Solana Hits 400 Billion Transactions as SOL Eyes Key Support

Solana (Sol) is at a critical point after the recently -only collapse above $ 150 and exceeds a major milestone of 400 billion total transactions.

The on-chain activity remains strong, but momentum indicators such as RSI and the narrow EMA gaps suggest bullish strength began to cool down. SOL is now trading near an important support level of $ 145.59, with the same downside risks and reversible gaming opportunities.

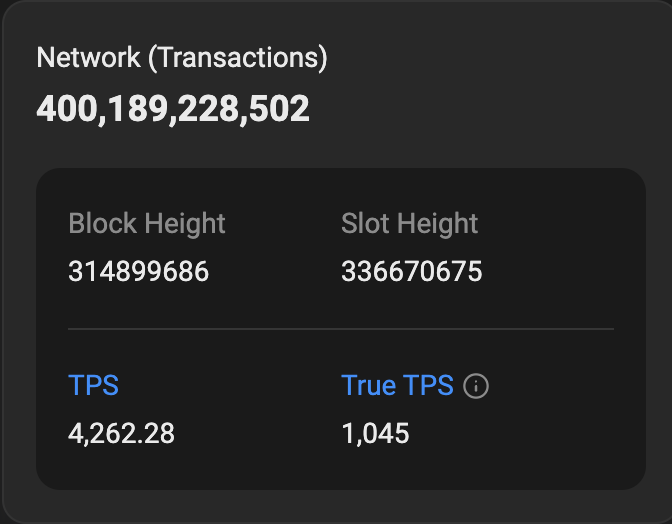

Solana network is more than 400 billion transactions

Solana has only destroyed a major milestone, which is more than 400 billion total transactions. The achievement will come during the modified momentum for Sol, with a price recently pushed above $ 150 for the first time since early March before facing a moderate pullback.

The on-chain activity remains strong, with a decentralized volume of exchange (DEX) covering $ 21 billion in the last seven days-an increase of 44% keeping Solana tightly at the top of the leaderboard.

Since hitting under the rock at $ 9.98 on January 1, 2023, Sol delivered a tedious 1412% rally, which stands as one of the leading emergues of the cycle.

Solana also saw an ecosystem explosion last year. The pump only generated more than $ 75 million in the fees over the last month, while heavy protocols such as Raydium, Meteora, Jupiter, and Jito continue to form millions on monthly income.

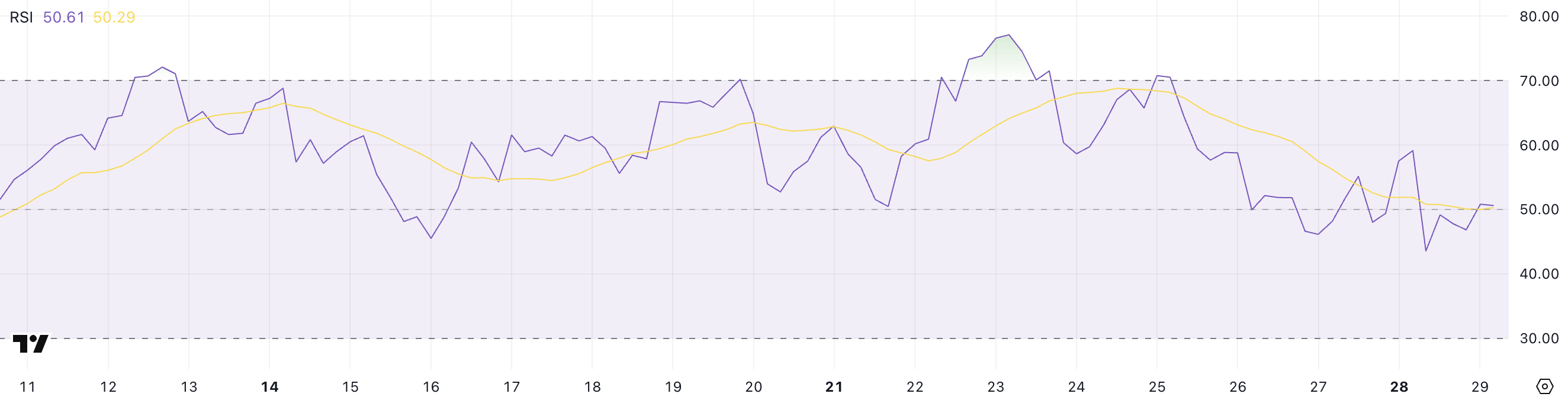

Momentum Cools for Sol as RSI has fallen sharply from recent highs

Solana's (RSI) Kaba -child is cooled sharply, lowering to 50.61 after hitting 70.52 four days ago.

The rapid refusal reflects the slowing of Sol's price momentum after its rally above $ 150, suggesting that the bullish strength is losing steam.

RSI, a widely used momentum indicator, measures how fast and strong prices have moved to a given period. Readings above 70 signal overbought conditions, and below 30 indicate oversold territory. A level around 50 usually reflects a neutral bearing, where the purchase and sale forces are more balanced.

The market is in a major branch with RSI by Solana who is now walking near 50.

If the bullish pressure is again selective, the RSI may rise back to levels of excessive thinking, setting the way for another leg higher. On the other hand, a constant lowering can confirm the weakening of the momentum, opening the door for a broader price correction.

Sol's momentum is clearly cooled so far, and entrepreneurs are watching closely for the next decisive move.

The bullish setup is facing the test of Sol: Support or Breakout Ahead?

Solana's EMA lines still indicate a bullish setup, with short-term averages above long-term. However, the gap between them was narrow compared to a few days ago, reflecting the loss of momentum.

Solana prices are currently walking near a major support level at $ 145.59 – a businessman's area is watching closely.

If this support is broken, the price can be slippery to $ 133.82, and if the sale of pressure is intense, a deeper transfer to $ 123.46 may play.

On the contrary, if consumers recover the momentum seen earlier this month, Solana can recover and retire around $ 157.

A clear breakout in the upper zone is likely to spare a push towards $ 180, the bullish is resurrected.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.