Bitcoin Eyes $124,000 As Golden Ratio Signals More Gains Ahead

Crypto's prominent analyst Burak Kesmeci has tapped Bitcoin (BTC) to hit a target price of $ 124,000 based on data from the Golden Ratio multiplier price model. This prediction of Bullish came after a wonderful price climb over the past week, indicating that the leading cryptocurrency may have more room for immediate price growth.

Can Bitcoin return to the 1.6x target peak of accumulation?

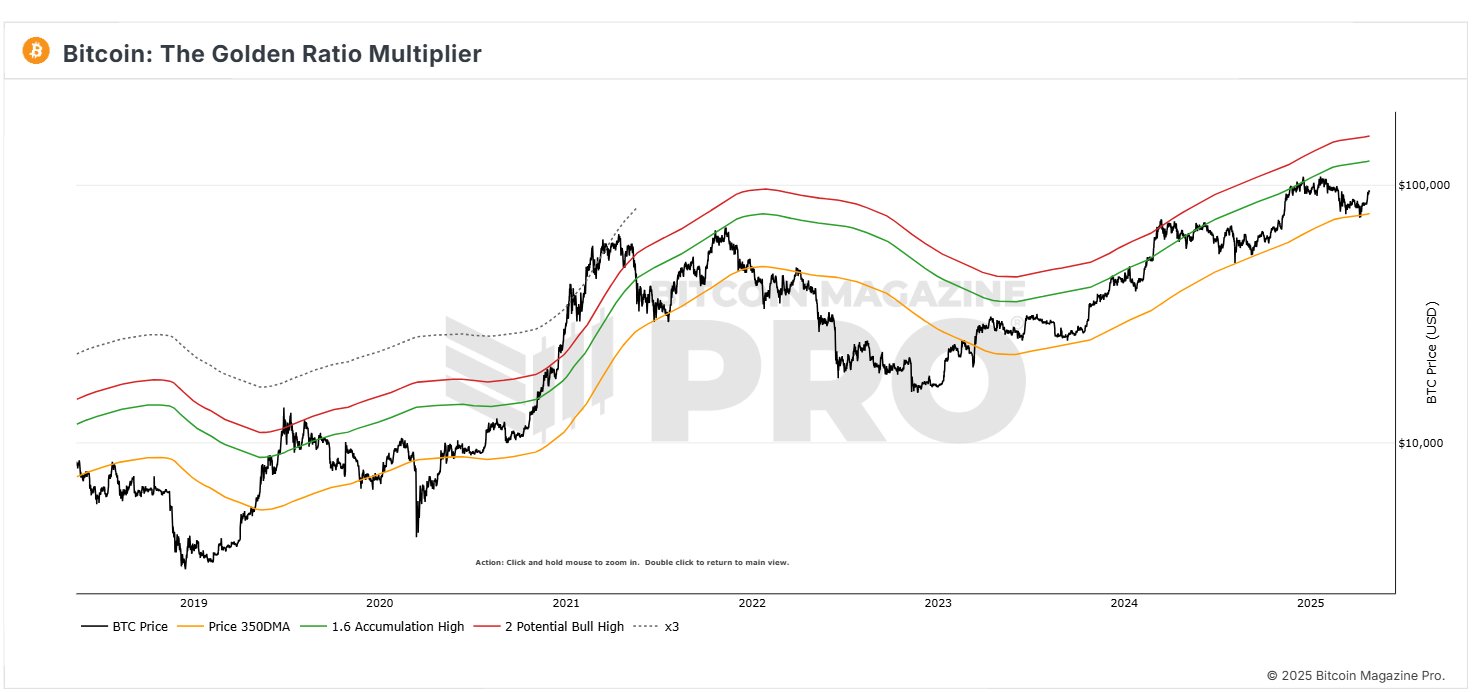

To an x Post On April 26, Burak Kesmeci shared the latest updates on the Bitcoin Golden Ratio multiplier price model, which referred data from Bitcoin Magazine Pro. For the context, the golden multiplier gold ratio model uses moving averages and Fibonacci ratios to help determine when the BTC can be overly granted or depleted, thus signing possible market topics or good accumulation opportunities.

According to the chart below, Bitcoin has recently reiterated the 350 -day -day moving average (350DMA) to $ 77,000. As the name implies, 350DMA monitors the average BTC price for the last 350 days and acts as a major zone support. Pressing or short sinking below this level often sign a potential long-term purchase opportunity.

Bitcoin recently bounced at its 350dma, after a price that dipped $ 75,000 followed by two subsequent price rallies to trade as high as $ 96,000.

According to price bands in the gold multiplier ratio, the BTC will now go for 1.6x accumulation high, that is, 1.6 times 350 DMA, currently at $ 124,000. Therefore, despite the ongoing incorporation of the price, the BTC is likely to produce another price rally based on the price model price of the gold multiplier.

Noteworthy, when Bitcoin moves near or above this level, it often indicates the end of an accumulation stage and the onset of a stronger bullish. Therefore, the BTC of up to $ 124,000 will only provide a way for further price acquisitions in accordance with the lofty targets of some market analysts.

BTC Miners earns $ 18.60 million in income

In other news, another leading crypto analyst, Ali Martinez, Report Miners have recently been capitalized on the wonderful Bitcoin price rally, realizing nearly $ 18.60 million in income as prices have passed $ 94,000.

This has realized the highlights of the revenue spike that early miners are strategically taking revenue at high price levels. However, it should be noted that Bitcoin maintains a strong bullish momentum despite the sale of this pressure, which has been -fueled by many factors, including strong flow to the ETFs of the spot.

At the time of writing, BTC costs $ 94,393, reflecting a price decline of 0.76% on the previous day.

Featured image from Investia, Chart from TradingView

Editorial process For Bitcoinist centered on delivering thoroughly researched, accurate, and unbiased content. We promote strict sources of sourcing, and each page undergoes our team's enthusiastic examination of the leading technology experts and timely editors. This process ensures the integrity, relevance, and value of our content for our readers.