Stripe is Building a Stablecoin Product

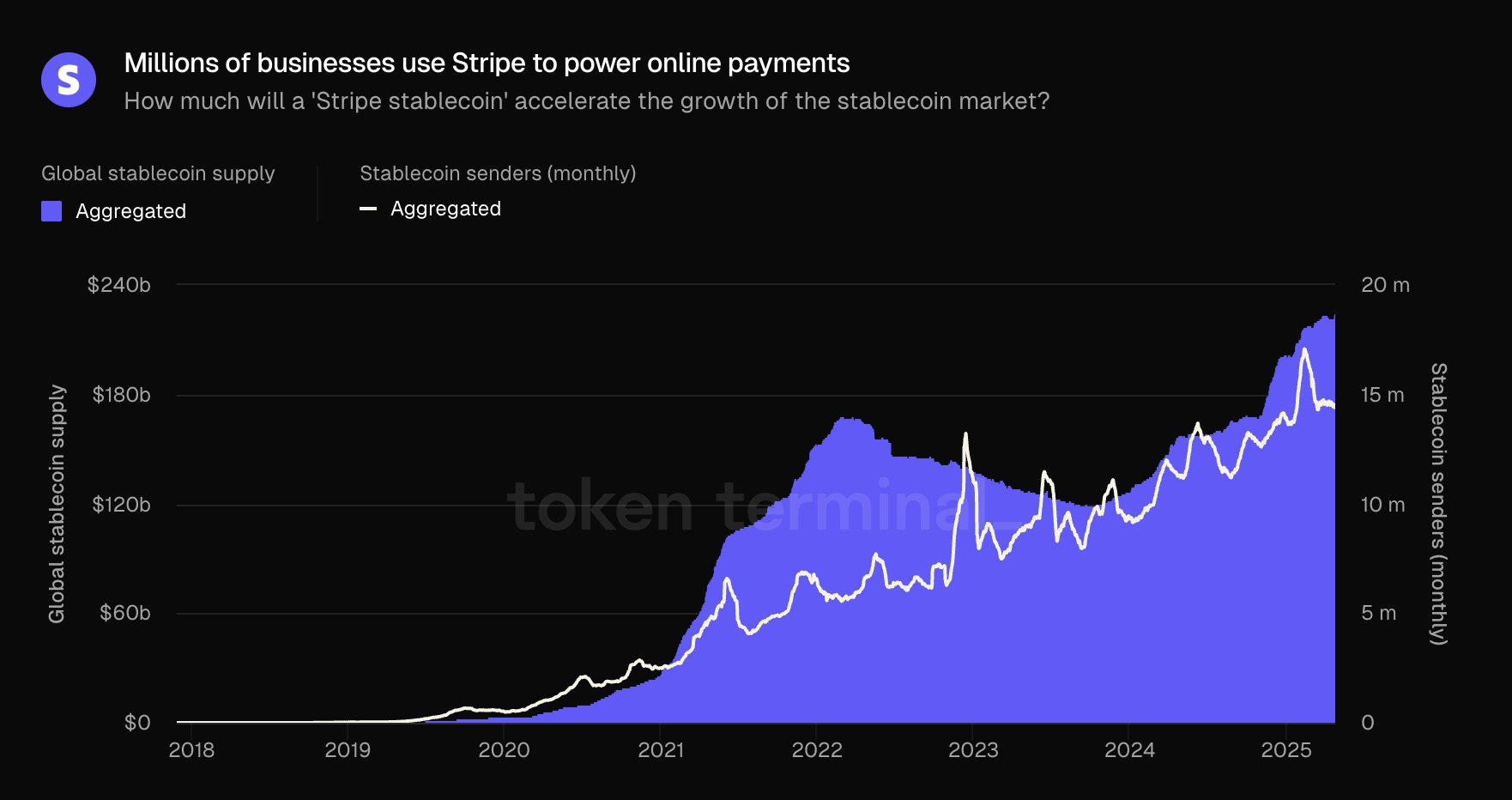

Stripe, a global leader in the payment infrastructure, enters the Stablecoin market amid the sector's ongoing growth.

On April 25, CEO Patrick Collison confirmed that the company was actively developing a Stablecoin -based product, which marked a major milestone after nearly a decade of internal discussions.

Stripe to launch the stablecoin product powered by the bridge getting

Collison announced that Stripe had been thinking of this project for a long time but only found the right environment to move forward.

The company has not yet shared deep details about its motions. However, the plans suggest the initial controlling of the Business is targeting businesses outside the United States, European Union, and the United Kingdom.

Stripe's adventure with Stablecoins came shortly after February $ 1.1 billion taking Bridge, a company that specializes in Stablecoin's infrastructure. Bridge technology is expected to be the foundation for the upcoming Stripe digital currency initiatives.

The confirmation complies with the outsplace of speculation about Stripe's interest in blockchain technologies. The stripe, which holds transactions to more than 135 currencies and supports billions -billions of dollars in global commerce year -time, sees stablecoins as a natural extension of its services.

Adding a Stablecoin product can offer businesses faster, cheaper, and better ways to handle cross-border transactions.

The giant payment transfer came because other major fintech companies also explored stablecoins. The main traditional financial institutions such as PayPal are already in contact with the sector, featuring its growing momentum.

Today, the Stablecoin market is dominated by major players such as Tether (USDT) and Circle (USDC).

However, industrial analysts, including those in the standard chartered, believe that Stablecoin circulation can steal the past $ 2 trillion by 2028, driven by increasing regulatory clarity.

In Washington, lawmakers are promoting law to provide administration and structure in the Stablecoin industry.

Two key bills-Stablecoin Transparency and Accountability for a Better Ledger Economy (Stable) Act and the guidance and establishment of national innovation for US Stablecoins (Genius) ACT-suggest stronger liquidity requirements and anti-money laundering standards.

These efforts aim to stimulate more confidence in the stablecoins released by the US and maintain the dominance of the dollar in global finance.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.