No XRP ETF launch for U.S. investors as ProShares confirms delay

Confusion crossed the cryptographic community after rumors suggestd prOshares would launch an XRP ETF on April 30. However, Bloomberg ETF analyst James Seyffart said there was no specific date.

The confusion was born from a regulatory file made by the company on April 15, which the media wrongly reported.

To clarify more, a proshares spokesman said that the company had no ETF products in the pipeline for April 30. They pointed out that there were no other updates for the moment.

You may have seen the big titles on the launch of XRP proshares ETF this week.

But a spokesman said to me:

“Proshares has no ETF launches scheduled for Wednesday, April 30. We have no news to share for the moment. ”

– Ben Stuck 🟪 (@strack_ben) April 28, 2025

ETF XRP based on future on the horizon

While the frenzy on a proshares XRP product has grown, it has become obvious that future ETFs would be based on term contracts. In her response, Nate Geraci, president of the ETF store, clarified That Proshares intended to launch FNB based on future, not a spot XRP. Generally, FNBs in the long term are less regulated, although they have access to investors to assets without holding them.

Geraci stressed that product offers could include leveraging and reverse options, allowing people to engage in XRP price movements in several ways. He also noted that Teucrium introduced the 2x long ETF XRP (XXRP) to amplify the daily return of the part through exchange contracts.

However, regulations are still pose a problem for approval of ETF XRP. Currently, some of the companies that seek to have their ETF spot approved are gray levels, Bit, Franklin Templeton, Wisdomtree and 21Shares. Seyffart de Bloomberg also said that the final decisions about these Application zones are not likely to occur before October 2025.

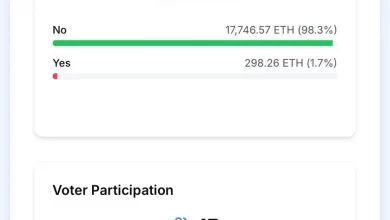

According to pOlymarket The data, the chances of having an US XRP ETF approved by December 2025 are 78%, against 68% on April 22. However, it is still lower than 87% on March 23.

Ripple's world FNB expansion

The global expansion of the Ripple FNB continues to get started with the goal despite the challenges that the United States faced on April 25, the Brazilian Crypto Hashdex company began to negotiate the first world and XRP world spot under the symbol XRPH11 in exchange B3. Managed by Gential Investmentos, the fund invests at least 95% of its reference value in XRP and emulates the NASDAQ XRP reference price index.

Hashdex made its debut in Brazil and added its unique ninth ETF on B3, which focuses on Bitcoin, Ethereum and Solana, among others. According to Hashdex Cio Samir Kerbage, the fund aims to appeal to institutional investors who wish to invest in the crypto in the regulated Brazilian market system.

One of the key aspects that affect the global ETF XRP is the legal battle with which Ripple is currently faced with the dry. A recent file – a suspected request submitted on April 10 – may indicate that settlement negotiations are underway.

Analysts argue The fact that the DSA's decision to withdraw or maintain its appeal on the decision of Torres judge on programmatic XRP sales may affect the approval time. According to Bloomberg, the newly elected SEC president Paul Atkins will become a key figure to decide to accept Crypto ETF.

Although there have been rumors that XRP is in difficulty, it still climbs to $ 2.29, up 0.59% of its lowest day. Daily market capitalization and XRP negotiation volume also increased by 1% and 28%, respectively, and were estimated at $ 133.5 billion and $ 3.25 billion.

Cryptopolitan Academy: tired of market swings? Find out how Defi can help you create a stable passive income. Register