Stocks edge up as Trump teases new trade deals – but S&P 500 still can’t break resistance

Stocks pushed slightly higher on Friday while President Donald Trump, from the White House, said the new trade agreements were on the way. He also supported the reduction of tariffs in China in advance of weekend meetings.

But even with those announcements, the S&P 500 still failed to cross a major level of resistance, keeping the entrepreneurs stuck to the same limbo they had entered for a few weeks.

Trump Na -Post In fact social, “There are many trade deals with Hopper, all good (well!) That came after he announced a draft agreement with the United Kingdom, the first international trade deal from the US from the so-called” tariff “update update in early April.

Investors responded with careful gains: the average industry of Dow Jones rose 87 points (0.2%), the S&P 500 rose 0.4%, and the NASDAQ composite rose 0.6%. However, it is not in the bigger problem.

Traders are watching the S&P stall again below the level of the main

The S&P 500 ended on Thursday around 5,664, which looked decent on paper, but it was far under the intraday high of 5,720. Before 3:30 pm et, the index was sitting at 5,709, but it fell sharply. That pattern-the brief optimization followed by a late day seller-has been a story for several weeks.

Rob Ginsberg, a strategist from Wolfe Research, Says“Not the good close, because the ~ 5700 objection proves to be a bit stubborn because it first released it by S&P 2 months ago.” He explained that traders were looking for a close more than 5,700, which did not happen since late March – until Trump dropped his announcement on April 2.

Rob added that the S&P also remained under the 200-day moving average, now sitting around 5,748. “The Ebullience in the UK Trade Deal has paved the way for a last day to break down as the market re-closes under the 200-day transfer of average,” he said. He called the average a useful indicator of long-term changes in trend. Over the past two months, the index has only closed above the number twice. The last time was on March 25, when it ended at about 5,777.

Without a clean rest above 5,700 and the 200-day, Rob warned the rebound from the low April could fall quickly. So even with Trump talking about cutting tariffs or landing deals, nothing changes to the levels of resistance finally to break.

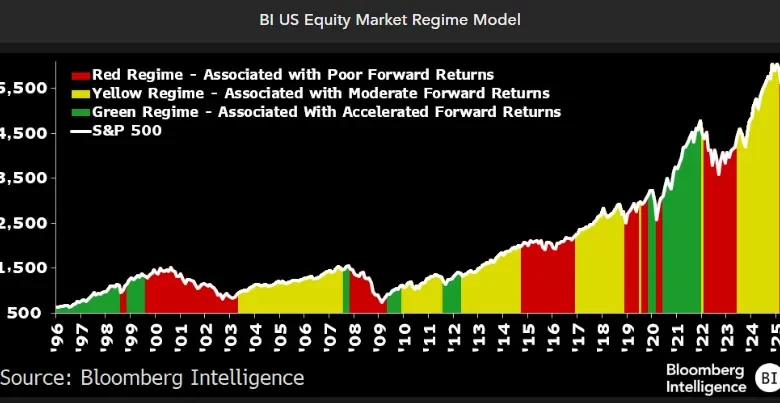

Bearish signal from the Bloomberg model increases pressure

At the same time, a major stock market signal just flashes red. The model of the Equity market regime, built by Bloomberg Intelligence, is now dropping its worst stage – known as the “Red Zone.” That stage has a history taught in weak future performance for the S&P 500, especially if it has been attacked by macro fears such as trading policy confusion.

Gina Martin Adams and Gillian Wolff, who manages the model, Says This change occurred in both March and April. This is the first time the model has turned red since February 2022, when concerns with the increase in the Federal Reserve rate drag us stocks in a bear market.

The numbers are clear. In seven previous instances where the model entered this stage, the S&P 500 lost an average of 5.6% over the next 12 months. For now, it's unclear if that happens again. But the model had previously remained in the “neutral yellow” zone for almost 21 months, so the flip was meaningful to red.

Gina and Gillian say the red stage is “early” for most model pieces, meaning the whole effect has not been felt. That makes some entrepreneurs think earlier earlier, especially in Trump's trade policy that still leaves many unanswered questions. Investors are now divided. Some think that the worst is done. Others are cycling for more sale.

Either way, the stocks have not been damaged. And if the S&P 500 continues to fail at 5,700, there is no value of new trade deals or social media posts that can save it.

Cryptopolitan Academy: Tired of market swings? Learn how the Defi can help you develop a steady passive income. Register now