The strategy doubles with bitcoin, adds 15,355 BTCs to another

The strategy extended the April purchase bar with another acquisition of another 15,355 BTC with a value of $ 1.42 billion. The recent purchase coincided with the BTC stabilizing over $ 94,000.

The strategy (Mstr) bought another 15,255 BTC with a value of $ 1.42B of their last US SEC submissionTo. In April, the company continued the trend of weekly acquisitions, on Monday with a regular announcement. Over the past month, a total of 25,370 BTC added a strategy to its Treasury.

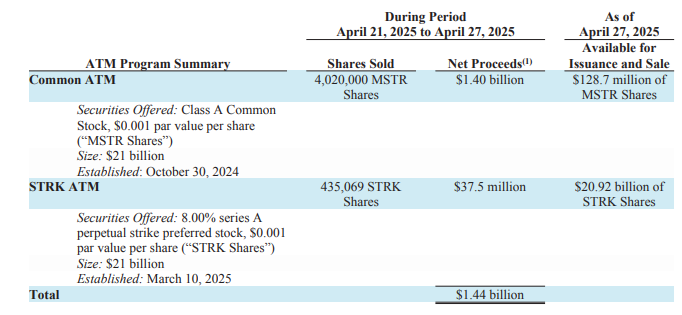

The Michael Saylor Foundation acquired a new BTC batch at an average purchase price of $ 92,737 per BTC, which is higher than previous purchases. Acquisition is followed by another MSTK shares and STR shares for $ 1.44 billion. The strategy now owns about 2.6% of the total BTC offer, which is almost 2.8% corresponding to the Blackrock ETF.

At the time of the purchase of April, the strategy also used most of its authorized shares, with only about $ 128 million remaining in the facility. Most future purchases can be based on STK or STRF.

Strk sales are still much harder, with only $ 37.5 million raised during the last round. In the coming months, 8% of preferred shares may be the key to ongoing acquisitions.

Stroke Provides harvest but has a weaker correlation with Mstr and BTC. In the coming months, it will be clear how attractive property is for those who want both passive income and BTC exposure.

After the last announcement, BTC jumped again, recovering to $ 95,258.42. Over the past week, the strategy also bought DIP as the BTC shook at the lower range.

Before the official acquisition, Saylor rejoiced in anticipation, adding to the market rally.

$ Mstr has acquired $ 15,355 BTC at a price of ~ $ 1.42 billion ~ 92,737 dollars per bitcoin and has achieved BTC yield 13.7% YTD 2025. From 4/27/2025 $ Btc Acquired ~ $ 37.90 billion at a price of $ 68,459 per bitcoin.

– Michael Saylor (@saylor) April 28, 2025

Mstr shares hinted in the series of acquisitions, trading at a peak of $ 368.71. Mstr is still the fastest developing technology stock, reflecting the BTC performance and the value of the company's portfolio.

The price of the MSR is also closely monitored and a breakthrough is expected for BTC rallies to higher ranges. Traders also make irrational contributions, showing that the market has returned to risk taking on the risk of a risky approach.

The average purchase price of the strategy is now slightly higher – $ 68,459, with an average portfolio of over 39%.

Series weekly purchases In April, the delays and the two -week period were followed without purchase. The strategy participation in the market is still considered to be largely one of the Bullishi factors of BTC.

The strategy runs the growth of the company's treasury

After the last inflow, there are now large -scale units 3.22m BTCTo. Strategy, MetaplanetAnd Semler Scientific were the only active buyers of the last week, while Mara Holdings has been passive for the last four weeks.

Another significant change in buying a company is the US XXI, an indigenous, aimed at acquiring BTC over time. The fund started with 31,500 BTCs, becoming the third largest owner of the company units. In the coming months, the fund is expected to compete with a strategy with an aggressive BTC.

The strategy easily buys the monthly production of the new BTC and is still the most important unit to remove the coins from the market.

Cryptopolitan Academy: Soon – a new way to earn a passive income with a defi in 2025. For more information