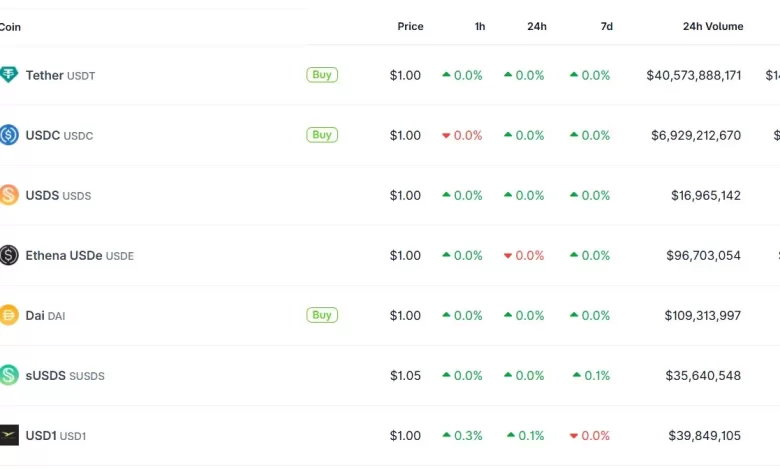

Launched in March with a size of $ 3.5 million, USD1 zoomed into a market capitalization of 2.2 billion dollars. The cumulative market capitalization of the stablescoin is 246 billion dollars, with USDT de Tether leading the charge.

USD1 reached a market capitalization of $ 2.2 billion

USD1 is still lagging behind on the market such as USDT ($ 149.5 billion in market capitalization) and USDC ($ 61 billion in market capitalization). However, he managed to exceed the market capitalization of $ 872 million in USD paypal, the first market capitalization of $ 1.5 billion in USD digital and even gold attached to $ 823 million.

This wave was largely brought by its almost exclusive publication on the BNB channel supported by the Binances. While $ 2.1 billion in USD 1 USD is circulating on the BNB channel, it represents more than 99% of its total supply. Meanwhile, a slice much smaller by $ 14.5 million exists on Ethereum.

USD1 accelerated sharply at the end of April, when its market capitalization increased 1,540%, from $ 128 million to $ 2.1 billion.

The Spike is also supported by Eric Trump's announcement that the ABU Dhabi Investment Company MGX would channel $ 2 billion in Binance using USD1. Meanwhile, the WLFI community is busy voting on an air proposal. The reports suggest that 90% of WLFI investors are not American.

After the major announcement, senator Elizabeth Warren did not waste any seconds and declared“A fund supported by a foreign government concludes an agreement of $ 2 billion using the stablescoins of Donald Trump.” She is furious that the Senate led by the GOP is preparing to adopt the law on genius, a bill on the stables that she claims could “help the president and his family to border their own pockets”.

The World Liberty Financial Project team includes President Donald Trump's affiliates such as his son Eric Trump and Zach Witkoff, son of Trump's special envoy in the Middle East, Steve Witkoff.

Witkoff had announced that USD1 was jumping on Tron, which is Justin Sun's blockchain.

Bitcoin eyes of $ 100,000 while Trump cryptos become parabolic

The Sun turns out to be the largest known investor in WLF with at least $ 75 million in the pot and is also a project advisor. However, Sun also moderated the panel where Witkoff and Eric Trump were all of USD1.

This happens when the American Securities and Exchange (SEC) commission interrupted its securities fraud file against Justin Sun earlier this year. Meanwhile, Donald Trump doubled the promises of being the “president of cryptography” and revising the American cryptography rules.

The global digital asset market displayed a overvoltage of approximately 3% early Thursday morning as Bitcoin Pouces towards the $ 100,000 mark. The cumulative market capitalization of cryptography violated the 3 dollar billion mark with a negotiation volume of $ 112 million.

The price of Bitcoin jumped 2.5% during the last day and is negotiated at an average price of $ 99,613 from press time. Ethereum, the largest Altcoin, recorded a 5% leap in order to find the crucial bar of $ 2,000. ETH is traded at an average price of $ 1,936 in press times.

Trump Trump of Trump is among the biggest winners of the day, because his price has skyrocketed 12% in the last 24 hours. Trump is negotiated at an average price of $ 12.25 with a negotiation volume close to $ 1 billion. It is still down 83% compared to its summit of $ 75.35.

Cryptopolitan Academy: Do you want to develop your money in 2025? Learn to do it with DEFI in our next webclass. Record your place