S&P 500 – Trust the thrust

In our past three updates, we have signed off with “take a deep breath and azoom out. There are still no signs of a bear market. Although there is one, history shows us that every bear market is a major purchase opportunity (Bimbo) for those who have a time to reach than a few days to week.” We have given many facts to tell us why we keep repeating this mantra, and to update today, we add another: the zweig width thrust (ZBT).

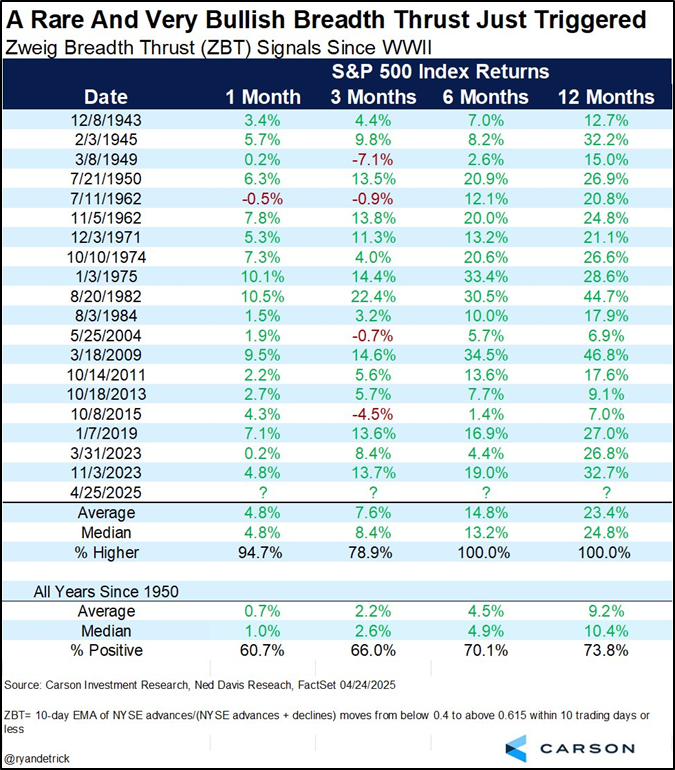

To produce a ZBT signal, the 10-day exponential transfer of NYSE's advanced averages divided by advances along with denials (A / A+D) will have to go from the bottom 0.400 to the top 0.615 within 10 days of trading. The main idea of the indicator is that a sudden swing from the negative to positive width indicates a reliable bottom is formed. Last week, on Thursday, April 24, a ZBT was provided. See the blue box in Figure 1 below.

S&P 500 since 1940 with (zweig) width of thrust indicator

This is the 20th hour, since 1940, that such a signal was given; So, this is a rare event that we should pay attention to. Using the S&P500 (SPX), we found that in these previous occasions,

-

Three leads to New Lows (1949, 2004, 2015): 9.1, 6.2, and 9.1% below the ZBT trigger level, respectively, before acquired double-to-triple-digits have been achieved over the next few years, for decades. See orange boxes in Figure 1.

-

Three did not lead to New Lows (1962, 1974, 2011), but prices dropped by 8.2, 11.0, and 5.2% below levels from when the ZBT has been attacked. Another thrust followed the second higher low, except in 2011.

-

In all other 13 cases, the index rallied essentially unfinished.

Moreover, after all 19 events, the stock market was 100% of the time higher six and twelve months later 14.3% and 24.8%, respectively. See Table 1 below.

Thus, based on this scale, there is now an 84% (16/19) opportunity April 7-9 lows will not be destroyed. While the thrust event is not mistaken, like all in financial markets, “60% of the time, it works all the time,” the tested results show the basic premise of the indicator of a reliable bottom formation.

Let's do math. Twelve months after an event in ZBT, the SPX was, on average, 24.8% higher. In this case, ZBT has been able to trigger Thursday's closing price of $ 5485. I -multiplied 1.248 and we get $ 6,845. This level corresponds to our Elliott Wave (EW) number of principles for a larger th -3 -wave between $ 6738 and $ 7122, expected between October this year and July next year. See Fig. 3 below.

The SPX Weekly Chart is our preferred number of EW

Our ongoing objective evaluation of stock market price charts and related indicators has helped us to explain their condition throughout the PABAGU -change these weeks and prevent bias and subjectivity, which often leads to irrational decisions, for example, seller instead of buying. Like this, we continue to fired the bullish horn at these uncertain times. The recent ZBT event adds weight to the evidence of a bullish resolution, which corresponds to our suited EW number shown on April 10.