Suzlon Share Price Today Can NSE:SUZLON Break Out of Its Holding Pattern?

- Summary:

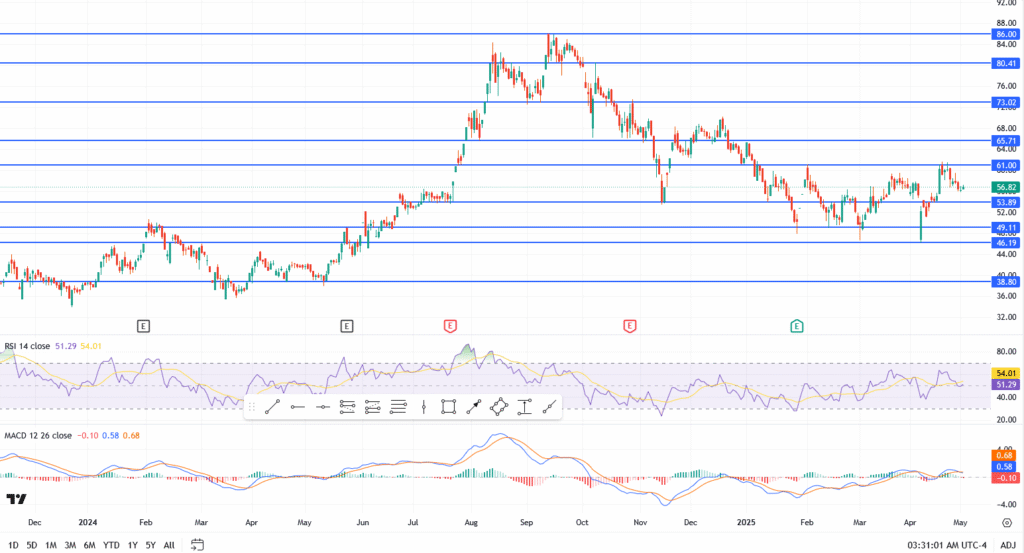

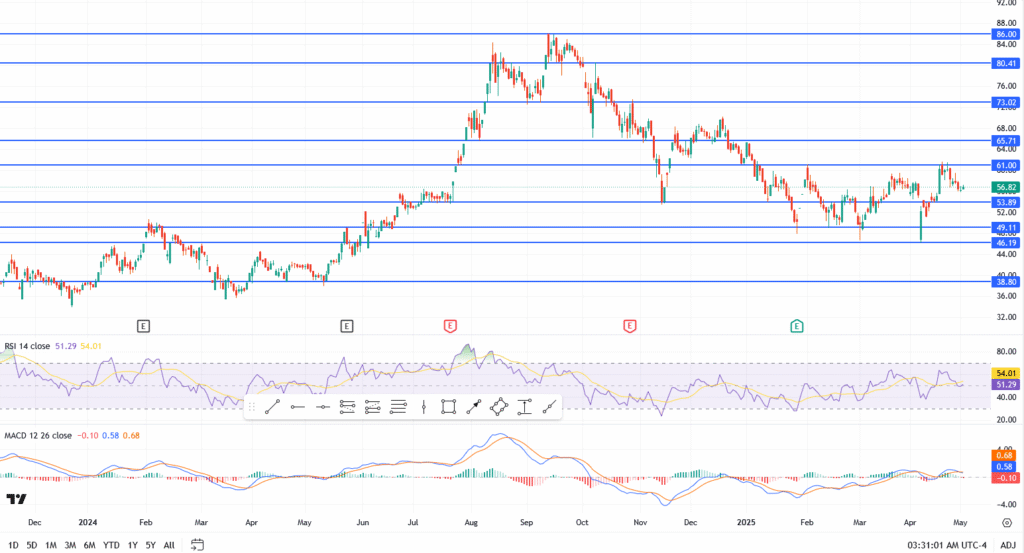

- Suzlon share price coils under ₹ 57. The NSE: Suzlon exploded the previous resistance this week or break? Eye entrepreneurs ₹ 61 breakout and ₹ 53 support.

Suzlon (NSE: Suzlon) opened the week on a careful note, trading just below the main resistance around ₹ 57. After a solid April recovery, the stock was now stuck to a sideways coil, and the bulls were growing restless.

Mood mood: quiet but tense

There was no violation of the news this morning, but that was part of the story. Entrepreneurs are watching closely for signs of life, especially after Suzlon's wonderful bounce from 46 in early March.

The wider market tone will not help, either. The funny midcap is flat. Volumes are decent, but still lose their belief.

Suzlon Technical Analysis: Basic levels to watch this week

- Immediate resistance: ₹ 57 – Price struggles to close above this zone

- Next Breakout Level: ₹ 61 – Basic horizontal level since early February

- Handling Support: ₹ 53.89 – minor dip last week was quickly purchased

- Deeper floors: ₹ 49 – psychological and structural support

- RSI: 51.29 – neutral, no excessive thinking or excess edge

- MACD: Flat – Momentum is fading, but no bearish crossover yet

So far, Suzlon's chart is compressed, but it can't last forever. When it comes to triggering, breakouts from this type of section tend to move quickly.

See also

Suzlon Stock Outlook: Will the momentum be back?

Suzlon Energy is still one of the more liquid mid-caps that acts tied to India's green energy. But the stock needs a spark. If the ₹ 57 is that it has been in volume, the 61 may come quickly, and above it, the door will open to ₹ 65.

But failure to move as soon as possible can trigger revenue getting back to ₹ 53, or worse, a retest ₹ 49 support.

So far, this stock is in limbo, and the next few sessions will likely set the tone for the rest of May.