Stocks set to retrace as tariff concerns resurface

Have you reached stock prices on their short -term top?

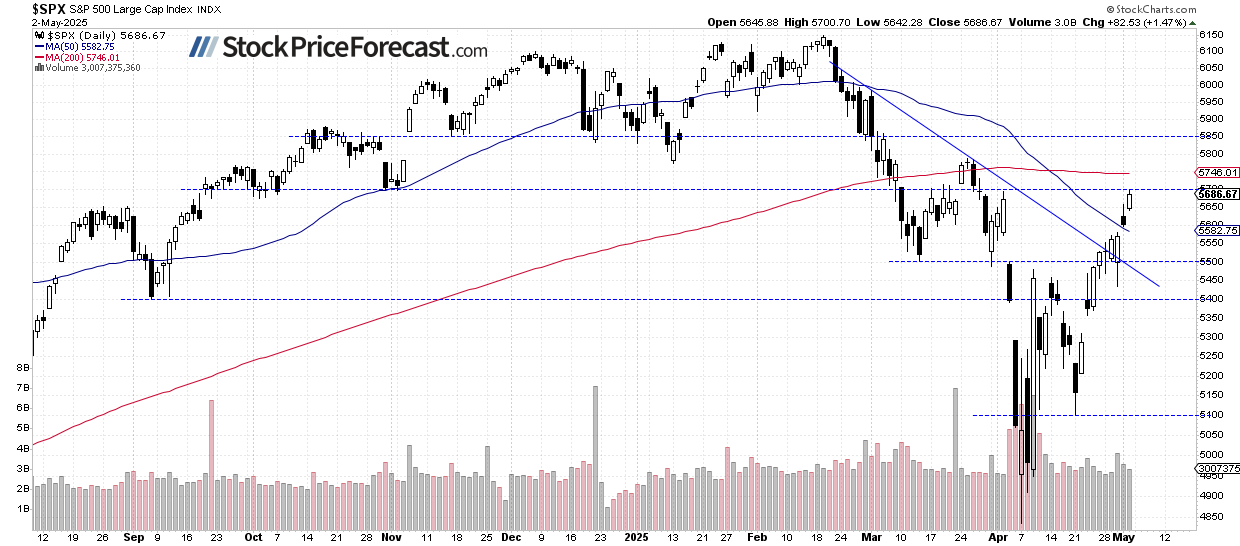

The S&P 500 gained 1.47% on Friday, expanding its uprising following a higher than the expected release of nonfarm payrolls. The market has advanced despite the mounted concerns about the impact of new tariffs and their potential impact on the corporate revenues forward.

This morning, US stock futures are lower, with S&P 500 expected to open 0.7% lower, reinstating some of Friday's rallies as investors are melting a barrage of trade-related titles from President Trump and focusing on the upcoming FOMC rate decision on Wednesday.

The investor's sentiment worsened, as shown last Wednesday by the AAII Investor Sentiment Survey, which reported that only 20.9% of individual investors were bullish, while 59.3% were bearish.

The S&P 500 approached the late local highs, as we see in the sun -day chart.

