PI Token Shows Signs of Reversal as Technical Indicators Turn Bullish

- Pi token trading lower than the descending trend line since April 12 after a summit of $ 3.

- Volume indicator on the balance sheet points out an increase in the purchase interest.

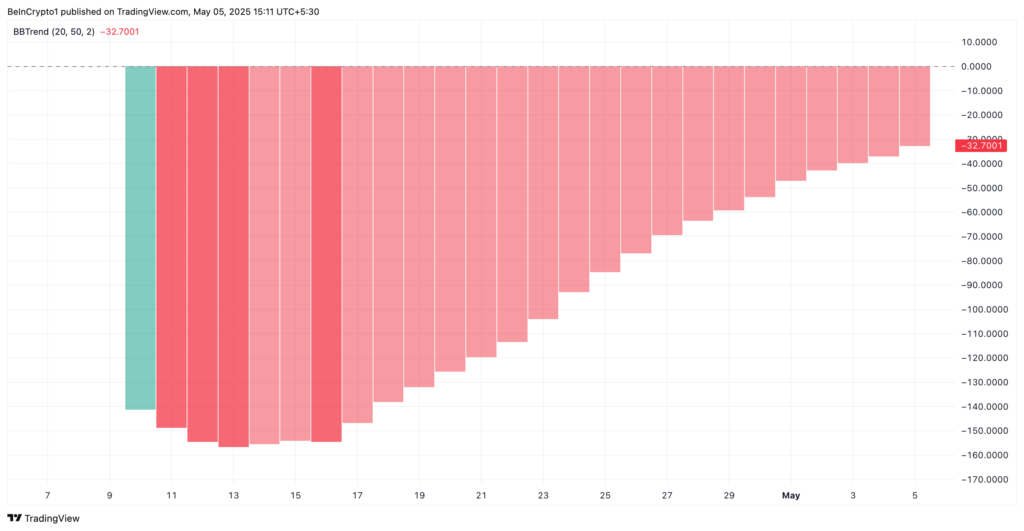

- Bbtrend histogram contraction points to weaken the sale pressure.

The Pi token was taken in a persistent downward trend since it reached its $ 3 summit on February 26, the prices constantly trading below a descending trend line since April 12. This prolonged decline has created a negative feeling on the market around Altcoin, but several technical indicators now suggest that a bubble reversal can form.

According to a recent analysis, the PI / USD graph of a day displays the first signals of a potential rally after this period of extended low price. The most revealing among these indicators is the volume of balance (REBR), which has shown a notable increase in the last two days of negotiation.

The REBR indicator is a technical analysis tool that uses volume flow to predict price movement changes. It works by adding volume on the days when prices are closer and subtracting the volume on the days when prices are getting closer. In the case of PI, the increase in the OBB, even if the price remains moderate creates an upward divergence – generally a reliable signal that the feeling of the market moves below the surface.

Current data show that buyers accumulate pi tokens

Current reading indicates that buyers quietly accumulate the Pi tokens despite the low prices in progress. This accumulation phase frequently precedes price escapes, especially when combined with other technical support factors. One of these factors is the visible contraction of the Bbtrend Pi indicator histogram, where the red bars gradually shortened during recent negotiation sessions.

The Bbtrend tool measures the relationship between price and Bollinger bands, with contractual histogram bars indicating a reduction in sales pressure. This pattern often serves as an early alert signal that a downward trend which prevents momentum and could soon be reversed.

For merchants supervisor Pi, the convergence of these technical signals suggests that the token can approach a significant turning point. The combination of the increase in purchasing interests (as indicated by the OBRI) with a reduced sales pressure (shown by BBTREND) often precedes an bruise escape, in particular after a prolonged downward trend has pushed prices at potentially occurring levels.

However, prudent investors should note that for a complete reversal of trends, PI should surpass themselves above the downward trend line which has capped its price since April 12. Until this resistance is definitively broken, the token remains in a technical decline tendency despite the encouraging indicators.