Peter Schiff Warns Bitcoin Is No Hedge Against Inflation Despite Recent Price Surge

Peter Schiff has questioned the role of Bitcoin de Cover against inflation, declaring that his recent negotiation models do not support the complaint. Schiff, known for its strong position on gold, argued that Bitcoin continues to behave more as a technological stock than a value store.

Peter Schiff criticizes the story of Bitcoin inflation coverage

In the midst of continuous economic uncertainty in the United States, Peter Schiff has renewed his skepticism towards the usefulness of Bitcoin as a cover against inflation. According to Schiff, the recent price action shows that Bitcoin always reflects the behavior of technological actions rather than that of gold.

“Bitcoin has not decoupled from Nasdaq,” said Schiff in a recent postAdding that investors concerned about inflation should rather focus on gold. He argued that Bitcoin does not have the necessary stability to serve as a reliable reserve of value and remains sensitive to wider market oscillations.

Peter Schiff also noted that the increase in the price of bitcoin seems more linked to the speculation of investors and macroeconomic developments than to intrinsic monetary properties. He continued to warn that Bitcoin may not offer the same long -term protection for wealth as traditional security assets.

Senator Lummis connects Bitcoin to the relief of national debt

Senator Cynthia Lummis also participated in the discussion by connecting the adoption of Bitcoin to a broader economic policy. In a public statement, it approved the Bitcoin law as a possible solution to tackle the national debt of 36 billions of dollars in the United States.

According to Lummis, the current administration has shown the desire to consider digital assets, and therefore the transition from Bitcoin law is “the only solution to the debt of 36 t $ in our country”. Even with limited details, the proposal marks the growing interest of political decision -makers in the exploration of alternative financial systems.

Lummis, known for its pro-bit position, has always supported legislative efforts that encourage adoption and regulatory clarity. However, while Microstrategy (MSTR) announced a loss of $ 16.49 per first quarter of 2025 resulting from a depression of $ 5.9 billion from the drop in Bitcoin price earlier this year.

However, Microstrategy remains one of the biggest holders of Bitcoin companies and says that he is willing to develop his assets. To indicate long -term value in the asset, Saylor said he intended to raise up to $ 84 billion to acquire additional bitcoin.

Market conditions increase the momentum of Bitcoin

The price of Bitcoin increased by more than 14% in April, benefiting from the relaxation of inflation data and increasing expectations of interest rate reductions. The PCE inflation rate arrived by 2.3% from one year to the next, reinforcing the opinion that the Federal Reserve could consider reducing interest rates during future meetings.

In addition, US President Donald Trump recently urged the president of the Federal Reserve Jerome Powell to reduce interest rates before the next meeting of the Federal Open Market Committee (FOMC). Trump said there was “no inflation” and that current economic conditions justify a more loose monetary position.

Analysts noted that Bitcoin's performance continues to exceed traditional stock markets. While the S&P 500 has remained mainly flat, the rise in bitcoin was supported by reducing trade tensions, favorable macro-data and renewed institutional interest.

Different views of the role of Peter Schiff on Bitcoin

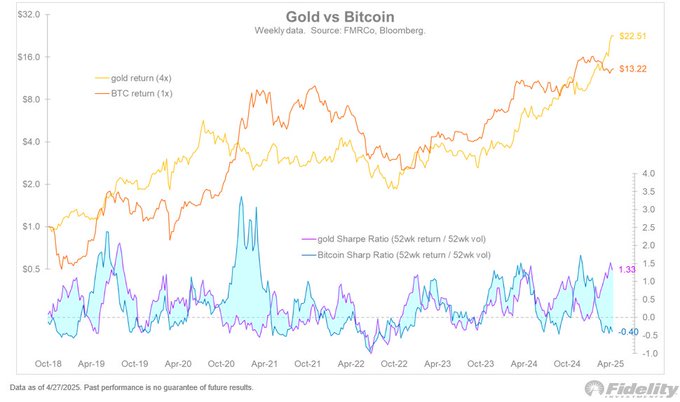

Jurrien Timmer, director of the world macro at Fidelity, commented On the double characteristics of Bitcoin, by comparing it both to the assets of gold technology and speculative technology. Unlike Peter Schiff, he noted that Bitcoin can behave differently depending on the larger financial conditions.

“Bitcoin has a personality from Dr Jekyll and Mr. Hyde,” said Timmer, explaining that he sometimes acts as hard money but that he is negotiating as a risk asset. He added that Bitcoin's performance has historically been linked to the growth of global money markets and actions.

Timmer has also shared data showing a recent divergence between gold and Bitcoin depending on their Sharpe ratios. He stressed that gold currently has a higher Sharpe Sharpe report, indicating more coherent risk yields, but suggested that Bitcoin could surpass again if the liquidity conditions become more favorable.

According to Glassnod long -term holders, adding more than 254,000 BTC in recent months, demonstrating confidence. However, as BTC prices are approaching $ 99,900, the risk of increasing sales pressure may increase.

Warning: The content presented may include the author's personal opinion and is subject to the market state. Do your market studies before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.

✓ Share: