SUI Death Cross Ends After 7 Weeks – What’s Next for the Altcoin?

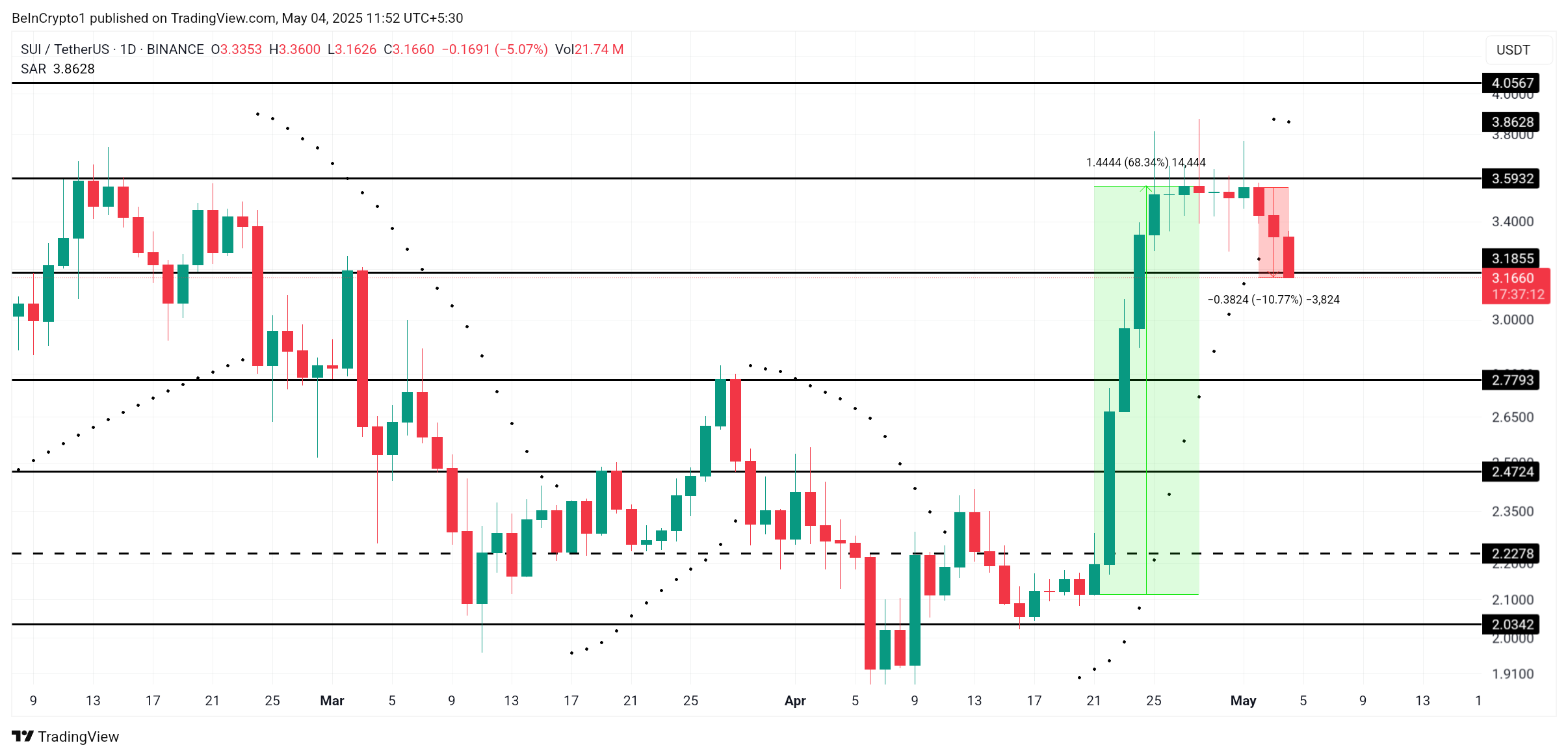

After rising nearly 70% in recent weeks, SUI faces a rapid correction, pouring 10% of its value over the past three days. Despite the strong bullish momentum that drives Altcoin to the spotlight, the sudden pullback does not upset the investors.

The broader perspective for SUI remains intact, with on-chain metrics and market indicators that have signed that this collapse may be nothing more than a cooldown.