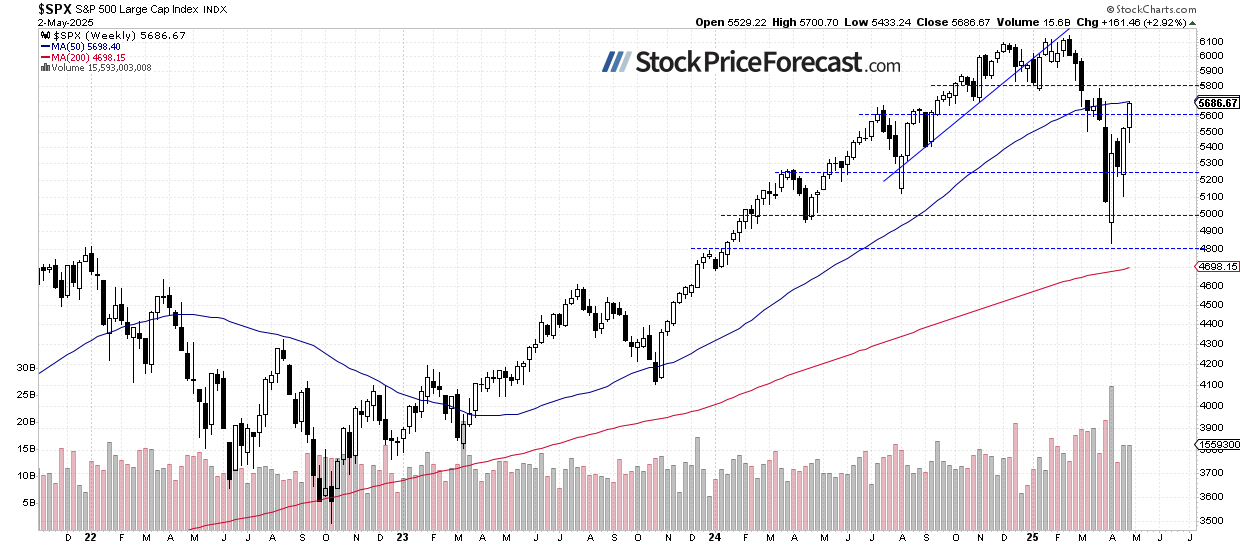

S&P 500: Another Weekly Advancement

The S&P 500 gained 2.92% last week, extending the rally of last week to 4.6%. Despite this strong performance, it remains uncertain if we see a new developing or just a correction within a broader fall. During tech revenue that is common, the market may suffer a correction or integration -including the recent rally.

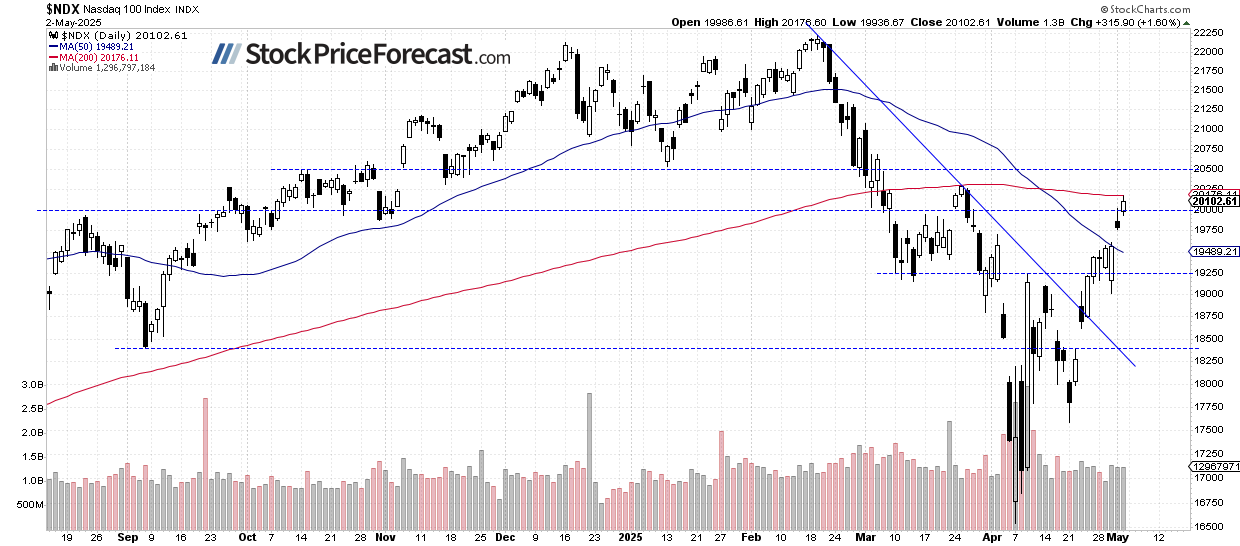

NASDAQ 100 BREAK 20,000 levels

The Tech-Heavy Nasdaq 100 closed 1.60% higher on Friday but hoped to now return to 20,000 levels, with futures pointing to a 0.9% decline in tomorrow.

The pullback on tech stocks appears to be driven by President Trump's announcement of new 100% tariffs on movies made outside the US, weighing on Netflix, Disney, and Warner Bros Discovery shares in premarket trading.

