Nearly $1 Billion Liquidated as Bitcoin Surpasses $100,000

Over the past 24 hours, the cryptocurrency market has experienced significant volatility while officially broke Bitcoin (BTC) above the $ 100,000 mark. This price movement has contacted massive fluids, reaching nearly $ 1 billion throughout the market, and led to a transition to the businessman's behavior.

In addition, data from the Bitcoin derivatives market has warmed up. Analysts are concerned about the potential for the larger wave of extermination.

Long Position Liquidations Surge while Bitcoin breaks $ 100,000

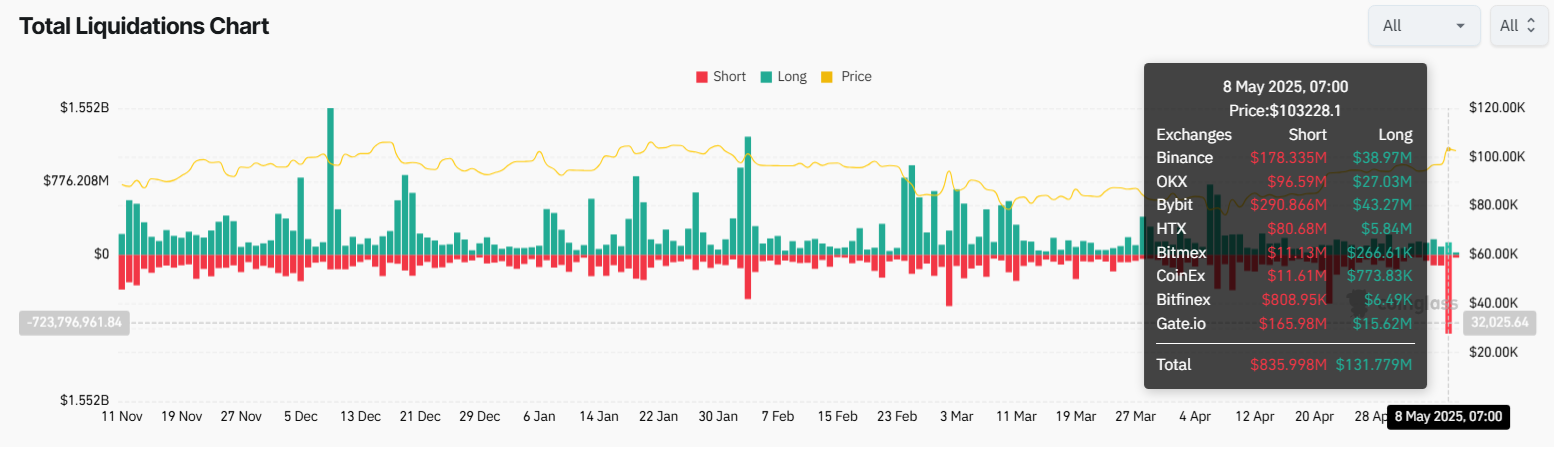

According to data from coinglass, around 190,000 merchants are liquid, with a total losses of up to $ 970 million. Short positions hit the hardest, worth $ 836 million in losses. This event has marked the largest short exertion since 2021. Coinglass also noted that actual numbers could be higher.

“This is the biggest short extermination since 2021 … Binance has not fully disclosed its destruction data, and the actual data is more,” coinglass Nakasa said.

Although short positions have been eliminated, the market is faced with a new risk: a sharp increase in long positions.

