SOL, XRP & LTC Tipped as Next in Line for Crypto ETF Approval by Bloomberg Analysts

The landscape of the Crypto Exchange (ETF) Fund has completely changed in the past year after approval of the first lot of FNB Bitcoin Spot by Securities and Exchange Commission (SEC) of the United States. The regulatory tide went completely in favor of the digital currency sector.

The new Trump administration promotes in particular the cryptographic economy and has responded positively to the growing pressure of institutional investors who believe that it is time for more FNB Crypto and other financial products. The new president of the SEC, Paul Atkins, took a entirely different policy line compared to his controversial predecessor, Gary Gensler, who has often acted as a major obstacle. From now on, the debate is around which cryptocurrencies will obtain an FNB in the near future rather than whether it will happen or not.

XRP, Solana, Litecoin: the 3 best candidates of the next ETF?

According to Bloomberg analysts, Eric Balchunas and James Seyffart, several major digital currencies are faced with better chances for new ETF approvals by the securities regulator.

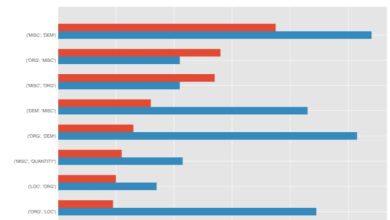

Solana, Litecoin and XRP of Ripple at the top of the list at the moment, the first two commanding a probability of 90% of ETF and XRP approvals up to 85%.

This estimate is considerably increasing, against around 65% a few months ago, which shows how the tide turned in their favor. Seasoned analysts cite increasing demand at the institutional level, the friendly leadership of the SEC and greater regulatory clarity for this decision. The relative success of existing FNB Crypto also makes it much more likely.

Crypto ETFS ODDS Approval

The XRP supported by Ripple has witnessed the most improvement with regard to the ETF approval ratings in the last two quarters. The fourth largest cryptocurrency by market capitalization won a major trial against the dry, and finally the latter had to remove it. This has contributed to eliminating major legal obstacles with regard to the approval of Son ETF. Several main active managers executing FNB, including bit levels and gray levels, already have ETF XRP deposits before the dry. Since the uncertainty concerning the legal situation is away, approval is very likely.

On the other hand, the main digital active ingredients like Solana and Litecoin have their own convincing cases. Litecoin particularly erases more convincing legal obstacles, because it is already classified as basic products by commodities and future trading commission (CFTC) of the United States.

Solana, on the other hand, is lacking in such a qualification, but there is a wave of major institutional interest, in particular because of its growing culture of money, its imprint defies and its use in non -loot tokens (NFT). Solana is also much more precious than Litecoin, but the latter is much older than the first, which brings both almost equally with the ETF approval estimates.

Certainly, other digital assets also seek to benefit from ETF approvals. They include Dogecoin and Hedera, each with a chance of approval of 80% according to Bloomberg analysts. Cardano, Avalanche and Polkadot each have about 75% of approval. Currently, an ETF from Cardano has been deposited by Grayscale, while the applications concerning Polkadot and Avalanche are also underway and are currently being examined by the dry.

Despite the growing optimism, in recent weeks, there has been a decline in the dry concerning these ETF. The dry did not provide any concrete reasons behind this delay and even rejected decisions on ETF Ethereum as it seems to avoid any attached implementation mechanism. Fidelity and Franklin propose mechanisms of intention, but dry considers that such a decision classifies them as titles and, therefore, an ETF would not be possible.

However, despite these short -term delays, the legal paradigm has certainly changed in favor of the crypto in recent years. There are bipartite laws in place for digital assets, and with the change in the direction of the dry, the historical position against the crypto has changed considerably. The FNBs are incoming, and although they can certainly be delayed, they cannot be arrested.

According to Balchunas and Seyffert:

“If the dry approved Bitcoin and Ethereum by virtue of these structures, it would become more difficult to justify a rejection for comparable assets.”

ETF issuers are currently busy updating their deposits with the dry to respond to all the concerns of the upper regulator. Recent proposals include more detailed monitoring of surveillance sharing, an improved pricing strategy and robust safety arrangements for underlying digital assets. These modifications are part of the vast routine to have an ETF approved in the United States, and the same goes for last year during the disputed approval of the first ETF Bitcoin. The biggest concerns about market manipulation and investor protection should remain.

The highest regulatory body delayed decisions on several of these ETF deposits, including Franklin Templeton's deposits for XRP and Solana, as well as Hedera and Cardano ETF applications.

Bloomberg analysts paint an optimistic image for ETF approval in the United States, in particular with regard to altcoins. According to them, the second half of 2025 will see an ALTCOIN ETF approval, and even if you are authorized, this will cause a snowball effect, and over time, a wide range of these financial instruments should be authorized in the immediate future. The cryptography market explodes in the United States, and we can be on the verge of the next major extension.