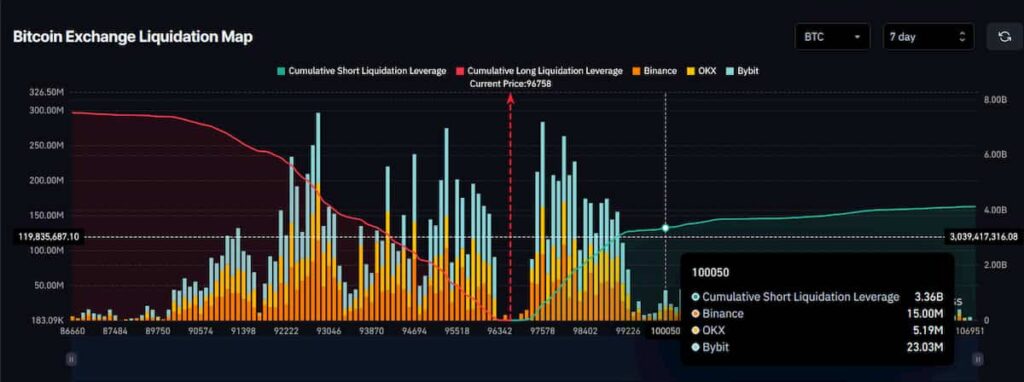

Over $3 billion in Bitcoin shorts risk of liquidation if BTC hits $100,000

⚈ The Bitcoin trading nearly $ 97,000 puts $ 3.36 billion in shorts at risk of liquidation.

⚈ An increase in prices of 3.14% BTC to $ 100,000 would trigger short mass liquidations.

⚈ A decrease of 3.07% to $ 93,973 would also threaten $ 3.36 billion in long positions.

Bitcoin's move (BTC) increased could place Crypto Bears in a fairly difficult position if the current cryptocurrency rally continues.

The main digital asset was negotiated at $ 96,950 at the time of the press on May 2, after having seen an increase in the price of 2.64% in last week.

Some $ 36 billion in Bitcoin short positions are at risk of liquidation if BTC prices reach $ 100,000, according to data analyzed and recovered By Finbold of Market Intelligence Platform Rinsing.

An increase of 3.14% of the BTC price could lead to the liquidation of $ 3.36 billion

So, what are the key levels to watch while Bitcoin tackles a new $ 100,000 threshold test? Currently, the next level of resistance is $ 97,828, just 0.9% above current prices – a retain of this level is imminent, unless a major lower catalyst emerges in a very short time. An increase at $ 100,000 would increase 3.14% compared to the price at which digital assets are currently negotiated.

Readers should however note that this more reflects the extent of leverages, rather than a large-scale calculation error on the part of cryptocurrency traders.

If a movement equivalent to the decline should occur, the extent of liquidations with long bitcoin position would be similar. To be precise, a decrease of 3.07%, which would see the BTC being negotiated at a price of $ 93,973, would lead to roughly the same capital amount – $ 3.36 billion, in danger.

Star image via Shutterstock