SEC ends Ripple lawsuit after admitting lack of clear guidelines

After a large -scale legal battle that lasted more than four years, the American Securities and Exchange (SEC) commission officially closed its trial against Ripple.

In a one -minute video published on X, the legal director of Ripple, Stuart Alderoty, awarded the retirement of the SEC to regulatory ambiguity.

In the last crypto in one minute, the legal director of Ripple @S_ALDEROTY Explain why the SEC abandoned its call against Ripple in March 2025, and where the United States went with a regulation of intelligent cryptography on the horizon:

🔒 Protect consumers

🟢… pic.twitter.com/kd9bi66sgi– Ripple (@Ripple) May 2, 2025

The Alderoty summed up six years of disputes in a few words, arguing that the dry cannot justify the application without first giving legal clarity. “You cannot continue someone before explaining the rules,” he said, criticizing the agency's approach to cryptographic surveillance.

A silent but impactful victory that Ripple was able to win was that the SEC abandoned the case after the SEC itself withdrew its final appeal in March 2025. However, the legal observers consider the decision as the admission that the case of the SEC did not have a solid regulatory basis.

With the trial behind them, Ripple is now ready to start working with the legislators, according to Alderoty. He also underlined the need to leave the courtroom and focus on cleaning the regulatory confusion that tormented the cryptography sector for a while. The cabinet said he intended to work with the congress looking for a legislative approach to support innovation, not to the detriment of compliance.

Ripple extends its connections

Now that the trial is behind, Ripple focuses on expansion worldwide. Business recently purchased Hidden Road in an acquisition for $ 1.25 billion, which strengthens the position of the company in brokerage and traditional financial regulations.

In a more daring movement, Ripple allegedly increase Its offer proposed to acquire the USDC transmitter of Circle at more than $ 20 billion, compared to $ 5 billion. Bloomberg sources said the agreement was actively negotiated.

If Ripple succeeds, he will take possession of the second largest stablecoin in the world and will change the balance of powers on the StableCoin market. The acquisition comes when Circle recently filed an introduction to the American stock market and adopts a cautious approach to public procurement.

Ripple’s international progress is also marked by its payment corridor developments. Ripple continues to work with SBI gave in Japan to faster cheaper funds more quickly, using XRP as a bridge asset. He joined Moneygram and Stellar in creating real utility for crypto in cross -border payments. The RIPPLE model reduces exchange costs and allows users to eliminate the need for preferred accounts on the sub-banking markets.

Clinching of the ETF XRP ratings

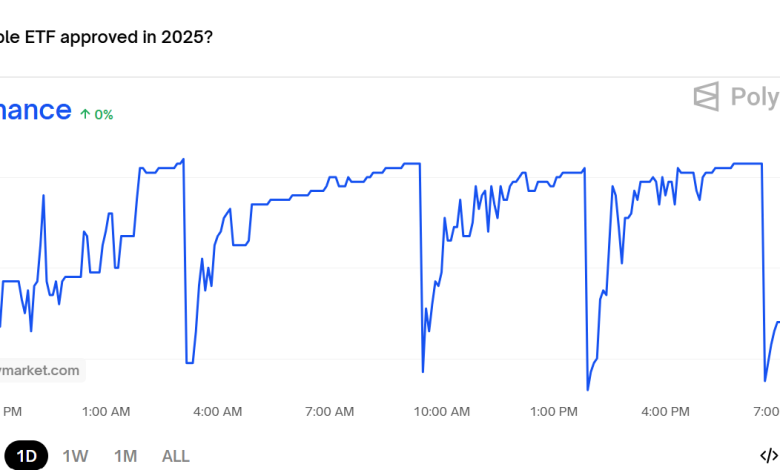

The growing prospect of approval from the XRP spot has drawn market attention. Polymarket data shows that the probability of approval by the end of 2025 has increased to 78% against 65% in recent weeks.

Analysts say that the passive position of the dry and the silent acceptance that XRP ETF deposits can be deposited indicate that approval could already occur. If it is approved, the XRP ETF will exhibit institutional and detail investors at XRP while avoiding the need to maintain the token directly. This decision would follow in the footsteps of the FNB Bitcoin and Ethereum, which have already opened the valves of capital entrances.

XRP Negotiates to $ 2.20 after increasing more than 5% in the last 24 hours. The volume of the part currently exceeds $ 2.1 billion. The behavior of investors also indicates optimism. However, Santiment also noted that whale wallets holding between 10 million and 100 million XRP added 200 million tokens this week.

Cryptopolitan Academy: Do you want to develop your money in 2025? Learn to do it with DEFI in our next webclass. Record your place