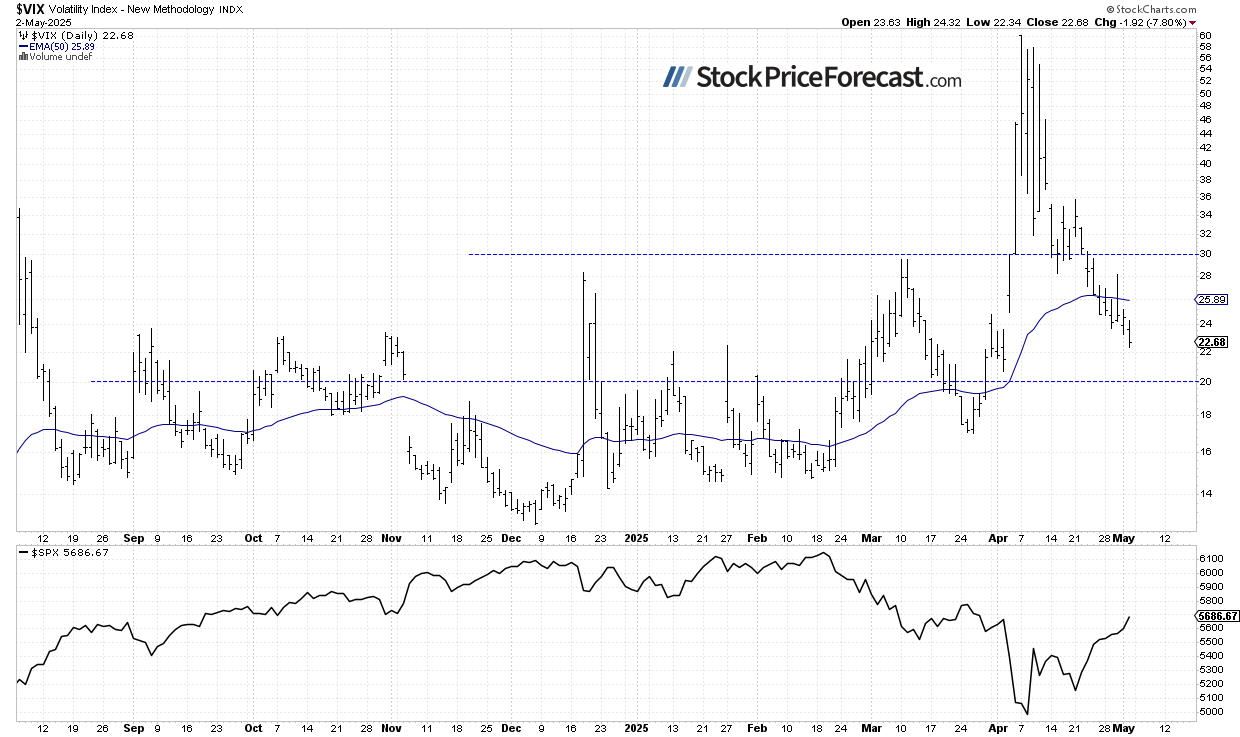

VIX expands the rejection

The VIX sank again on Friday, suggesting a growing investor confidence despite concerns about trade and economic growth policies. VIX reached as low as 22.34.

Historically, a declining VIX indicates less market fear, and the VIX increase is accompanied by stock market collapse. The lower the VIX, the higher the likelihood of down the market returning. On the contrary, the higher the VIX, the higher the possibility of upward market backwards.

S&P 500 Futures Contract: Returning below 5,700

This morning, the S&P 500 futures contract traded below 5,700 levels following an overnight shrinkage.

The resistance level remains around 5,700-5,720, while the support is at 5,600, marked by recent local low.

Conclusion

The S&P 500 is expected to be returned this morning, likely to return a portion of progress this Friday. Despite its recent strong performance, it remains uncertain whether we are seeing a new uprising or just a correction within a broader fall.

With today's major income catalysts mainly behind us, the focus on the market will transfer to economic and central bank economic data. Investors must maintain the discipline management of the risk provided by conflicting signals and increased the likelihood of volatility into the Wednesday's decision.

Here's the breakdown:

The S&P 500 gained 1.47% on Friday following higher than the expected release of nonfarm payrolls.

The futures indicate a 0.7% lower tomorrow, which re -revoked some of Friday's rally.

During tech revenue that is common, the market may suffer a correction or integration.

The markets eagerly await the decision at the Fed's interest rate on Wednesday.

Do you want free follow-up to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!