Tether Bought $65 Billion in US Treasury Bonds Last Quarter

Tether just released the Q1 2025 testimony report, describing a massive increase in US Treasury bond handling. The firm bought more than $ 65 billion in these possession between January 1 and the end of the quarter.

Tether's report has repeatedly mentioned a potential role in the USDT's global dollar flow, calling the USDT “the leading digital representation” of this currency. Treasury holders today represent more than 80% of its total ownership.

Why does Tether buy US treasury bonds?

When Tether, the world's largest provider of stablecoin, published the Q4 2024 testimony report, reported the $ 33 billion of the US treasury bonds.

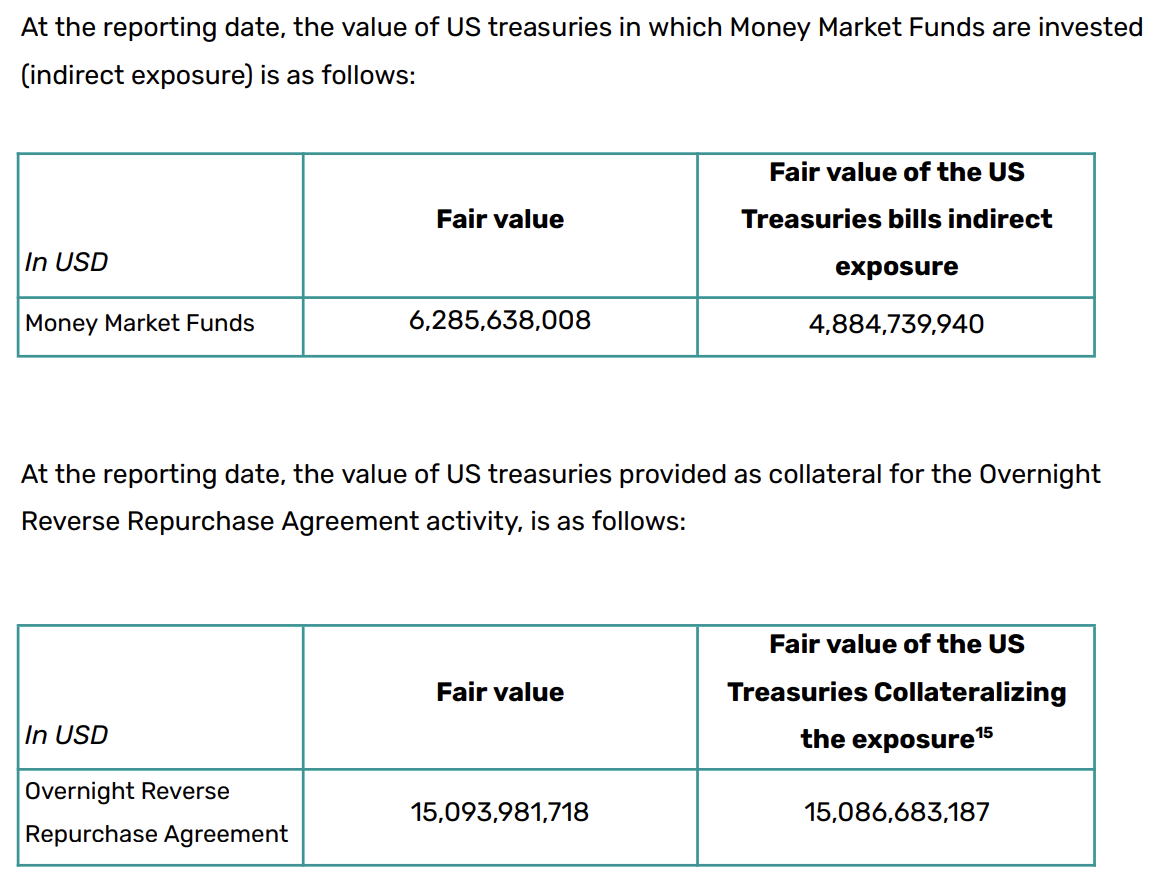

A whole quarter since later, and the newest of the company Report Details of a massive extraction pattern. By March 31, it held $ 98.5 billion in Treasury Bonds, with another $ 21.3 billion in indirect exposure.

The company's report further claims that its total ownership costs $ 149.2 billion. In other words, more than 80% of Tether's possessions are directly and not directly held in US treasury bonds.

Compared to, it only holds $ 7 billion in BTC, which the company has continued to earn in the past.

Rumors have suggested that the firm prioritizes Bitcoin to better align with US Stablecoin regulations, and this event may occur. If the proposed law becomes a law, the US will require tether to handle most of its reserves owned by treasury bonds. Thanks to these acquisitions, that request is fulfilled.

Tether is re -re -reinning its business in several basic ways to facilitate compliance with US regulations. In late March, President Trump suggested that Stablecoins could support the dominance of the dollar, and Tether seemed interested in this goal.

The Report Repeatedly mentioned concepts such as Tether's “growing role in distributing the dollar denomination of liquidity” and “Supporting the global relevance of the US dollar to a rapid emerging economy.”

The firm described the USDT as “the leading digital representation of the US dollar,” and its CEO, Paolo Ardoino, uttered these sentiments:

“Our mission is clear: for the digital economy to be responsible and responsible and the US dollar role in the global phase,” he said.

If Tether wants to make this change, the massive handling of the US treasury will greatly help with that work. Its holdings are widely larger than most governments', until it can move the global Treasury market.

In general, these purchases are likely to drive a huge tether business adventure to the US market soon.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.