Pullback nearing end, upside potential ahead

Pan American Silver Corp. (PAAs) is a mining company based in Vancouver, Canada, dedicated to silver, gold, zinc, lead, and copper. Established in 1979, it administers exploration, development, acquisition, processing, and refining. The company operates in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. Below we will look at the Elliott Wave Technical Outlook.

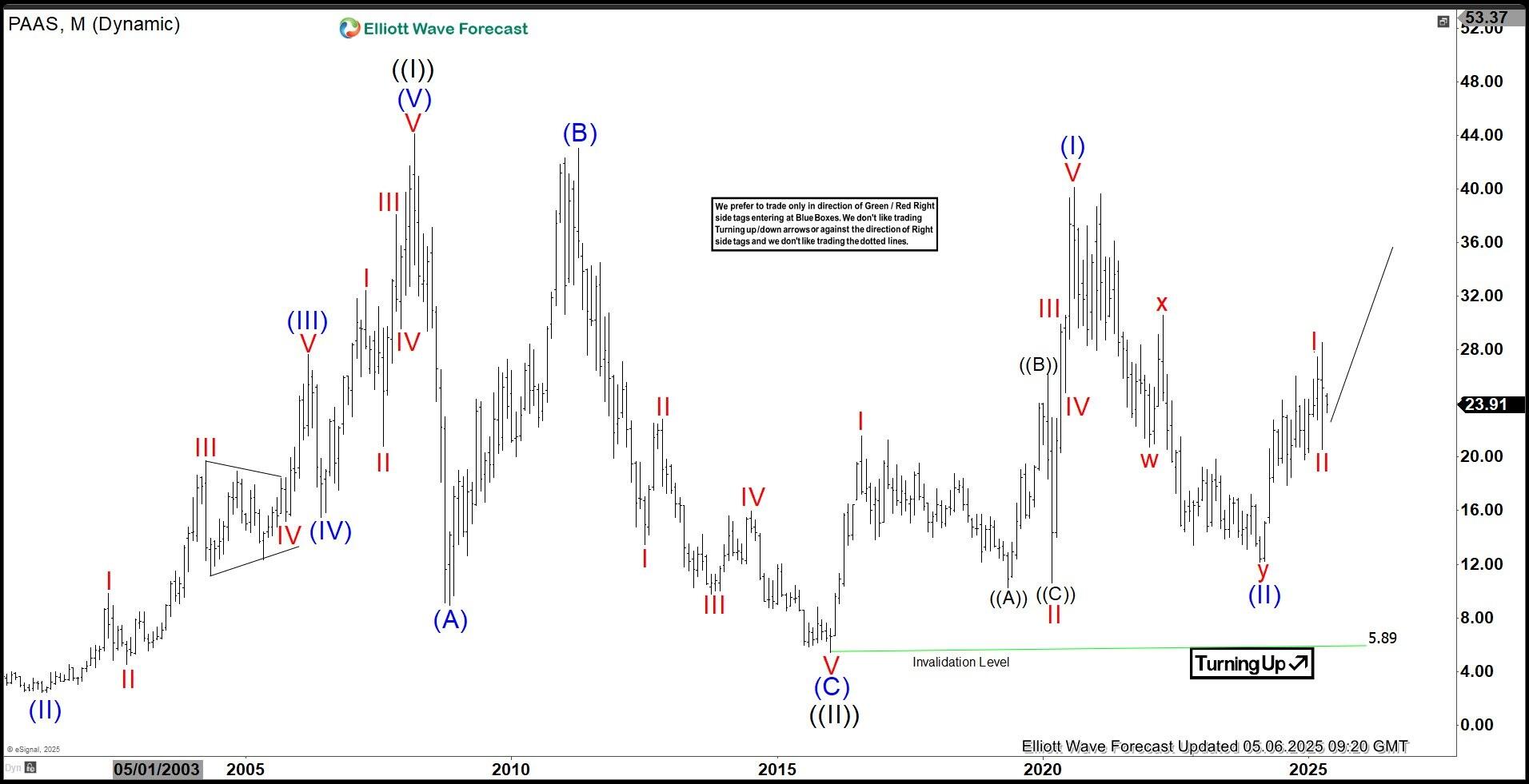

Paas Monthly Elliott Wave Chart

The Elliott Wave's monthly chart for Pan American Silver (PAAs) indicates that the Wave ((II)) pullback ended at $ 5.89 in January 2016. Since then, the stock began to move forward with the wave ((III)). From the wave ((II)) low, wave (i) sank to $ 40.11, followed by a wave (II) pullback dropped to $ 12.16. The stock now continues its upward trend to the wave (III). Inside this wave, I reached $ 28.60, with a subsequent wave II pullback ending at $ 20.55. As long as the $ 5.89 low hold, the stock is expected to continue to rise.

Paas Daily Elliott Wave Chart

The Elliott Wave's daily chart for Pan American Silver (PAAs) indicates that the Wave (II) pullback ended at $ 12.19. From this low, the stock began an upward transition to wave I, structured as a diagonal pattern. Inside the wave I, the wave ((1)) sank at $ 24.27, followed by a wave ((2)) pullback to $ 17.86. The stock then climbs the wave ((3)) up to $ 26.05, with a wave ((4)) dip ending at $ 19.80. The final wave ((5)) completed the wave I at $ 27.47. A subsequent Wave II pullback ended at $ 20.55. As long as the $ 12.19 low remains intact, the stock is expected to continue to rise.