The institutions decompose with Ethereum but keep ETH on the hook

Ethereum has been one of its more uncertain periods since its entry. The use of the base layer is falling, with core metrics approaching the lowest level of the perennial and even co -founder Vitalik Buterin offers radical architectural overhaul.

The institutions do not expect it to play. Blockchain data show that long -term supporters like Galaxy Digital and Paradigm have reduced its ether (Eth) holdings in recent weeks.

So far, the activities of the Ethereum base layer have continued to collapse in April. Ethereum's Network charges falland Inflation has risenTo. Although layer-2 networks Continue to develop, they are cannibalize Capping the value of the base layerTo.

But the story is not completely about the collapse of Ethereum. Some whales treat this decline as a rare opportunity. Even those who sell the ether cannot be completely released.

Ethereum lead to institutions, but how long?

The institutions lead to Ethereum, but it is the former they continue. It's not completely out of the picture – just benches until they explore opportunities like Solana (Salt).).

In recent weeks, analysts for the search for large crypto -shapes have noticed a number of institutions that move out of their labeled wallets from ETH. View reported This Galaxy Digital deposit Binance 65,600 ETH ($ 105.5 million). According to Arkham, the broadcast of the investment company increased by about 98,000 coins in February, but it has fallen to almost 68,000 ETH at the time of writing.

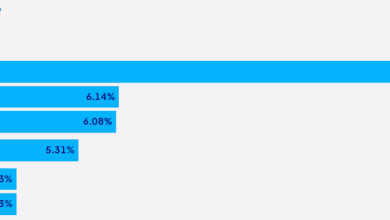

Galaxy's stakes may have decreased in recent weeks, but are still higher than the beginning of the year. Its ethereal properties reflect the wider trend of investment products in Ethereum. According to Coinshares saw ETH Funds out of the last week outflow $ 26.7 million, bringing a total of $ 772 million over eight weeks. However, the streams are positive, with a net stream of $ 215 million.

When Galaxy kept on its air, he also took back 752,240 sol ($ 98.37 million), Lokonchain said. Ethereum lost a significant momentum to SolanaWhich became a chain of the Memecoin casino, which dominated much of the 2024 and 2025. Here Finally cooled down in the midst of unbridled fraudRobots and low-quality chips, it was also Solana's technical exhibition-truth-providing its ability to process massive transaction volumes without higher fees or downtime.

Related: Pump.Funi Memecoin Friik Show may cause criminal charges: expert

Paradigm is another investor who has reduced the air. On April 21 moved 5500 ETH ($ 8.66 million) Anchorage Digital. The paradigm wore about 97,000 ETH (about $ 301.57 million) in January 2024, which was then taken to centralized stock exchanges as Onchain analyst Embercn pointed outTo.

“Although institutional investors originally bought the narrative 'universities' money, they are now facing reality, where reducing the revenue of the protocol and weakening of tokenomas cause legal problems,” Jayendra Jog, co -founder of Sei Labs, told Cointelegraph.

Ethereum returns to an inflationary state

The deflation of the ether has been an attractive sales point for Ethereum investors. It was integrated into the network through two major versions. First London hard fork August 2021 Introduced Ethereum's proposal 1559, which partially burns transaction fees. Then in Update the merger of September 2022Got a network of Ethereum evidence and drastically created a new symbol.

The offer of ether consistently decreased until April 2024, when Ether inflation began to accelerate. By the beginning of February 2025, the entire ETH offer had exceeded the level of its merger.

Part of the ether inflation is due to a decline in fees, resulting in less ether burned. According to Interteblock, Ethereum collected 1,873,52 ETH from April 14 to April 21. This is slightly higher than the 1,697.61 ETH fees starting on March 17, which were the lowest fees (measured ETH) from 31 July 2017.

Buterin's radical RISC-V proposal to Ethereum

On April 20, Buterin made a proposal RISC-V coaching sets the current ethereum to replace the virtual machine The language of the contract aimed at improving the speed and efficiency of the network filling layer. Some keep a proposal for the white flower of the existing architecture.

“The proposal of the Vitaly RISC-V is essentially the recognition that EVM's basic architecture has reached its limits. If the founder of Ethereum recommends replacing the nucleus or whatever supporting the entire ecosystem, it signals that it does not develop, but also recognition of design restrictions that cannot be increased,” Jog said. ”

Cointelegraph has reached the Ethereum Foundation and refreshes this article when it answers.

Related: Cryptocurrency Guide: Analyzing Strategies and Performance

The proposal follows a Management in Shuffling Ethereum Fund After complaints after the project.

Could Ethereum be the one who escaped?

Part of Ethereum's struggles has been attributed to the scaling of this network. The idea was to build a Layer-2 scaling network that would download transactions from the base chain, but still use its security. It has alleviated congestion during high network requirements, but has also caused new problems, such as the decline in ether burns and fragmentation of ethereum ecosystem.

But is Increased focus on layer 1 scalingAccording to the new CEO of the Ethereum Foundation, Tomasz Stańczak. Stańczak said from X that the Ethereum Foundation directs the focus on recent goals, such as layer-1 scaling and 2. Layer scaling support.

Some whales have taken advantage of the cheaper price tags of Ethereum. On April 23, Lookonchain identified Two wallets are gathered in millions of dollars Eth. Detected Block Chain Monitor Another wallet On April 22, which has accumulated more than $ 100 million in ETH since February 15th. Ether is currently down Plus-$ 4000 it reached in December But on April 23, over 10% rose over $ 1,800To.

In a recent customer letter, the Standard Chartered Bank reduced its 2025 year price forecast of $ 10,000. But with the current whales, the potential remains, as the bank still predicts $ 4,000.

Geoff Kendrick, Head of Research of Digital Assets of the Bank, attributed a more cautious outlook To the structural decline of Ethereum, noting that Layer-2 networks for improving the scalpency now extract much of the revenue of the fee when the base layer is reflected.

Magazine: What are the indigenous people? A complete guide to Ethereum's latest innovation