Stocks advanced again but uncertainty lingers

Will the S&P 500 continue to increase despite mixed economic data and prudent advice from technology giants?

The S&P 500 won 0.63% Thursday, extending its upward trend after Microsoft and Meta Impressive Gains published on Wednesday. The market has increased despite low economic data suggesting recession after recent trade policy changes.

This morning, improving job data provided additional support, with non -agricultural wages at +177,000 against +138,000 expected. The S&P 500 is expected to open 0.7% more, despite the withdrawal after the opening hours yesterday after the Amazon and Apple profits.

The feeling of investors has grown further, as shown by the Saii Investor Sensor Survey on Wednesday, which indicated that only 20.9% of individual investors are optimistic, while 59.3% are lower.

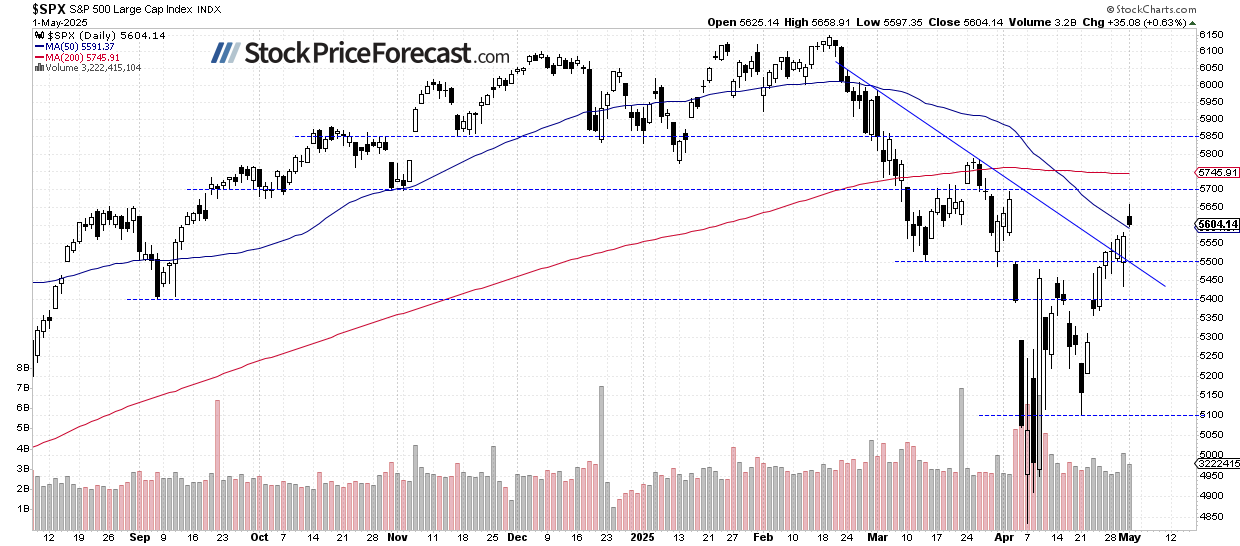

The S&P 500 broke out above the level of 5,600, as we can see on the daily graphic.

