Pi Network Rally Fades Fast After Brief Jump – What’s Next for PI?

The PI Network (PI) has dropped more than 8.5% in the last seven days. It was exchanged below $ 0.65 for six straight days but crashed below $ 0.60 today. The trend remains weak, with the price action stuck under the ichimoku cloud.

The RSI of Altcoin could easily arrive above 50 but dropped to 45, showing the fading bullish momentum. Ema is still bearish. It walks just above the main support, and the next move can decide between a deeper collapse and a potential rebound.

The PI network network is bearish pressure under Ichimoku Cloud

The PI network is still trading under the Ichimoku Cloud, which signed a bearish market structure in general. However, a potential shift can develop, as the blue tenkan-sen (conversion line) has recently crossed above the red kijun-sen (base line).

This crossover is often seen as an early bullish signal, especially if confirmed by increasing volume or a move to the cloud.

Despite this, the future cloud remains red, indicating the ongoing resistance ahead and a signal that the wider trend is still under pressure.

The Chikou Span (lagging line) is still below both price and cloud candles. This means that any reversal move is not yet confirmed.

For a real recurrence, the PI should break and above the cloud. The future cloud should also be green, with all ichimoku signals aligned with bullishly.

So far, the prefabination shows anesthesia. There is a short -term bullish crossover, but the price is still under the cloud, and the wider trend remains bearish.

PI network momentum slows down as RSI sinks below 50

The RSI of the PI network is currently sitting at 45.41, emerging after a sharp rally from 28.49 to 54.40 two days ago. This indicates a slowdown in momentum following a short recovery period.

The pullback from above 50 suggests that the purchase of pressure is weakened, and the PI enters a more neutral zone, where the bulls or bears are out of control.

The rapid return also reflects the uncertainty of the current price.

Kamag -child Index Index (RSI) is a momentum oscillator from 0 to 100, commonly used to identify excessive or excessive conditions.

The readings above 70 suggest a possession may be overwhelming and due to a correction, while the readings below 30 indicate oversold and potential conditions for a bounce. Values between 30 and 70 are considered neutral, with 50 as the main point of the pivot.

The current RSI of the PI at 45.41 is below that threshold, indicating a slight bearish lean unless the scale turns upward. If the RSI continues to decrease, it may reflect the growing pressure sales and a risk of additional price weakness.

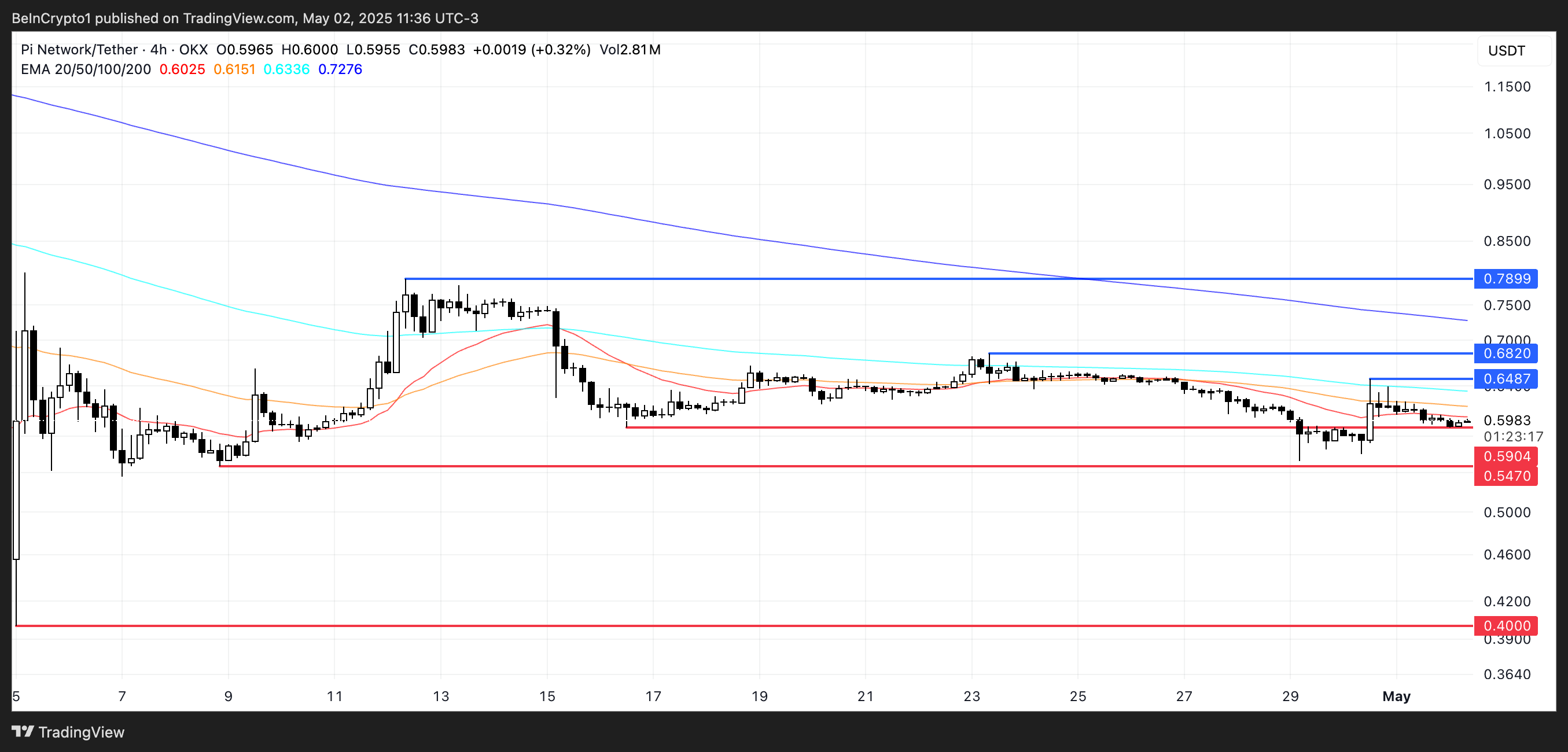

PI network hoves close to the main support in Bearish Emas

The PI price only trades above a major support of $ 0.59, with a bearish pressure building.

If this level is tested and damaged, the next important support lies at $ 0.547 and $ 0.40, which will potentially expose the token to a deeper correction.

The exponential transfer of averages (EMA) remains in a bearish alignment, with short-term emails positioned below the long-term. This structure usually signs that the wider trend is still down.

However, if the trend is reversed and the consumers are attending, PI may climb to test the resistance to $ 0.648, followed by $ 0.682.

A breakout above the same – especially if supported by volume and a bullish EMA crossover – can push the price to $ 0.789, which signed a move towards a longer climb.

Refusal

In accordance with the guidelines of the trust project, this price assessment article is for information purposes only and should not consider financial or investment advice. Beincrypto is focused on accurate, unparalleled reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy, and disclaimers are updated.