Is a Bigger Rally Ahead?

Ethereum's price went up due to rising purchase pressure following general market recovery. The prevention of tensions in China-US's trade war also made investors more positive about Ethereum. As a result, important on-chain numbers for Ethereum jump, and the Defi activity also increased. All of this makes it more likely that Ethereum prices can rise to $ 2,000.

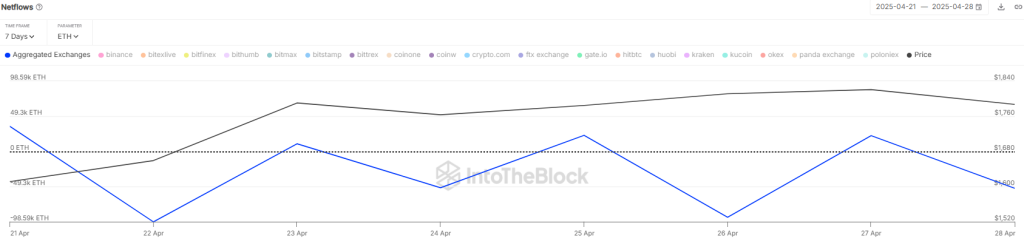

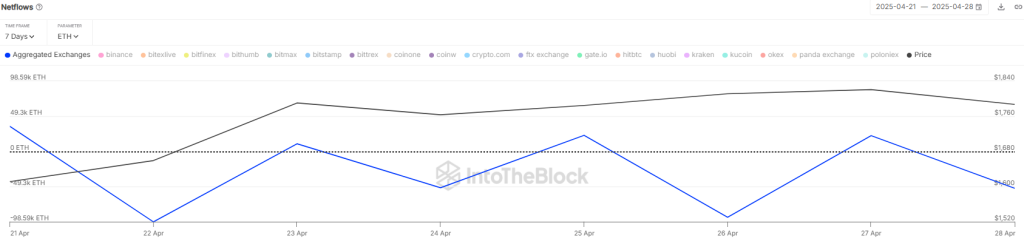

Ethereum's netflow became negative

In the last 24 hours, the price of Ethereum has faced the increase in volatility from both buyers and sellers. As a result, the volume of extermination increases in the middle of a fall in open interest. Data from coinglass shows that Ethereum witnessed a total extermination of nearly $ 26.7 million in the last 24 hours. Here, consumers have been able to do $ 10.6 million and sellers closed $ 16.1 million worth of short positions.

The recent rebound of Ethereum price is supported by strong on-chain data. According to Intoteblock, ETH Netflow has become negative, currently sitting at 51,590 ETH. This means that more Ethereum leaves exchanges than entering them, as holders move their coins into cold wallets. When reserves of exchanges fall like this, it is common to signal that investors want to hold their genitals instead of selling, reducing the sale pressure.

Also read: Ethereum price Prediction 2025, 2026 – 2030: Eth Bull Run to start in May?

In addition, the Ethereum exchange-traded funds (ETFS) brought $ 64 million to net inflows on April 28. It will come after a strong $ 151.7 million flow on the week ending April 25, the highest weekly flow from February 2025.

Meanwhile, in the Defi Space, Ethereum continues to dominate. Data from Defillama shows that the total network amount locked (TVL) rose to more than $ 51.7 billion, up to 15.5% last week.

Ethereum's activity on decentralized exchange also emerged, with a sunny trading volume rising by more than 30% last week, reaching $ 1.65 billion. The sharp increase of dex and on-chain activity points in the strong momentum, which increases the opportunities that Ethereum could break more than $ 2,000 marks.

What's next for the price of ETH?

Ether is closed above the 50-day transfer of average as the purchase demand has climbed. However, consumers are struggling to move forward at the top of $ 1,900 as the pressure sales intensify. As of writing, ETH prices traded at $ 1,826, which dropped more than 1.4% in the last 24 hours.

The main level to watch on the downside is the 20-day moving average ($ 1,802). If the price falls strong from there, consumers will likely try to push the ETH/USDT back to $ 1,950 – the zone where the previous collapse began. However, the sellers will probably put a hard battle here because if the price breaks at that level, it will quickly rally up to $ 2,100. A powerful purchase demand can send prices above $ 2.5k.

On the flip side, if the ether drops under the 20-day moving average and closes there, it will show that the seller is still in control. In that case, the ETH/USDT pair can drop more, up to $ 1,560.