Tron (TRX) Addresses’ Profitability at 95%, But There’s a Catch

Tron (TRX), the cryptographic asset of 10th classified by market capitalization, have seen a lot of buyers in recent times. In particular, an amazing quantity of its addresses is in profit because the perspectives of the part remain under the control of investors.

Tron's record address

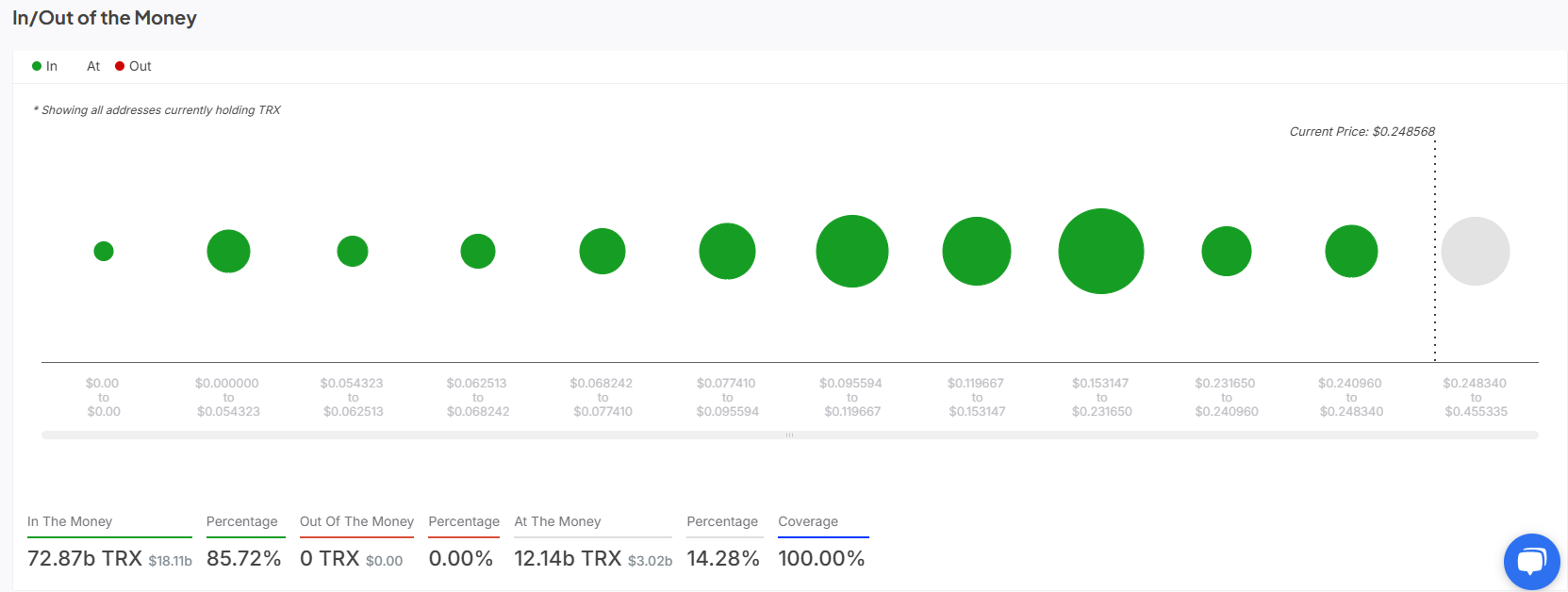

According to intotheblock data, 72.87 billion TRX, worth $ 18.11 billion, are “in money”. This represents 85.72% of the total addresses making a profit on the blockchain.

Significantly, no address is currently “out of money” and no holders are short of press time. This reports the impressive earnings that TRX has made for holders in the last 24 hours.

Meanwhile, 12.14 billion TRX, valued at around 3.02 billion, are “for money”. This represents addresses which do not make a profit or a loss of loss and represents 14.28% of the total addresses.

Despite this bullish development in the ecosystem, TRX is still experiencing high volatility alongside the wider market of cryptography. Current profitability could dive and throw some addresses from money.

At the time of the press, the tron price was change Hands at $ 0.2485, representing an increase of 1.81% in the last 24 hours.

However, the volume of exchanges dropped by 16.19% significant to $ 407.74 million over the same period. For the current configuration to continue, the volume of negotiation must remain high and the price must maintain this momentum.

Justin Sun Eyes new top of all time

Even if the commercial volume suggests prudence on the part of investors, the community remains optimistic about TRX. Justin Sun's bullish prediction on the asset could have fueled optimism.

In particular, the founder of Tron had, in a rare moment, predicted that Trx would display a summit of all time (ATH) in this quarter. He noted that before June, TRX will return $ 0.4407, which he reached the first week of December 2024.

Tron has shown potential on the wider cryptography market. Last month, he spilled Cardano, an amount in ninth place in terms of market capitalization.