This is Why Coinbase is Acquiring Deribit for $2.9 Billion

Coinbase has signed an agreement to acquire the derivator of the Crypto derivative exchanges for $ 2.9 billion, signaling the growing interest of the company for the crypto derivative market.

The scholarship will transfer $ 700 million into a drifting cash, which makes the rest of its payment in class A shares. This may or may not delay the finalization of the agreement for a few months.

Coinbase acquires the drinking

Coinbase opened talks for the first time with deribit at the end of March, but this agreement Obviously, took a lot of negotiations. In January, the Popular Derivative Stock Exchange began to publicly assess the buyout offers, but Kraken would have rejected a proposal to acquire it for 4 to 5 billion dollars.

Four months later, Deribit is willing to accept a much lower offer. We do not know what pushed Deribit to move forward with an offer of 2.9 billion dollars in Coinbase. After the Kraken agreement failed, the exchange of Crypto derivatives left Russia due to the sanctions of the EU.

This may have contributed to its lower evaluation, but it is difficult to say it with certainty. One thing seems obvious: Coinbase continued the agreement to extend its presence on the derivative market.

“With Deribit, Coinbase becomes the overall platform n ° 1 for crypto derivatives by a volume of options and open options. The drinking provides around $ 30 billion in open interests and 1 dollars + billion in the volume of negotiation. This is a major step in our global extension strategy. claimed on social networks.

Coinbase, one of the main exchanges of crypto in the world, has already been an actor in this market. He began to offer commercial derivatives almost four years ago and recently launched XRP term contracts regulated by CFTC.

This partnership with Deribit will however allow Coinbase to overeat these operations.

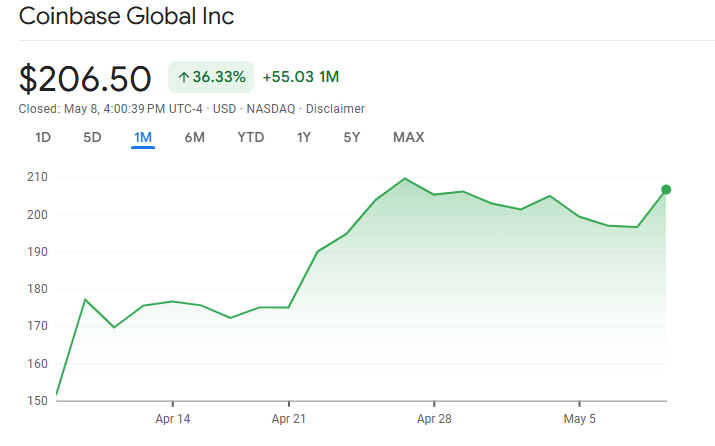

Meanwhile, Coinbase's actions courses have recovered considerably since Trump's radical rates last month. Coin has increased by more than 36% since April, while the exchange is preparing its report on the first quarter of 2025 results later in the day.

Deribit leaders will receive most of their requested price of 2.9 billion dollars in class A actions in Coinbase. This last company will pay $ 700 million in cash, but otherwise seal the acquisition agreement with 11 million shares.

According to the press release, this can delay the procedure somewhat, but the transaction “should close by the end of the year”.

In the future, Coinbase did not specify how it plans to take advantage of the resources of deribit for its own expansion plans. However, the company's public statements have repeatedly stressed that Deribit is the world leader in cryptographic derivatives.

By simply taking control of its user base and by exchanging volumes, Coinbase has acquired many opportunities to take the spotlight.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.