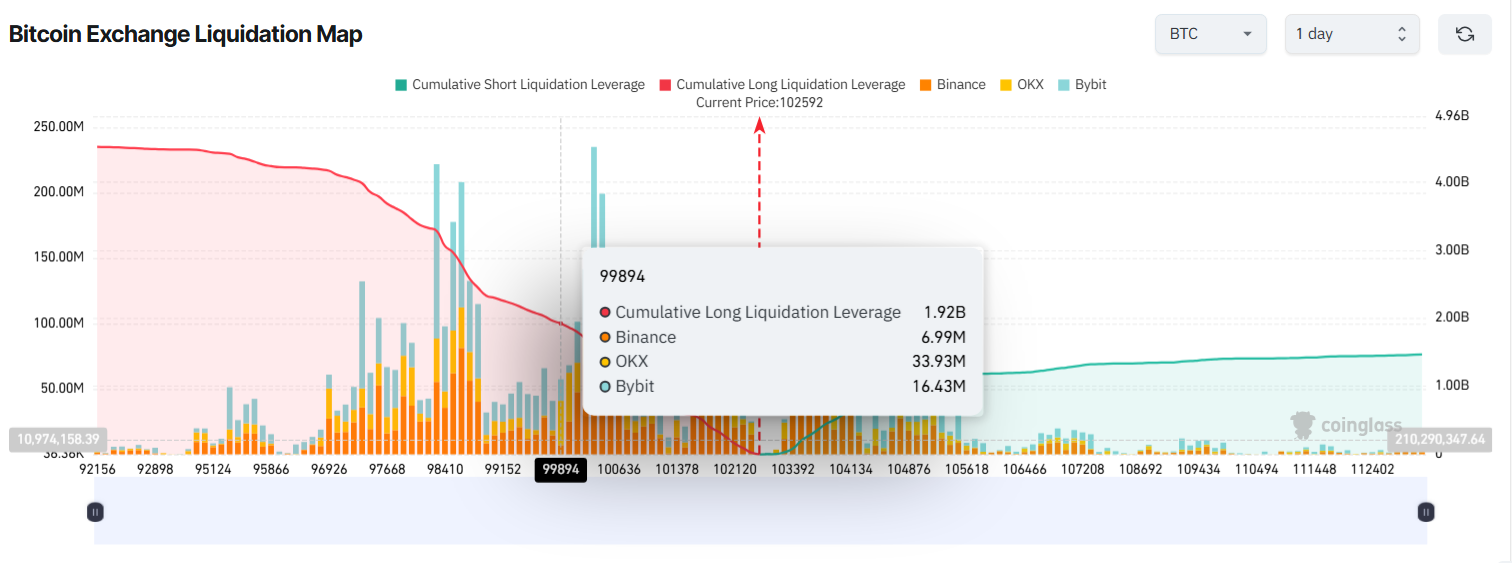

The 24 -hour Bitcoin map of coinglass shows that if the Bitcoin collapse below $ 100,000, the total long position in the exchanges could face nearly $ 2 billion in liquids. It raises concerns about a potential “long squeeze” -a phenomenon in which the masses of long positions motivate the panic that sells and accelerates price collapse.

The same map also shows that if Bitcoin drops below $ 98,000, the total volume of extermination can reach as high as $ 3.45 billion.

Excessive potential extermination from the long position indicates a transition to the businessman's sentiment. Many have betting more money and using higher actions, expecting the price of bitcoin to continue to rise.

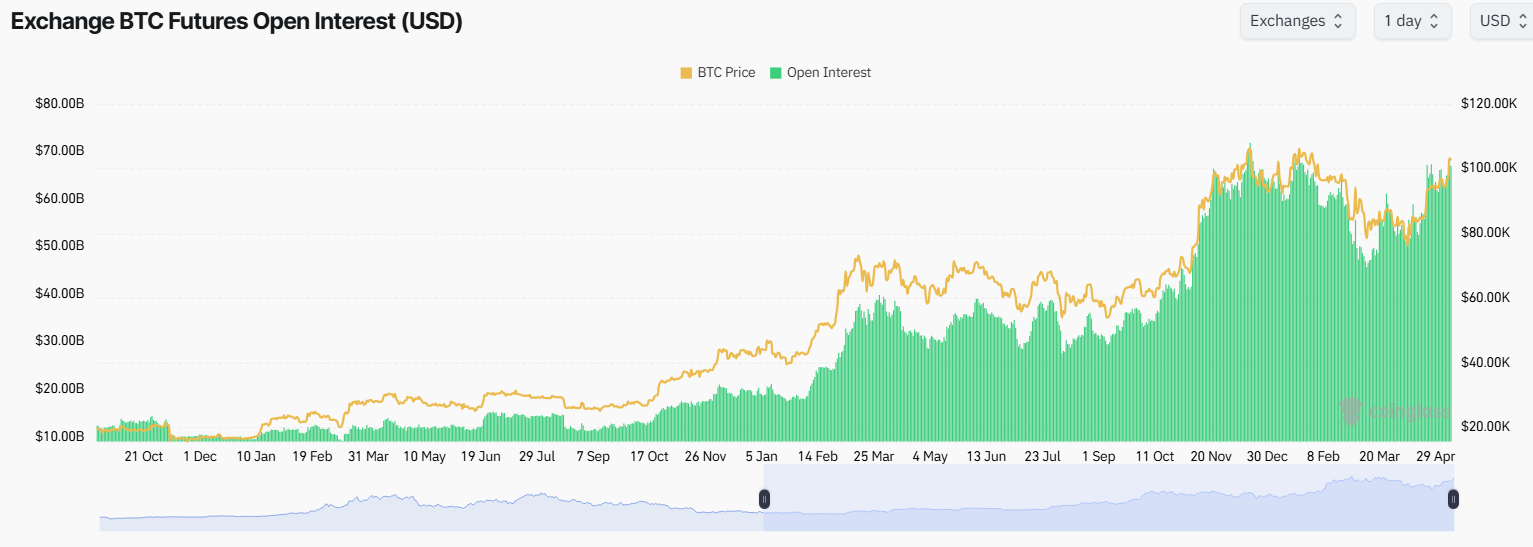

In addition, data from coinglass shows that Bitcoin Futures Open Interest (OI) in exchanges reached a record of $ 67.4 billion. It shows a climbing demand for short-term trading trading. Entrepreneurs are making big bets on the uprising, which increases the risk when the market suddenly returns.

Historically, every time Bitcoin's Oi exceeds $ 65 billion, a market correction followed shortly.

Bitcoin is now making headlines not only for over $ 100,000, but also for rising influences on global finance. At one point, the bitcoin even Amazon was over To be the fifth largest property in the world, with a market capitalization of $ 2.05 trillion. Meanwhile, the Standard Charter predicts Bitcoin can break all the time high and up to $ 120,000 in Q2.

Refusal

In compliance with the guidelines of the trust project, the beincrypto focuses on unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy, and disclaimers are updated.