The digital gold boom coincides with the central bank slows down

Market news

Market news - Gold -supported cryptocurrencies reached the highest level of three -year -old, with $ 80 million in the last month, pushing the ceiling of the sector market to $ 1.43 billion.

- The ETF came as the main demand for drivers, balancing the decline in central bank acquisitions and reflecting developing investor preferences.

The gold investment market has experienced major changes as gold -secured cryptocurrencies have shown its largest volume over three years. However, central banks buy less gold. The market for precious metals shows changing investors' behavior due to current gold prices.

Digital gold achieves momentum as the institutional demand evolves

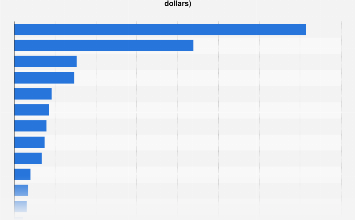

Recent data Shows that cryptocurrency chips supported with gold have been extraordinary growth in the previous month, generating more than $ 80 million worth of chips. The sector's market capitalization reached $ 1.43 billion after an increase of 6%, as the monthly transfer volume increased to 77% to $ 1.27 billion.

Digital gold market expansion occurs in the strongest first quarter with general gold requirements. Since 2016 it has reached 1,206 tonnes based on The Golden Council of the World data. Investment demand increased to 552 tonnes in the current period, while the central bank's acquisitions fell to 244 tons of their previous 365 tons.

ETFs have become the main power of market demand. This has driven the average quarter price, achieving its highest level – $ 2,860 per ounce, while showing 38% increase compared to last year. After a $ 2.35% price drop last week, the price of gold is $ 3,2,40, while showing 23.5% growth in 2020.

The pandemic has been caused by a cozy outbreak after the lowest decline in the traditional jewelry market. The physical bar and the coin market shows strong demand in China, while retail investors retain their interest, which supports institutional shifting towards gold.

The exchange represents the democratic development of gold investments, as digital signs provide both accessibility and trading that supports physical property. Global inflation concerns continue to attract investors who want the diversity of the portfolio and the protection of values through traditional and tokenized gold investments through various digital financial market products.

Crypto news highlighted today:

The net value of the Trump family grows by $ 2.9 billion from crypto investments, the report finds