“The fate of the economy is sealed”, “Clean” your portfolio, warns top economist

⚈ David Rosenberg, an economist, warns that 60% of the US economy is already in or near the economic downturn, calling on investors to reduce exposure to cyclic assets.

Despite the short -term optimism of trade transactions, markets are undeserved to economic risks and may soon face a major decline.

⚈ Other experts predict a serious recession by 2025, with warnings of potential systemic financial crises similar to the 1930s.

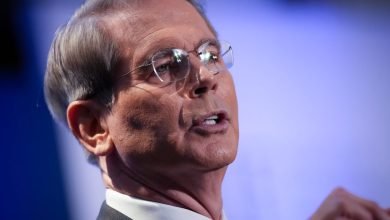

David Rosenberg, one of the influential voices of Wall Street, has published a warning of the next stage of the US economy, inviting investors to act quickly.

Chief economist and strategy Rosenberg's study Based on his caution in the last analysis of the beige book of the last Federal Reserve, inferred that about 60% of the US economy is either a recession or dangerously close to it, he said in X post April 25th.

Namely, the Federal Reserve 12 of the Regional Banks report offers a real -time overview of the business conditions throughout the country.

Unlike the fears of growth in 2022-2023, when the pandemic savings spent, Rosenberg noted that the current environment shows clear signs of consumer-based decline, with the weakening of sales and labor markets signaling significant slowdowns.

We analyzed the Fed beige book and came to the conclusion that about 60% of the US economy is already in the recession or on the edge of the knife. <…> As we all focus on alleged trade, the fate of the economy is sealed. <…> Use demonstrations to clean the risk and cyclical contact portfolio, ”said Rosenberg.

When financial markets have optimized for recent trade agreements, Rosenberg stated that the broader economic fundamentals tell a much more worrying story.

Reduction

He believes that markets have significantly reduced the risks, with only a fraction of possible damage in the case of stock prices and credit sections. To this end, Rosenberg advised investors to use demonstrations in the market to reduce exposure to high risk and cyclic assets.

If Rosenberg believes that the recession is already here, another economist Henrik Zeberg said that the economy is not yet a decline in the growing market risk. He noted how the sentiment had shifted to extreme suffering just weeks ago, highlighting how fast narratives could change.

Zeberg warned that the markets now form a “top of the blow”, a sharp rally that could precede a major decline. The expert argued that a strong recession, which is potentially worst since the 1930s, is still on the horizon.

Indeed, the calls for a potential recession have recently accelerated, caused by the trade tensions caused by tariffs. The tension was relieved after President Donald Trump claimed that he had a conversation with his Chinese colleague, which caused a positive reaction to shares and cryptocurrencies.

The timetable of the recession 2025

Namely, as Finbold announced, most calls are in line with the possibility of a decline in 2025, the CEO of which will set the schedule for the next six months. At the same time, Jamie Dimon, CEO of JPMorgan, warned that the tensions of US-China trade could put pressure on the S&P 500 revenue and make the economic downtop likely.

Similarly, Economist Steve Hurge estimated the likelihood of the recession of 2025, while Ray Dalio, the founder of Bridgewater, warned of even deeper economic problems exceeding the typical decline.

Interestingly, Peter Brandt, a veteran trader, said that if the financial system were experiencing a similar alloy in the 1930s, such reset would be necessary.

Highlighted image via Shutterstock