Tests 1.3800 support after pulling back from nine-day EMA

- The USD / CAD pair could hold the barrier at the bottom of six months of 1.3781.

- The pair tests the psychological level of 1,3800, followed by the lowest of six months of 1.3781.

- A break over nine days of 1.3845 could improve short-term price dynamics.

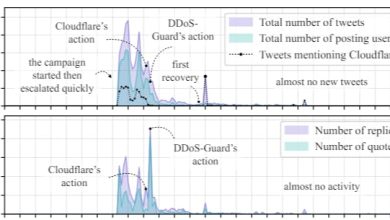

The USD / CAD pair traces its gains recorded during the previous session, exchanging around 1,3,810 at the start of European hours on Friday. However, the technical analysis on the daily graph suggests a potential bullish change in the feeling of the market, while the pair tries to break over the descending channel model.

In addition, the relative resistance index of 14 days (RSI) remains higher than the brand 30, indicating a continuous lower bias, but not in territory occurring. Another price action will provide a clearer trendy direction. The USD / CAD pair also continues to be negotiated below the exponential mobile average of nine days (EMA), signaling a small amount of short -term momentum.

Update, the USD / CAD pair tests the psychological level of 1.3800, followed by the lowest of six months of 1.3781, hit for the last time on April 21, which is aligned on the upper limit of the downhill channel. A decisive return to the canal would relaunch the lower bias and put down the downward pressure on the pair to navigate the region around the 1,3419 – its lowest point since February 2024, with additional support seen around the lower limit of the channel descending near the 1.33.50 zone.

The USD / CAD pair can find an initial barrier to the EMA of nine days of 1.3845. A rupture above this crucial resistance area would improve short-term prices dynamics and report an evolution towards a bias bias, paving the way for a movement towards EMA from 50 days to 1.4077, followed by a two-month summit to 1.4415. Other gains could target the next major resistance at 1.4793 – the lowest level observed since April 2003.

USD / CAD: Daily graphic

Canadian dollar price today

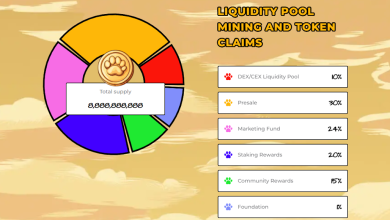

The table below shows the percentage of variation in the Canadian dollar (CAD) compared to the main currencies listed today. The Canadian dollar was the strongest against the US dollar.

| USD | Eur | GBP | Jpy | Goujat | Aud | Nzd | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.32% | -0.27% | -0.16% | -0.31% | -0.54% | -0.57% | -0.22% | |

| Eur | 0.32% | 0.05% | 0.18% | 0.01% | -0.20% | -0.22% | 0.10% | |

| GBP | 0.27% | -0.05% | 0.14% | -0.04% | -0.25% | -0.27% | 0.05% | |

| Jpy | 0.16% | -0.18% | -0.14% | -0.16% | -0.38% | -0.41% | -0.05% | |

| Goujat | 0.31% | -0.01% | 0.04% | 0.16% | -0.24% | -0.24% | 0.09% | |

| Aud | 0.54% | 0.20% | 0.25% | 0.38% | 0.24% | -0.02% | 0.31% | |

| Nzd | 0.57% | 0.22% | 0.27% | 0.41% | 0.24% | 0.02% | 0.33% | |

| CHF | 0.22% | -0.10% | -0.05% | 0.05% | -0.09% | -0.31% | -0.33% |

The thermal map shows the percentage of variations in the main currencies against each other. The basic currency is chosen in the left column, while the quotes motto is chosen in the upper row. For example, if you choose the Canadian dollar in the left column and you move along the horizontal line to the US dollar, the percentage of variation displayed in the box will represent CAD (base) / USD (quote).