Does the price of Bitcoin require $ 100,000 when Donald Trump hints at the relief of Chinese tariffs?

Bitcoin's price has recovered after statements by US President Donald Trump on Chinese trade tariffs. Digital assets have risen by more than 12% this week and is currently trading over $ 94,000, raising the question of whether it could soon recover the $ 100,000 limit.

Donald Trump's comments on tariff lowering were influenced by the market mood of several risk assets, including Bitcoin, XRP, Doge, Ethereum and other cryptocurrencies. At the White House event, the President said that Chinese tariffs would be reduced in the future with a “big and significant percentage”.

However, he claimed that they would not go to zero, but his tone change seems to pull back to global trade problems.

Bitcoin price rises in the middle of the trade war tensions

The markets that came to risk arose in the markets after us President Donald Trump floated Possibility to reduce tariffs About Chinese imports. He said that 145% is very high and is not so high. It falls significantly. ”

These statements were made after weeks of threatening words and gestures and was filled with recognition of the market.Moving supported the main indices rally and increased demand for risk assets like Bitcoin. For example, Bitcoin applied 6.77%on Tuesday to close the day trading over $ 93,400. Then, by Wednesday, the price of Bitcoin was again on the rise and traded over $ 94,000.

Investors kept a statement as a possible sign of relieving tensions in US -Chinese trade relations. The Wall Street Journal announced that Scott Bessent also supported the Treasury Secretary, also supporting a more relaxed position, claiming that he believed to have an agreement with China.

Data of chain and derivative indicate increased market confidence

According to K33 studies, investors have increased in the futures market. CME futures exposure increased to 140,000 BTCs, with premiums increased for the first time after January by more than 9%. It refers to wait for traders valuable estimateTo.

Open interest in Easter week (oh) increased According to K33 research report, about 5000 BTC. It sent a three-week range of OI to the fresh highest to 140,000 BTC. However, it is still below the 4th quarter and the beginning of the first quarter, where it exceeded 200,000 BTC marks.

The increase in futures awards and oi are generally related to the increased activity of institutional players. This trend points to higher prices, although the overall leverage is still not at the top.

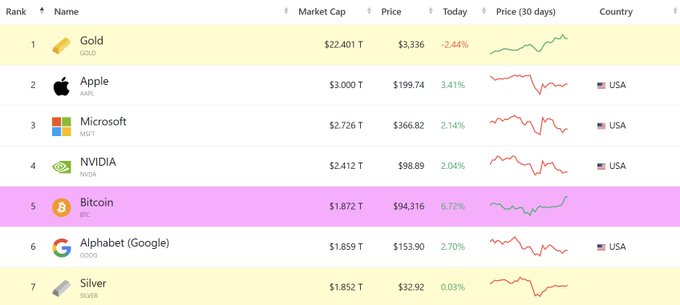

Bitcoin slides on Google's parent company and silver

Bitcoin has now exceeded Market value of alphabet, silver and Amazon. Companymarketcap data shows more than $ 1.8 trillion in Bitcoin's market capitalization, turning it into the fifth largest worldwide asset.

The BTC value is now $ 12 billion ahead of the alphabet of Google's parent company. The silver, which is considered valuable for a long time, is currently $ 1.856 trillion. Amazon follows the ceiling of the market $ 1.837 trillion.

This new leaderboard leads to the highest global assets of Bitcoin. The price and market value rally came after investors' concerns alleviated the uncertainty of the trade war and monetary policy.

ANalysts discuss the BTC cycle and possible trend reversal

Ki Young John, CEO of Cryptoquant, commented about the current market situation. He claimed that despite BTC price recent profitsHe sees that the market is moving in a wide variety. He said,

“If it breaks over $ 100,000, I am happy to admit that I was wrong.”

After all, it focuses on long -term supply and demand using chain data. He noted that the reactions based on the event would make it harder to predict a short -term price. According to him, “even the interpretations of the data may vary among the chain analysts”.

He also mentioned that the cycle theory could be reviewed if Bitcoin hits the highest level of all time before the second quarter. This would indicate that the market could enter another phase than previous bull cycles.

Obligations: The content presented may include the author's personal opinion and is subject to market conditions. Do your market research before investing in cryptocurrency. The author or publication is not responsible for your personal financial loss.

✓ Share: