The bigger the base, the higher in space

Two decades ago, while reading the outstanding technical research “market interpretations” from Louise Yamada and her team, I found “The technician's creed – in price with knowledge” where one of the assumptions of technical analysis is that periods of accumulation are preceded by the uprising, and distribution periods are falling down falls; In addition, that size, or extent, of an accumulation or distribution tend to have a relationship with any subsequent advancement or denial. In other words, trends tend to have relationships with another. Simplistically said, the larger the base, the higher the space; The larger the top, the greater the fall; And the greater the fall, the longer the need for repairing …

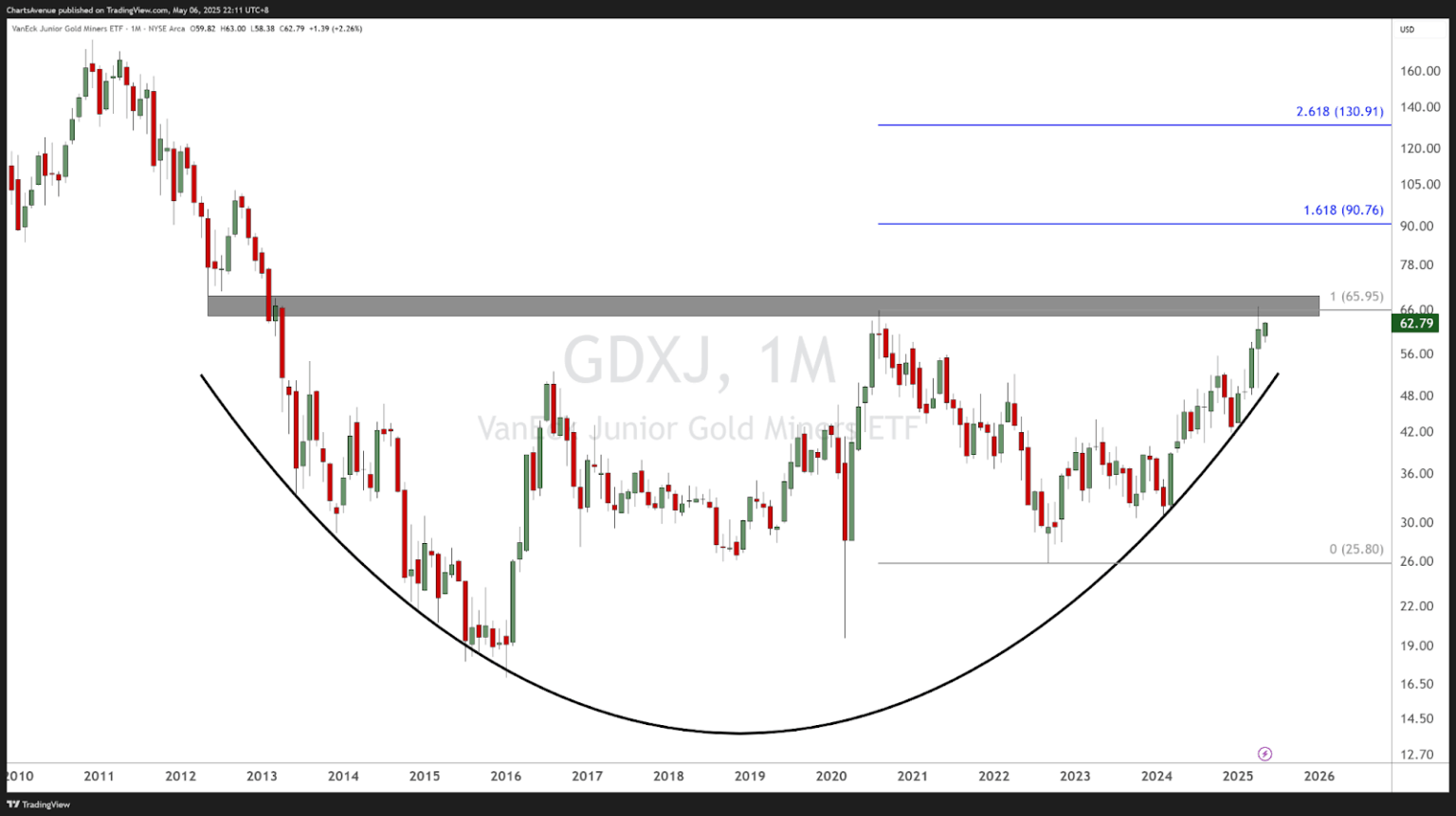

Thinking, here's a monthly Vaneck Junior Gold Miners ETF (GDXJ) chart, which has been building a basis for the past twelve years! The GDXJ really requires repair after its collapse from the highs in 2011.

Now, I can't ahead myself with the target price of the stratospheric, especially if the price has not been damaged in its resistance … Therefore I go for a down-to-earth target by using Fibonacci extension levels from the last significant pullback, meaning August 2020 High to September 2022 low, projects at a first target under $ 91. First, I will let the price break its base before acting here. To make that happen, the price needs to get more than $ 66 a monthly closure basis.

TRV: Fibonacci guides the current patery

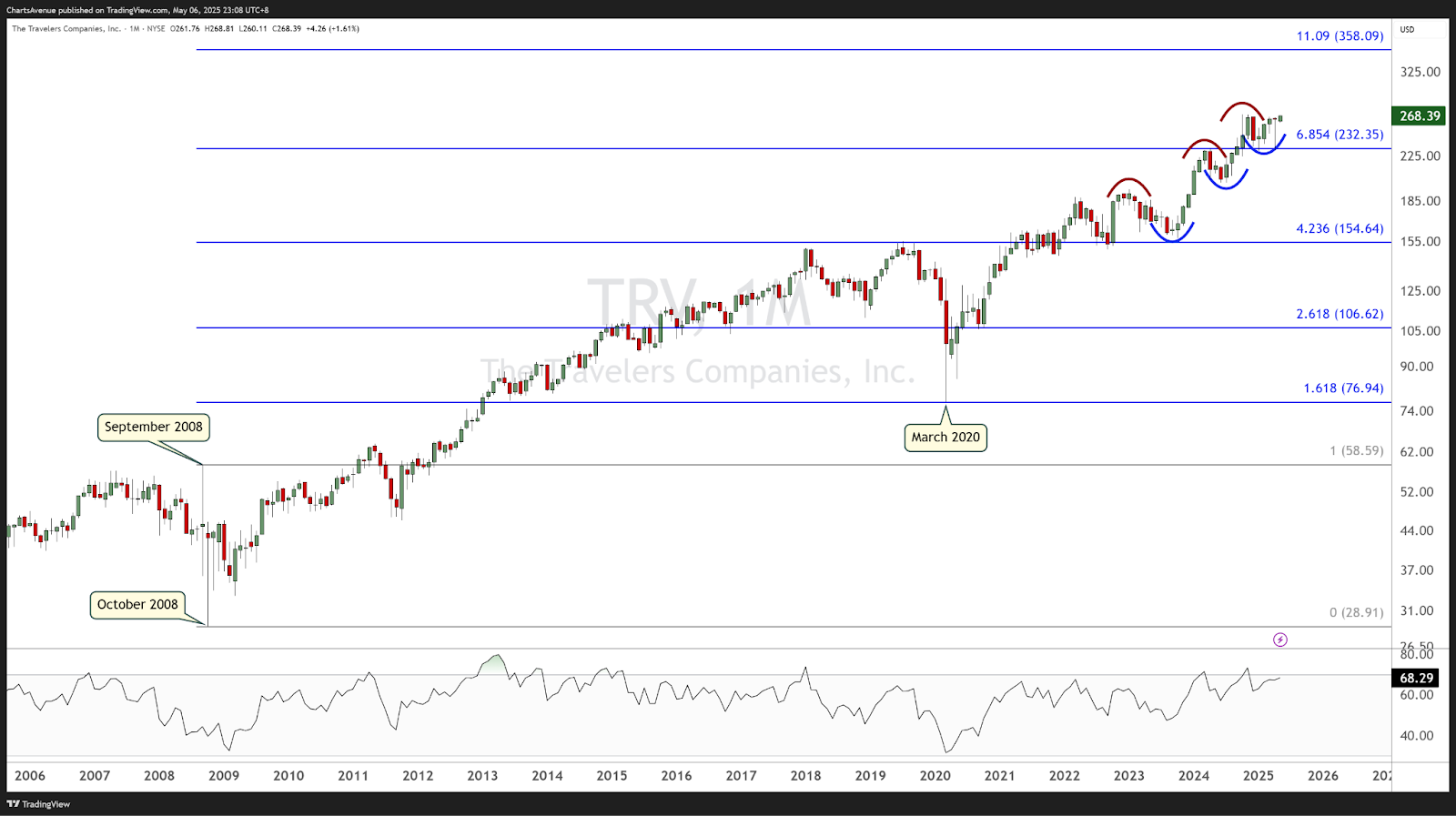

The monthly chart of Travelers Company (TRV) shows a wonderful compliance with Fibonacci extension levels, which are anchored from September 2008 to high until October 2008 low.

In March 2020, TRV dropped 5 cents away from an extension of Fibonacci, marking a significant point in the process. Because of that low, the stock is in a strong uprising.

An interesting -kind feature is the behavior around the 4.236 Fibonacci Extension (~ $ 155), which initially acted as a tough resistance in early 2018, mid -2019 and 2021 that spends most of its year around that level. After a decisive breakout above this $ 155 place, it flipped into a reliable support, tested several times in 2022 and again in 2023, strengthened the rising strength as the price continued to produce a series of higher and higher lows.

The RSI remains in a bullish regime (more than the edition of Friday – but briefly, when the RSI does not go down to a certain level during pullbacks, it is known to be in a bullish regime).

TRV is now viewing the next major extension at 11.09 Fibonacci Level (~ $ 358), which serves as a long -term target upside down.

ITB has fallen after Bearish Divergence Flags Trend Shift

The weekly chart of Ishhares US Home Construction ETF (ITB) describes a return of the trend following a multi-year uptrend from March 2020 low to October 2024 high.

During its climb, ITB is supported by two unique trends:

-

A dotted blue trend that connects lows of candle bodies,

-

A solid blue trendline that tracks lows of wicks/shadows.

Both trendlines offer reliable support, reflecting a healthy uprising. However, an early warning of the warning appeared in 2024: a difference of bearish built at the RSI between March 2024 High and the October 2024 high. Although the price made a higher in October, the RSI posted a lower high, which signified that the upward momentum had weakened despite rising prices. The difference is that this is a classic indicator that consumers are losing strength and that a potential return may be in reach.

By early 2025, the price broke below the trends, proving a move to the market structure. The ETF is now combined -now near the 38.2% fibonacci retracement (~ $ 88.80), drawn from 2020 low to 2024 climax.

Bottom Line:

The breakdown below the same trendlines, in conjunction with the previous difference -the RSI bearish, proves that the main revolt of ITB is reversed. Support of $ 88 should be carefully guarded: an ongoing violation can trigger deeper pullbacks towards 50% and 61.8% Fibonacci levels.

Unlock exclusive gold and silver signals and updates that most investors do not see. Join our free newsletter today!