SUI investors can rejoice

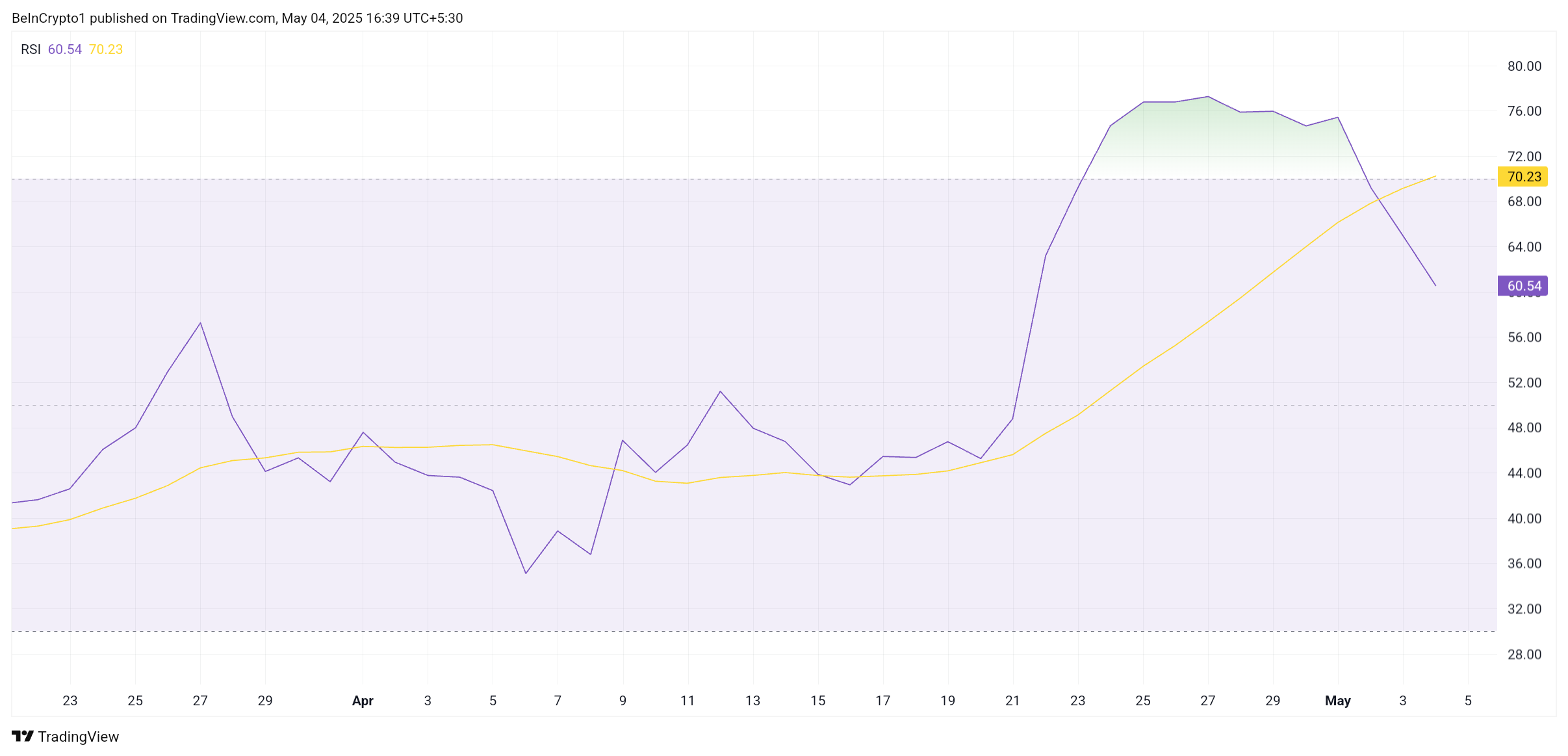

The 50-day average transfer of the average is on the side of the seizure in the 200-day EMA. This close-crossover suggests that SUI can witness a gold cross-a powerful technical signal that indicates a move to long-term momentum.

If the crossover is complete, it will mark the end of Sui's death cross that began seven weeks ago.

Such a move is likely to encourage the modified purchase pressure. A gold cross is often preceded by significant rallies, and in the SUI price that gained about 70% before the recent collapse, the bullish emotions appear far from fading. '

Recently the Koma's Koma -Child (RSI) index of the Koma -child (RSI) has violated the excessive threshold, which has been able to compromise a cooldown while entrepreneurs earn the income. This RSI DIP corresponds to the 10% price collapse, which signifies that the owner is temporarily overheated and required to stabilize.

Despite the retreat, the RSI remains within the bullish territory, which walks just under the overbought zone. This means that while the rally is paused, the overall trend remains intact, and the additional acquisitions may be at reach if the purchase of the volume rises again.

Sui Price aims to bounce back

At the time of press, SUI traded at $ 3.16, which slipped below a major support level in the last 24 hours. The 10.77% decline comes from Altcoin's failure to break the $ 3.59 level of resistance, combined with a general cooldown in the market. However, the correction was viewed by many merchants as temporary.

The wider indicators continue to reflect bullish conditions. The nearby Golden Cross, elastic RSI, and strong upward momentum all clues that SUI can get $ 3.16 in support. If the momentum returns, the owner can retest $ 3.59 and potentially break it, continue its previous recovery path.

However, recovery delays may change the script. If the SUI fails to recover $ 3.16 as soon as possible, the risks of altcoin are still slipping. A failure to violate $ 3.39 or the support of the support of $ 3.18 could send price collapse to $ 2.77, which potentially improperly bullish thesis and sign a recurrence.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.