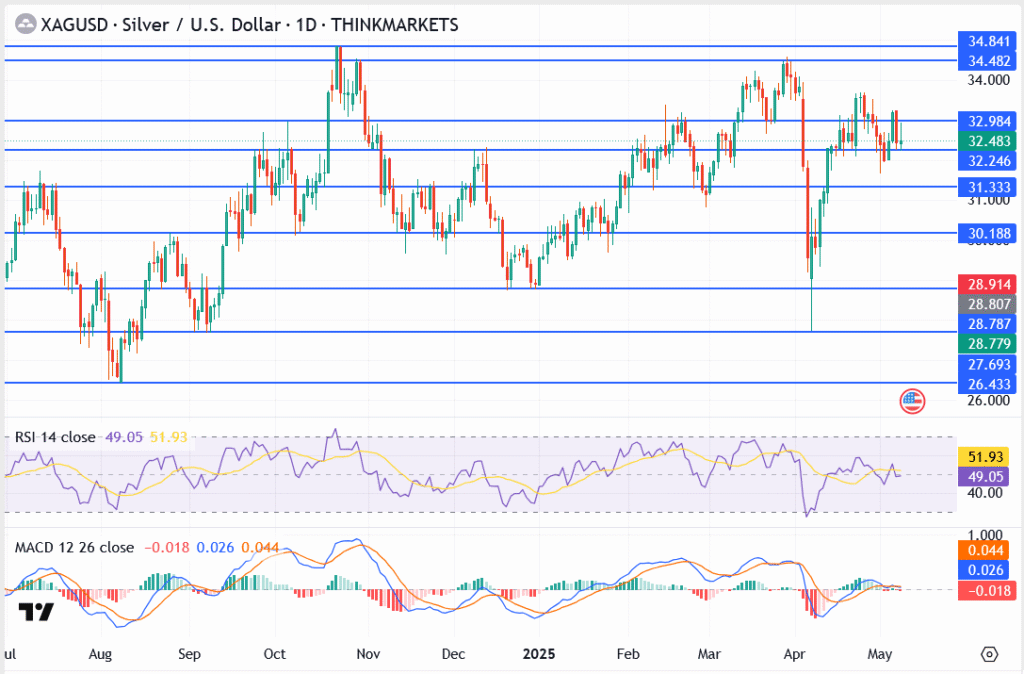

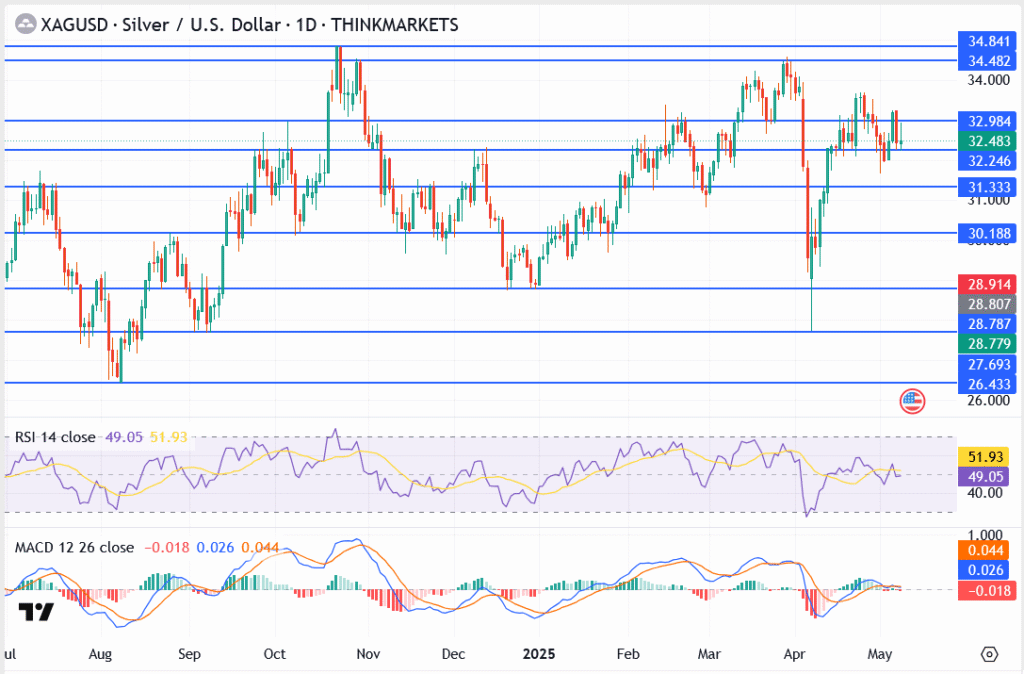

Silver Falls Below $33 as Dollar Firms, Support at Risk

- Summary:

- The price of silver dropped below $ 33 as the dollar force of forcing metals. Support $ 32.24 focuses as momentum fades and sentimental shifts at risk.

The price of silver was behind the foot this morning, slipping below $ 33.00 as updated by the US dollar strength and a careful tone of risk to weigh the goods. Until May 8, 2025, XAG/USD traded near $ 32.48, down moderate but threatening to break short -term support. The metal struggles to handle the reversed momentum despite recent geopolitical tailwinds and dips in treasury yields.

Macro pressure maintains a bull's hesitation

Silver's weakness comes as the dollar finds fresh buyers, with dxy hovering near 105.30. Entrepreneurs are looking at the revised US-China Trade Chatter and Hawkish Fed Commentary, which cooled the sentiment at risk that helped metal rallies in April. The gold is also surprisingly near $ 2,360, and adds friction to Silver's breakout attempts.

Silver technical analysis

- Current Price: $ 32.48

- Resistance Levels: $ 32.98, $ 34.48

- Support Levels: $ 32.24, $ 31.33, deeper than $ 30.18

- RSI: 49.05-Mid-Range, no clear momentum

- MACD: Flat – There is no dominant gaming trend

See also

The silver is holding it now, but the momentum clearly fades. If $ 32.24 fails, sellers can test $ 31.33. On the flip side, reclaiming $ 32.98 will bring a $ 34.00- $ 34.48 zone back to play.

Conclusion

It is not a territorial purchase, not yet. The silver is flying, it won't break. The price action is without convincing, and the bulls lose grip on the sides. If the dollar continues to climb and produce staying sticky, silver can be dragged into deeper territory. A clean recovery of $ 33 is the only thing that resets the tone. So far, the silver remains exposed, and the path of at least resistance is lower.