Royal Gold (RGLD) bullish nest for a break above $200.00

Royal gold (Nasdaq: Rgld), founded in 1991, is a world leader in royalty and streaming of precious metals. With interests in 194 properties in more than 20 countries, he manages active gold, silver, copper, lead and zinc. This article assesses his bullish Vague elliott Framework and highlights potential paths for more in -depth growth.

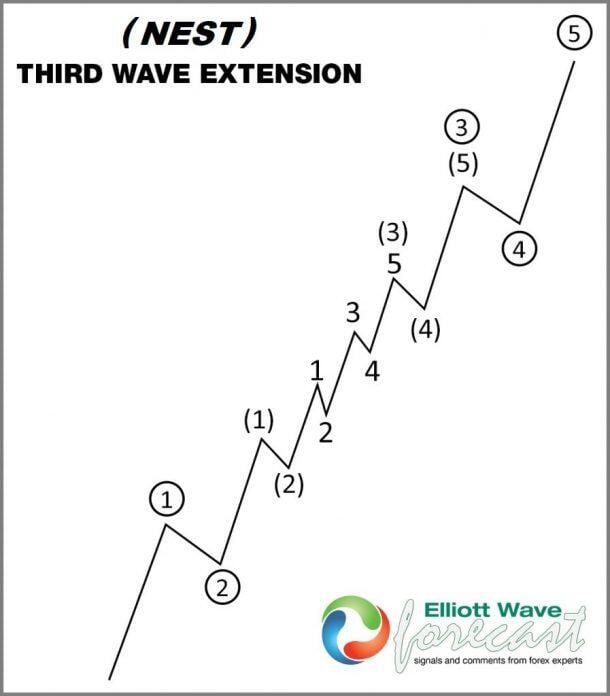

After 5 years of consolidation in a lateral range, RGLD has decisively crossed to new heights of all time in a robust impulsive wave structure (III). The weekly graph reveals an upward nesting formation, therefore, it suggests that an extension of the third wave is likely to take place, strengthening the upward trajectory of the stock.

The graph below illustrates the Nest Training, presenting the I-II series, leading to the extension of the wave III. Admittedly, the identification and capitalization of an escape within a nest is among the most rewarding opportunities for the merchants of the Elliott waves.

Third wave extension

RGLD Weekly Chart

RGLD is expected to continue its rally through a series of 4th and 5th waves, ending its whole cycle from 2020 in an advance of 5 waves greater than $ 200. Once this cycle ends, a greater degree correction is planned. In the meantime, we expect the daily withdrawal to remain sustained. After that, buyers are likely to search for long entries, positioning themselves against the lowest in December 2024 of $ 130.6. This level serves as a critical support point in the current upward progression.