Solana owners make a profit – can the SOL price reach $ 200?

Solana has recently achieved an impressive price revenue, reaching a two-month height and reaching near the $ 180 border.

However, it is faced with a significant level of resistance that has prevented Altcoin from pushing over $ 200. In the case of market conditions and investors, the journey to $ 200 can be difficult for Solana.

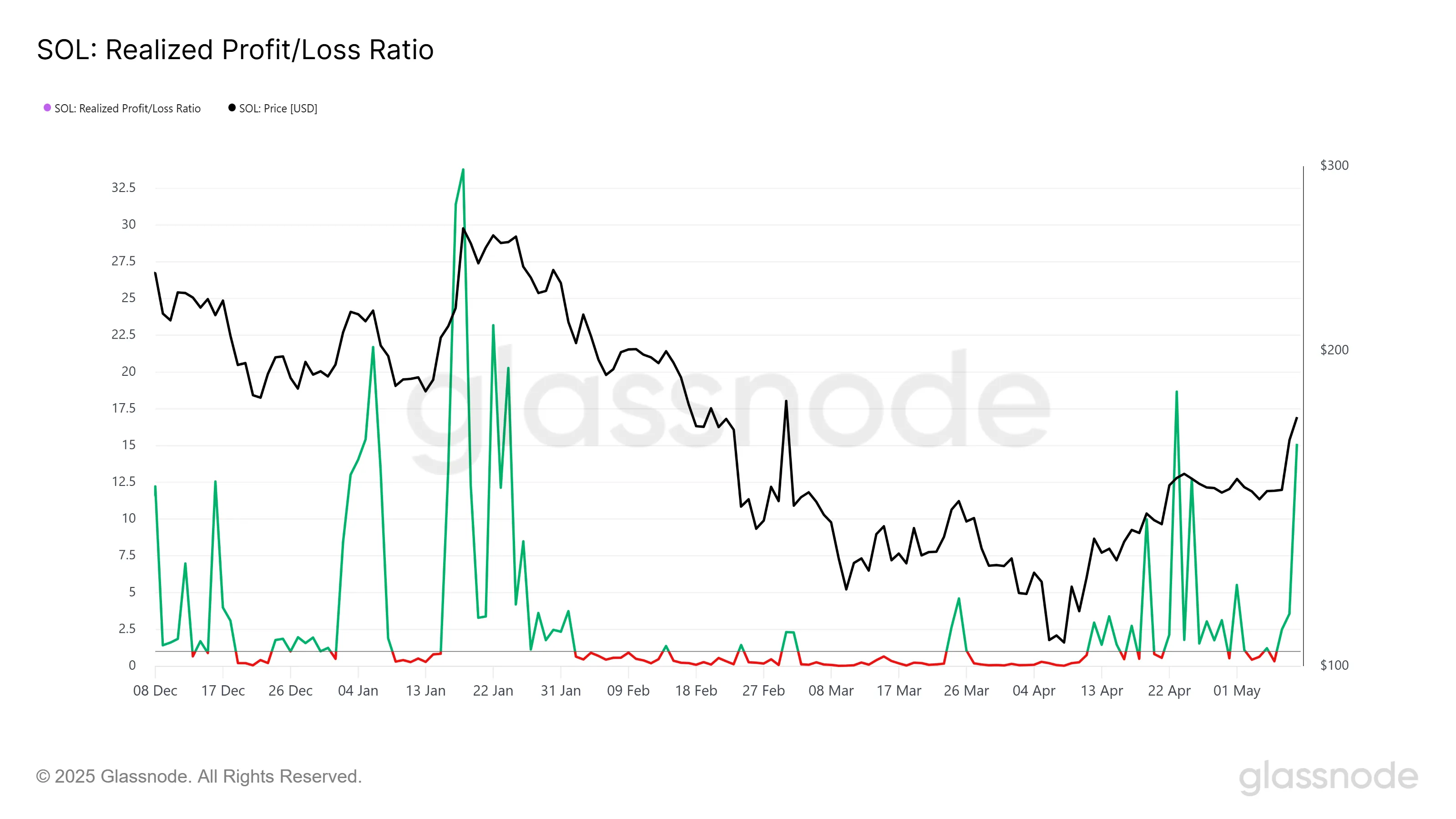

Solana investors move to sell

Many Solana (SOL) owners decide to book profits by contributing to the realized profits/loss ratio. This indicator has risen to 15.0, signaling that too much sales can cause concern. Historically, when this ratio exceeds 10.0 thresholds, it often leads to short -term price corrections.

This behavior of profit -making can also exacerbate market volatility by delaying or stopping the Solana rally. Sales inflow can be considered at a price, even if Solana has been able to gain significant benefits in the last month.

As a result, Sol may be facing backlog.

Solana's technical indicators also suggest that its bullish momentum may be saturated. The relative strength index (RSI) is currently over 70.0, placing the Solana over -purchased zone.

This suggests that the Altcoin rally can be achieved with its peak, similar to what happened in mid -January 2025, when Solana's price saw a decline after a similar level. RSI with investors' behavior signals that Solana's price may be a short -term decline.

Sol Price faces an old enemy

Solana's price has risen by 61%in the last month, $ 170 during writing. Altcoin is just $ 180 under an obstacle, not too far from the long -awaited $ 200 limit.

If the current momentum continues, Solana may overcome this resistance and rally towards the 200 -Dollaris milestone, creating further interest and investment.

However, the above factors may be concerned about the price of Solana. The combination of increased sales pressure and overloaded technical indicators can lead to reversal.

In this case, the price of Solana may fall to $ 161 or lower, at a level of 148 -dollar levels, the following key payment is potentially. This would hold a 3-month barrier, which is $ 180 untouched, delaying the long-awaited breakthrough.

On the other hand, when SOL new investors are absorbed and the price can benefit, Solana can overcome the 180 -Dollaris resistance. This would open the road to $ 200, making the Bark's prospect of invalid and continuing it with a bullshit trend. Such a step would require constant market resistance and demand to overcome current barriers.

Giving up

In accordance with the trust project instructions, this price analysis article is only for informative purposes and should not be considered as financial or investment counseling. Beincrypto is dedicated to accurate, impartial reporting, but market conditions may change without notice. Before making financial decisions, always conduct your research and consult a professional. Note that our conditions, privacy policies and dislike have been updated.