Mosaic’s Q1 earnings beat, revenues fall short of estimates

The mosaic company A revenue reported $ 238.1 million or 75 cents per part for first-quarter 2025, from $ 45.2 million or 14 cents per part last year.

The ban of one -time items, a fitting income per part was 49 cents, leading the estimated Zacks agreed of 39 cents.

Net sales refused around 2% years over the year up to $ 2,620.9 million in the quarter. The scale has not acquired the estimate of the agreed Zacks of $ 2,665.9 million. The lower sales prices in the potash unit caused the downside.

The price of mosaic company, consensus and surprise of EPS

Mosaic Company Price-Consensus-Eps-Surprise-Chart | Quote by mosaic company

The highlights of the mos segment

Net sales in the Potash segment was $ 570 million in the reported quarter, down around 11% years in the year, injured by lower sales prices. The figure defeated our estimate of $ 453.7 million. Sales volumes reached 2.1 million tons, down from 2.2 million tons a year ago. The figure missed our estimate of 2.2 million tons. The segment's gross margin declined for $ 80 per ton from $ 98 per ton of last year.

Phosphate Division's net sales were $ 1,099 million, down around 6% from last year. Lower quantities are that the higher prices are —offset. The figure led our estimate of $ 1,027.3 million. The segment sales volumes reached 1.5 million tons, down from 1.6 million tons a year ago, estimating our estimate of 1.7 million tons. The gross margin in the quarter was $ 111 per ton, from $ 97 per ton of last year.

Net sales in the segment of mosaic fertilizantes are around $ 934 million in the quarter, up to 5% years over the year, assisted by higher volume. The figure missed our estimate of $ 1,091.9 million. The quarter sales volume rose to 1.8 million tons from 1.7 million tons in the last year. The gross margin in the quarter is $ 69 per ton, from $ 44 per ton in the previous year quarter.

Mosaic financial

At the end of the quarter, the mosaic has a cash equivalent and cash of $ 259.2 million, down 5% from the previous quarter. Long-term debt is $ 3,329.9 million, flat sequentially.

Moset's view

The company expects sales volumes for the Potash segment between 2.3 million tons and 2.5 million tons in the second quarter.

For the Phosphate Division, sales volumes are expected to be 1.7-1.9 million tons, reflecting strong demand worldwide.

MOS also expects sales volumes for the second quarter around 30% higher than the first quarter for the mosaic fertilizantes unit. The distribution margin is expected to be in the annual Normalized $ 30- $ 40 per ton.

The company also sees Banda's capital expenditures of $ 1.2- $ 1.3 billion for 2025.

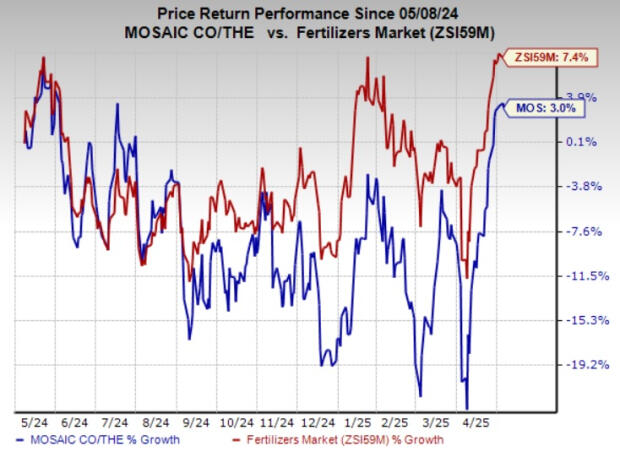

MOS price performance

Mosaic shares gained 3% in the last year compared to the rising 7.4% increase in the Zacks fertilizers industry.

Image Source: Zacks investment research

The rank of zacks of mos and other major picks

MOS is currently carrying a Zacks Rank #3 (Hold).

The better stock ranking in major material spaces is Hawkins, Inc., Avino Silver & Gold Mines Ltd. and Franco-NEVADA CORPORATION . While HWKN carries a rank of Zacks #1 (strong purchase), ASM and FNV carry a rank of Zacks #2 (buy).

Hawkins is set to report fiscal fourth quarter results on May 14. The consensus estimate for the fourth quarter Hawkins revenue is PEG at 74 cents. HWKN defeated the consensus estimate in one of the last four quarters while missing three times, with an average income surprise of 6.1%.

Avino Silver & Gold Mines is set to release first-quarter results on May 13. The consensus estimate for ASM first-quarter revenues is PEG to 3 cents. ASM has a trailing four-quarter income surprise 94.4%, on average.

Franco-NEVADA is set to release first-quarter results on May 8. The consensus estimate for FNV's first-quarter income has been peged to $ 1. The Zacks' approach of agreement for first-quarter revenues has climbed over the past 60 days.

Unlock exclusive gold and silver signals and updates that most investors do not see. Join our free newsletter today!