Super Micro stock plunges after surprise customer delays cost up to $1.4 billion in sales

- Material manufacturer and technology company Fortune 500 Super micro computer has published a disappointing update on its financial results in the third quarter. The technology giant reported on Tuesday that it expects an income deficit of $ 400 million to $ 1.4 billion and that its gross beneficiary margins have decreased by 220 base points compared to the previous quarter.

Time is money. And in Super Micro Computer caseCustomers need more time to make decisions on technological platforms or server configurations to buy. The offset in the customer supply Pushed some sales expected from the third quarter to the fourth, Super Micro announced on Tuesday, sending its 3% spiral actions during the day and more than 15% of trade after working hours.

Business cup Its previous sales councils of $ 5 billion at $ 6 billion at an expected range of $ 4.5 billion to $ 4.6 billion. The profit by action also arrives well below the previous advice at 16 to 17 cents per share compared to the previous advice from 36 to 53 cents per share. The beneficiary margin of Super Micro has dropped 220 base points, or 2.2 percentage points, the company told investors.

“During the third quarter, certain delayed decisions of the customer platform moved sales in the fourth quarter,” the company said in a statement. “The GAAP and non -GAAP margin for the third quarter was 220 basis points below T2, mainly due to higher inventory reserves resulting from older production products and accelerate costs to allow the marketing time for new products.”

The news occurs while investors expect more significant data on the impact that prices may have on AI companies and data centers. President Trump said in an April 11 executive decree That semiconductors are exempt from new prices, but imminent uncertainty and unpredictability have frightened investors in general. Super micro will make a profit call with investors to examine the third quarter results next week.

The technological company fought to restore its credibility to investors following a tumultuous 2024 in which the company was struck by a critical report of the open sellers, had It is auditor leavesthen delayed the issuance of audited financial documents and was threat with the implementation of Nasdaq. The exchange had previously suspended Super Micro in 2018 after a Dry investigation.

Super microphone has since hired Bdo like its new listener and announcement The results of an independent survey led by the Board of Directors. The company said that it would replace the current director Dave Weigand for a finance chief “by vast work experience as a finance professional in a large public enterprise”.

The company also announced that it would hire a general lawyer, widen its legal department and assess training programs around “policies and practices of the recognition of sales and income, including the role of accounting staff in the sales transaction process”.

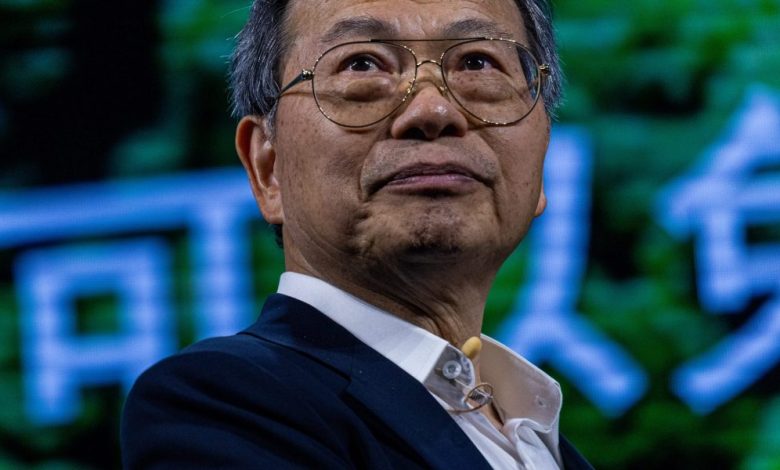

Meanwhile, Weigand obtained an increase of 5% to its basic salary during the year 2024, which ended on June 30, 2024, Super Micro told investors in its proxy declaration. The recommendation came from the CEO, founder and president Charles Liang and was based in part on the analysis showing that Weigand was paid well below the market for its role, said the company. Weigan's base salary is now $ 547,000 and its bonus has succeeded at $ 191,000. Liang also recommended that Weigand get a performance price worth $ 550,000, paid in a mixture of cash and performance actions. The total CFO CFO remuneration for 2024 was estimated at $ 9.6 million and included an option of $ 5.2 million.

Liang's remuneration, which includes a salary of $ 1 and without a bonus, was estimated at $ 28 million.

The Super Micro Board has seen some administrators attend dozens of what the company called “excess meetings”, likely to make decisions concerning the auditor's departure and to supervise the independent investigation. According to the proxy declaration, two administrators attended 20 excess meetings of this type; The board of directors pays $ 2,000 per meeting for each meeting in addition to a meeting of the board of directors up to 10 additional meetings.

Super micro did not immediately respond to a request for comments.

This story was initially presented on Fortune.com