Solayer Crashes 45% on Liquidity Shock—What You Need to Know

Solayer (layer) is under intense pressure after a sudden accident 45% destroyed weeks of bullish impetus. Once up 460% since February, the token has been negotiated below $ 1.70 while traders are jostling to understand what triggered the collapse.

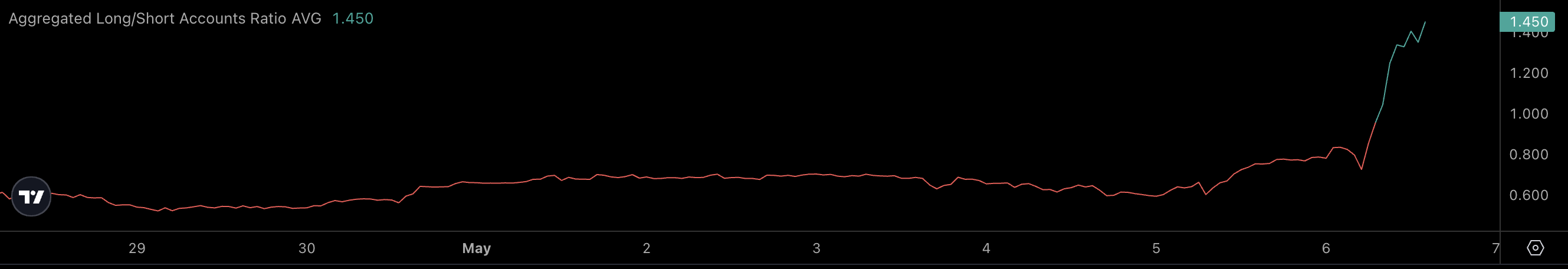

Altcoin has lost nearly $ 350 million in market capitalization in this crash. With the increase in volatility and the long / short ratio now at 1.45, the market seems divided between those who expected a rebound and those who would contrast themselves for more decline.

Solayer loses nearly $ 350 million in market capitalization – what is behind the drop?

The layer plunged around 35% in just 24 hours, from almost $ 3.10 to $ 1.90, letting the community rush to get answers. This clear drop occurs despite the solid fundamentals of Solayer – it is the first blockchain accelerated by the equipment designed to unload operations on programmable chips, aimed at more than 1 million GST and 100 GBPS of bandwidth.

The project also offers real world utility via its Solayer Emerald card, which allows users to spend USDC transparently via Visa, with Apple Pay and Google Pay.

From February 18 to May 5, the layer jumped 460%, making it one of the most efficient altcoins of the year – until the sudden crash disturbed the momentum.

At present, confusion reigns. Some blame the merchants for having triggered a liquidation cascade, others accuse the founders of shaded practices, while some to the daily unlocking of 110,600 layers.

However, these daily unlocks represent only $ 219,000 of value, enough to justify a stock market loss of 250 million dollars. What is more worrying is the next major release on May 11, when 26.5 million layers (worth around 51 million dollars) will be published.

If the feeling of the market is not recovered before that, this influx of tenders could intensify the sales pressure and potentially push the even lower price.

A layer accident deepens: $ 3.2 million long fuel panic liquidations

The long / short ratio of the layer was seated at 0.78 in the last 24 hours, with 56.14% of short -positioned merchants – reflecting the growing bearish feeling.

About $ 3.2 million long liquidations were launched, more than double the $ 1.5 million in short liquidations. This forced sale probably accelerated the drop from $ 3.10 to $ 1.90, because the liquidation cascades have worsened the pressure.

With the next unlocking of the May 11 token, the relaxation of leverage has become a key engine of the accident.

Although the long / short ratio has since overthreed 1.45 – indicating that more traders are now positioned for a rebound – the lack of depth of command book remains a concern. In such environments, price volatility can remain high, that feeling returns to Haussier.

Long heaps in the wrestling layer below $ 1.90

The perspectives of the layer remain very uncertain because its price is struggling to maintain more than $ 1.90 after a sharp drop.

Merchants and investors always seek to clarify the cause of the accident, while the feeling remains fragile before the release of the May 11 token.

In this context, the current long / short ratio of 1.45 reveals a significant change – more traders are now betting on a rebound, with 59.2% of long positions against 40.8% short.

This long growing bias can suggest that some believe that the worst is over, especially after an aggressive sale.

However, it also introduces new risks: if the layer is not recovered and falls more, these newly open long positions could be liquidated as before – triggering another forced sales wave.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.