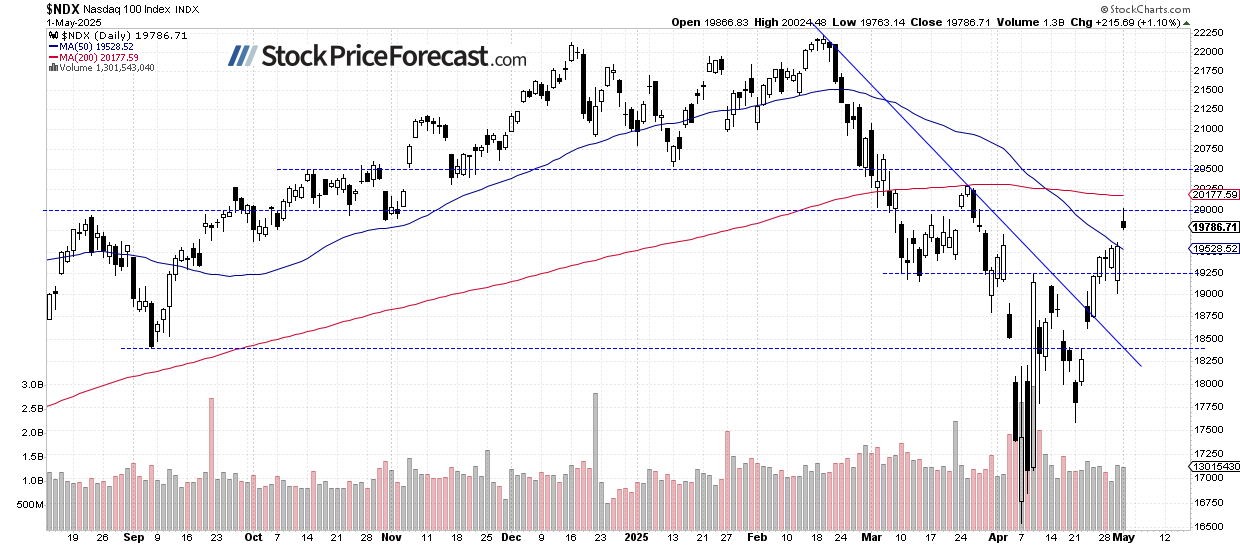

Nasdaq 100 has almost 20,000

Yesterday, the Nasdaq 100, a heavy technology, closed 1.10% higher but withdrew from the level of 20,000. It remains the nearest resistance. Today, this index should open 0.8% more to follow employment data, however, a decline in Apple's actions could weigh negatively on the technological sector.

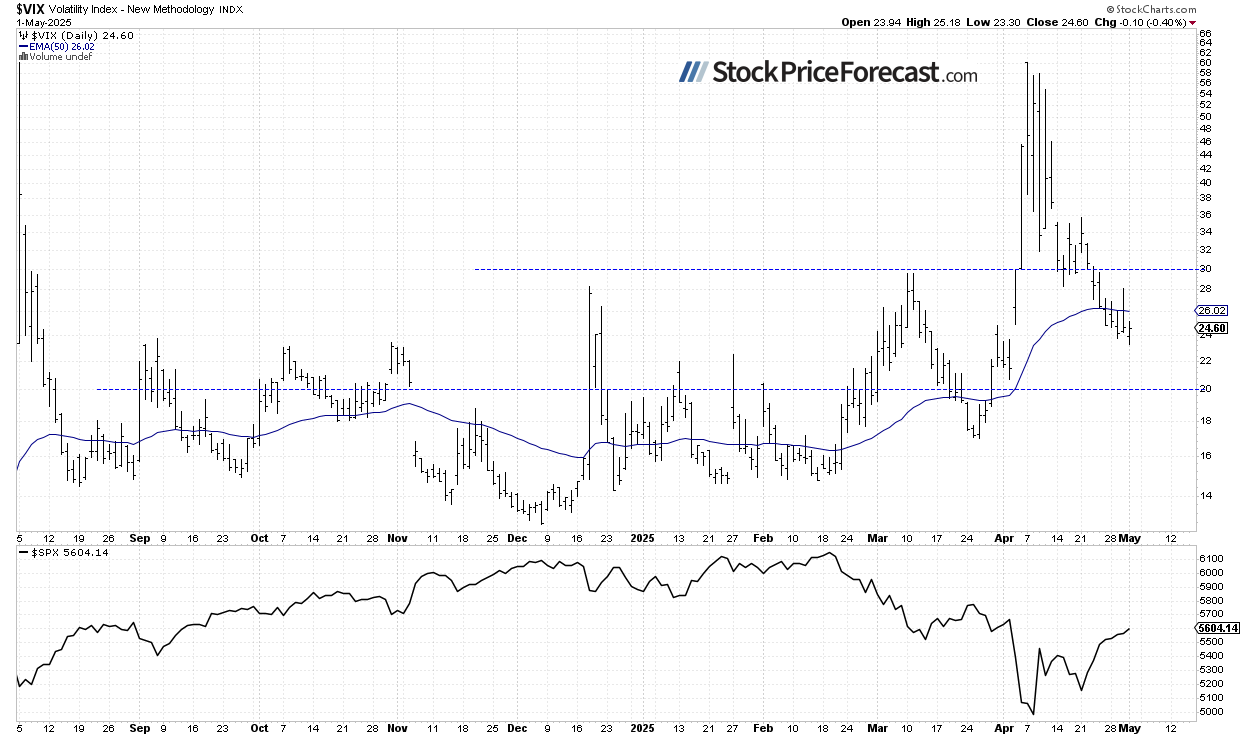

Vix: below

The VIX has stabilized at lower levels, suggesting growing trust in investors despite concerns about commercial policies and economic growth. Yesterday, the VIX was reached as low as 11:30 p.m.

Historically, a downward VIX indicates less fear on the market, and the increase in VIX supports stock market slowdowns. However, the lower the VIX, the higher the probability of the market decrease in the market. Conversely, the higher the VIX, the higher the probability of the market increase in the market.

