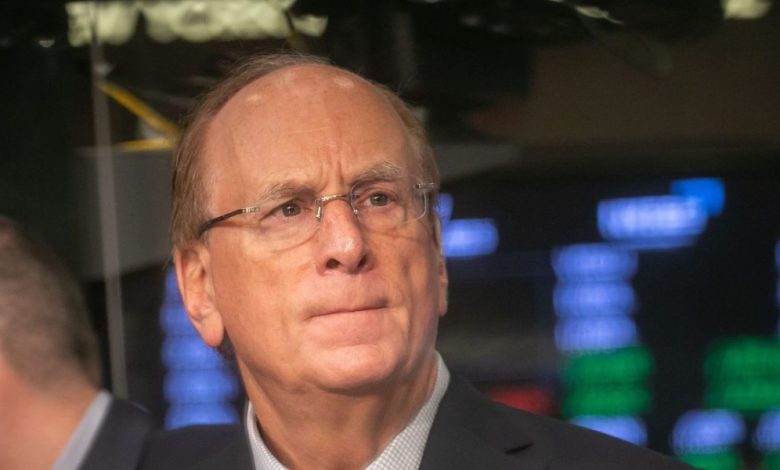

BlackRock is piling money into the U.K. as Larry Fink claims the country has discovered its ‘capitulation point’

Larry Fink, the CEO of 11.6 Billions of Dollars by investing Titan Blackrock, is used to making contrary bets. The entire British economy, very offbeat in the past year, could be its last.

Fink says that Blackrock is investing in British assets “in all areas” after being reassured by the “pro-growth” agenda of the Labor government, adding that the United Kingdom and Europe enter the rebound era after discovering their “capitulation point”.

The 72-year-old BlackRock boss saw an investment opportunity in the United Kingdom, Nameckeking finances actions like Natwest, Lloyds and St. James's places as actions undervalued by a level of negativity which, according to Fink, “was probably not justified”.

In his interview with the TimesFink underlined several examples of public trips that have given it confidence in the ability of the United Kingdom to discover new growth opportunities and argued that the government of Keir Starmer was focused on “difficult problems”.

“It simply resonated with me-that there are so many fundamentally strong attributes about the United Kingdom and Europe and that they were so stifled by over-control, by too much control,” he said. “And for me, it was very clear that we were at a capitulation point.”

Fink's positive ruminations on the British economy are a divergence from popular opinion, which painted the United Kingdom as a growth retardation at the dawn of both a recession and an exodus of its richest citizens.

Companies have complained about the new national insurance obligations and flexible employment policies which, according to them, make hiring and growth more difficult. Meanwhile, there are reports according to which billionaires hold a massive exodus of the country due to changes in non-Dom tax regulations. Billionaire Real Estate Investing Brothers, Ian and Richard Livingstone, were among the last to leave the United Kingdom, joining thousands of others since last election.

The United Kingdom also puts pressure on its already close public finances of threats from the Donald Trump administration of generalized reprisals that would considerably affect growth.

These pressures seem to lead the dominant feeling among the British public.

An Ipsos Mori survey revealed that 75% of British expect the economy to get worse in the next 12 months, marking the darkest feeling among the public since the launch of the survey in 1978. The group Economic optimism index Recorded one -68, worse than the cost of living crisis in 2022, the global financial crisis in 2008 and a global recession in 1980.

This feeling is similar among companies, which begin to build their defenses before a possible recession induced by the tariff war. The UK purchase managers index fell to its lowest level since 2022 in March, suggesting that companies reduce activity due to low confidence.

Despite these evidence to the contrary, Fink is more joy in the United Kingdom than in the last months of the Prime Minister of Rishi Sunak. Bloomberg reported Last year, BlackRock was one of the investment groups courted by Chancellor Rachel Reeves to help rebuild Great Britain.

“I have no more confidence in the British economy today than I did a year ago.”

Fink deplores the lack of space

An obstacle that could stop BlackRock's walking on the United Kingdom is the office space.

Fink wishes to bring all its 3,000 London employees under one roof to accelerate the group's bet on the United Kingdom that it is thwarted, however, by a lack of available real estate.

“I am so little space here in London with all our acquisitions. I need an office tomorrow but there is nothing here,” said Fink Times.

“If I knew I could put the shovel in the ground in the next 12 months, I was building ours.”

This story was initially presented on Fortune.com