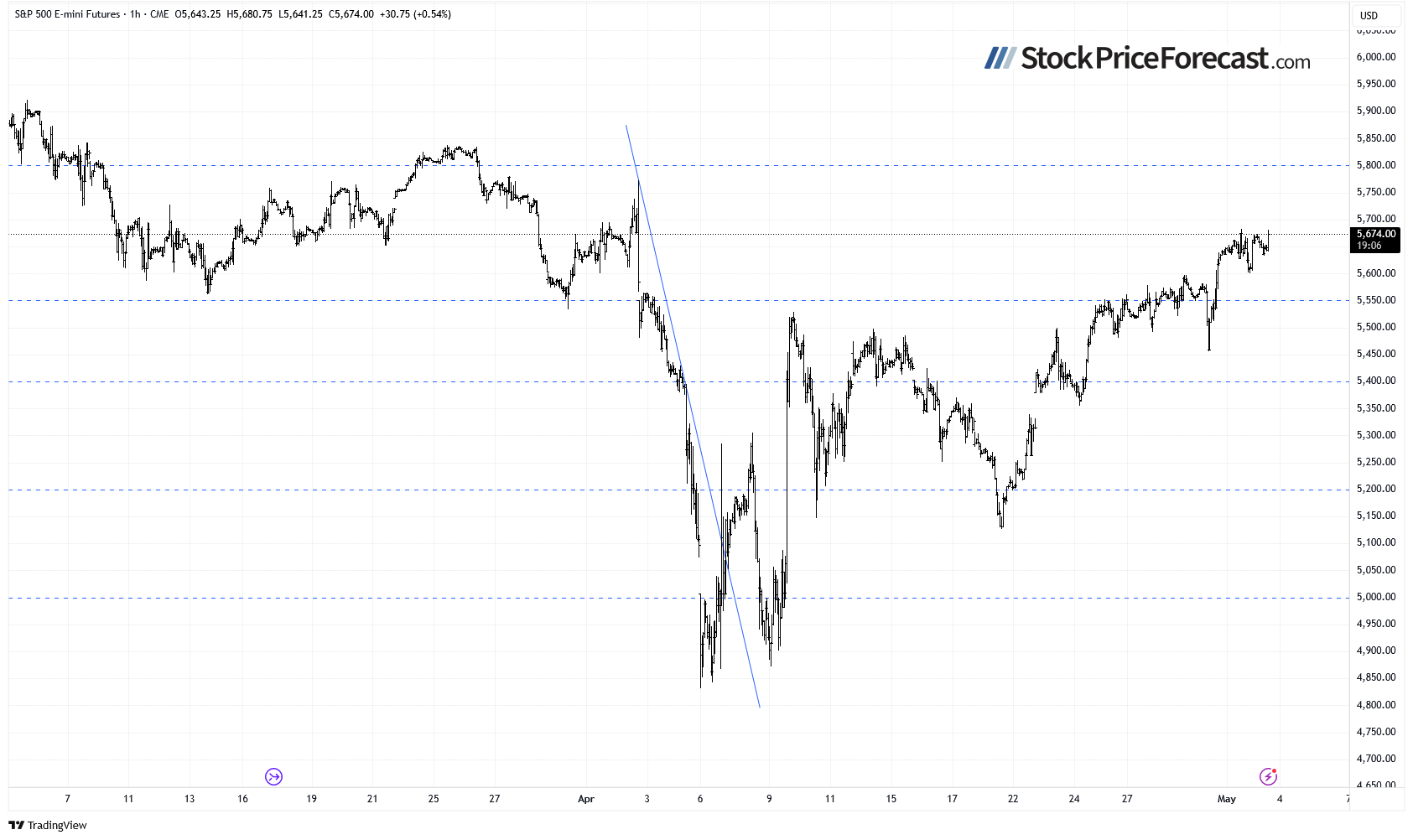

T lights S&P 500: rallying after gains

This morning, the S&P 500 contract is negotiated along its local summits, retraced its weakness overnight and winning 0.7%. The level of resistance is approximately 5,700, while the support remains at 5,600.

Conclusion

The S&P 500 should extend its earnings after the benefits of companies, positive developments in American-Chinese trade relations and the job report better than better than expected.

Last week, the market increased in several positive catalysts, in particular the relaxation of tariff fears, potential peace developments in Ukraine and quarterly press releases. That said, it remains uncertain if it is a new upward trend or always simply a correction in the downward trend.

Here is the ventilation:

S&P 500 won 0.63% Thursday, extending its upward trend after Microsoft and Meta Gains on Wednesday.

The market has progressed despite the low economic data suggesting a recession following a change in commercial policy.

Yesterday after the closing of the session, Amazon and Apple published their quarterly results; Apple’s stock should open 3% less.

With the mainly completed profits season, the market market goes to future economic data and has fueled political decisions.

Do you want free monitoring of the above article and details not available for 99% + investors? Register for our free newsletter today!